Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

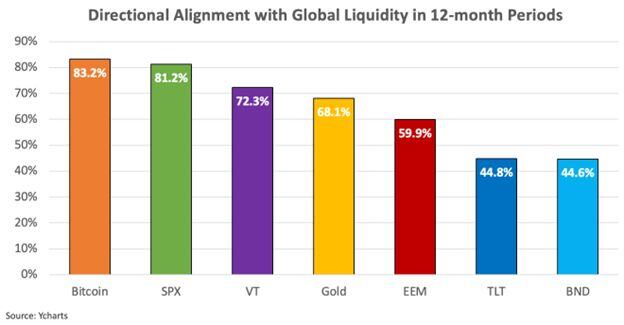

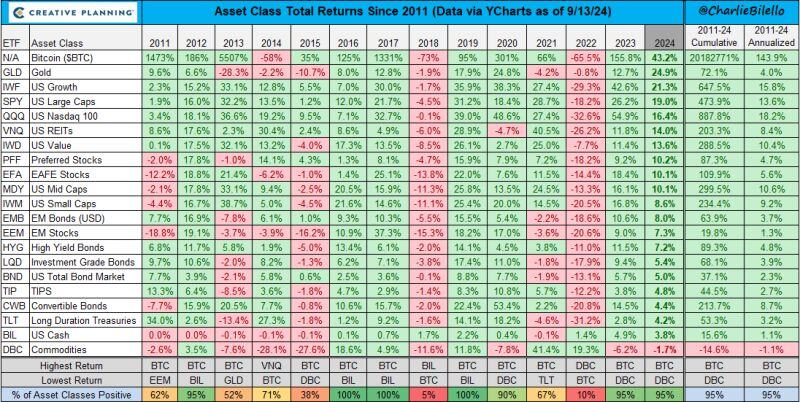

Lyn Alden commissioned a research report, written by @samcallah, to quantify Bitcoin's correlation to measures of global money creation relative to other asset classes.

Result: Bitcoin moves in the directional of global M2 83% of the time; more than other assets. Source: Lyn Alden on X

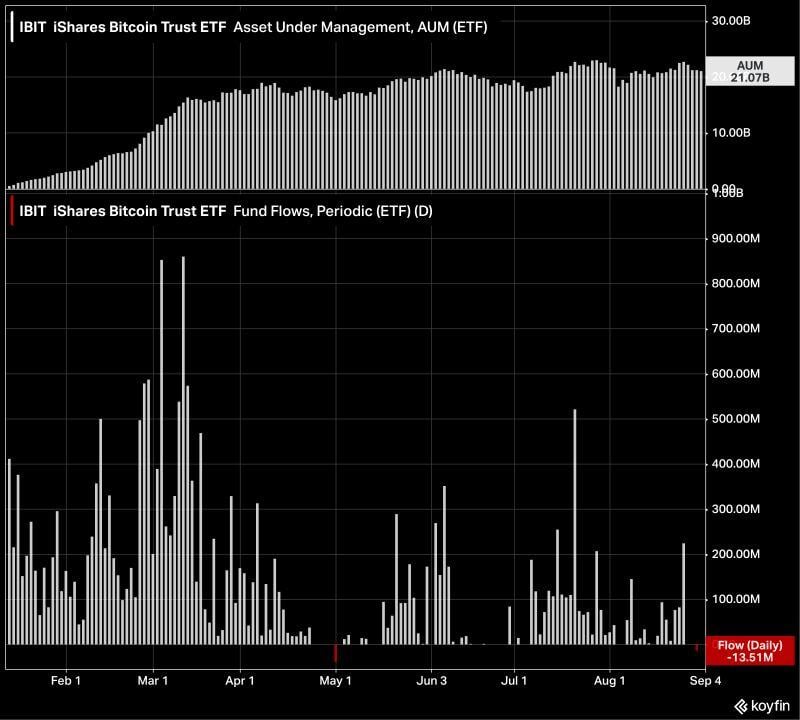

BlackRock Reveals It’s Quietly Preparing For A $35 Trillion Federal Reserve Dollar Crisis With Bitcoin—Predicted To Spark A Sudden Price Boom

