Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: MicroStrategy breaks $50 BILLION market cap and is now worth more than Ford Motor Company.

Ford has lost ~60% of its market cap since 2022 and holds $26 BILLION in cash, about 65% of its total market cap! The "melting ice cube" of cash holdings, eroded by inflation year after year. This is what Michael Saylor feared for his company when he decided to buy Bitcoin in 2020. MicroStrategy's market cap is UP ~45x since then. Source:

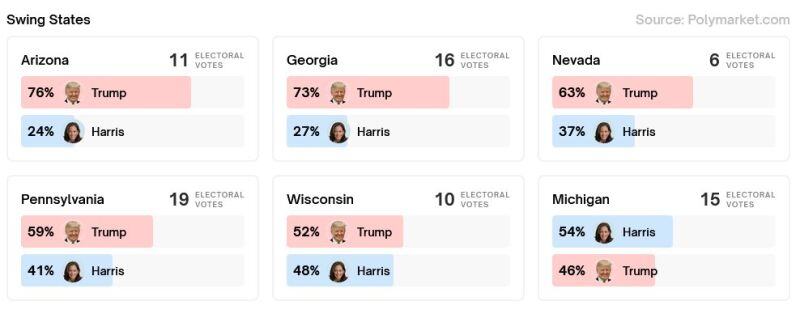

🚨 US ELECTION UPDATE >>> The "Trump trade" took a hit yesterdy (see bitcoin now trading below $70k).

One of the reasons could be this: Yesterday saw a big jump in Kamala's Michigan odds where she is again back on top; Wisconsin is also on the cusp of going back blue. After Trump had a comfortable lead in all swing states over the past week (he still leads comfortably in AZ, NC, PA, NV, GA) there has been a reversal in MI and WI. Thuis makes the race tighter hence some profit taking. Source: zerohedge

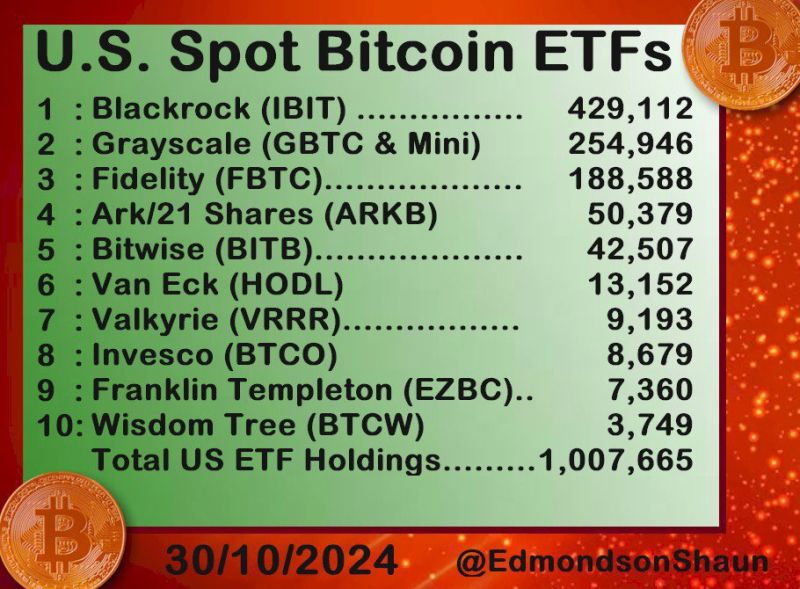

MicroStrategy just unveiled its bold new "21/21 Plan" to raise $42 billion in capital over the next 3 years.

The strategy includes $21 billion from equity and $21 billion from fixed income. With this capital injection, MicroStrategy aims to boost its Bitcoin holdings and enhance BTC yield, solidifying its commitment to Bitcoin as a core treasury reserve asset.

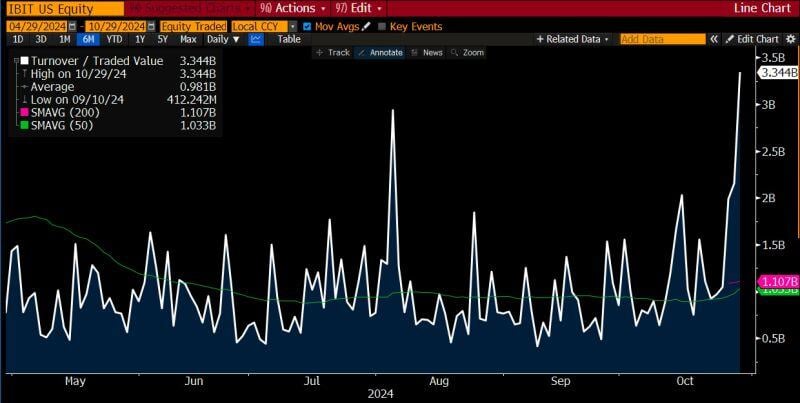

Eric Balchunas on X:

"$IBIT iShares Bitcoin ETF traded $3.3b today