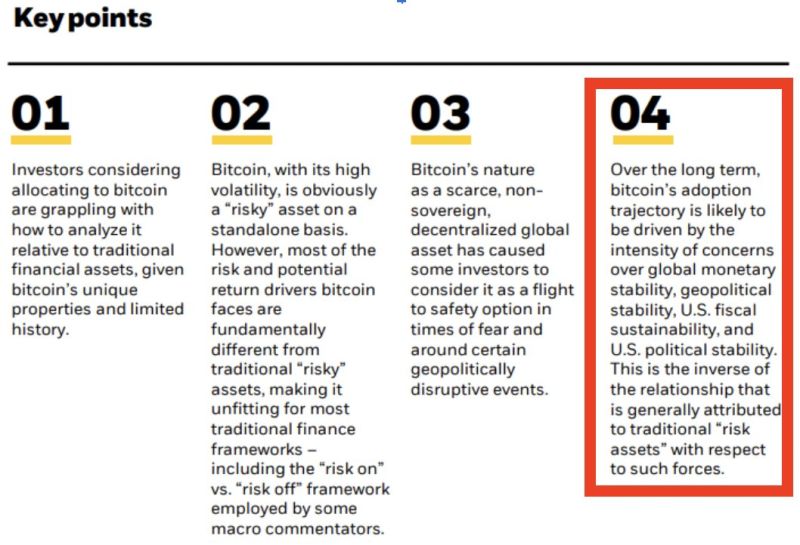

As fears swirl the U.S. dollar is on "the verge of a total collapse," the world's largest asset manager BlackRock has warned of "growing concerns" around the spiraling $35 trillion U.S. debt pile that's predicted to drive "institutional interest in bitcoin." "The growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the U.S. dollar," BlackRock's exchange-traded fund (ETF) chief investment officer, its head of crypto and its head of fixed income global macro wrote in a paper outlining the investment case for bitcoin. "This dynamic appears to be also taking hold in other countries where debt accumulation has been significant," the authors of the BlackRock paper added. "In our experience with clients to date, this explains a substantial portion of the recent broadening institutional interest in bitcoin." BlackRock, which has around $10 trillion in assets under management, described bitcoin as a "unique diversifier" to hedge against economic and political risk. "While bitcoin has shown instances of short-term co-movements with equities and other 'risk assets,' over the longer term its fundamental drivers are starkly different, and in many cases inverted, versus most traditional investment assets," the paper concluded. Source: Forbes Digital Assets >>> https://lnkd.in/ePufVM9J

BlackRock is now saying the quiet parts out loud!

“Over the long term, bitcoin’s adoption trajectory is likely to be driven by the intensity of concerns over global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability.” Source: Blackrock, Luke Mikic on X

BlackRock just put out a nine-page white paper that makes case for bitcoin ETF as a "unique diversifier" that can hedge against fiscal, monetary and geopolitical risks

also including section called "bitcoin's path to $1 trillion market cap". Read whole thing here: https://lnkd.in/e8XVW9gG Source: Blackrock

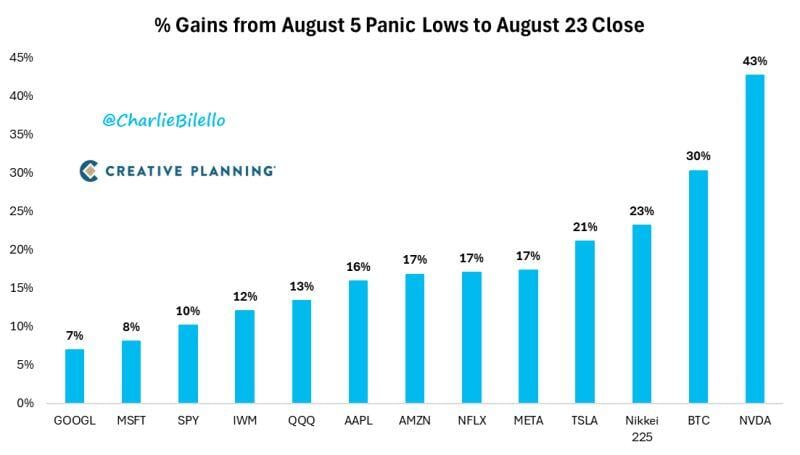

Gains from the panic lows 3 weeks ago...

Nvidia $NVDA: +43% Bitcoin $BTC: +30% Nikkei 225 $NIKK: +23% Tesla $TSLA: +21% Meta $META: +17% Netflix $NFLX: +17% Amazon $AMZN: +17% Apple $AAPL: +16% Nasdaq 100 $QQQ: +13% Russell 2000 $IWM: +12% S&P 500 $SPY: +10% Microsoft $MSFT: +8% Google $GOOGL: +7% Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks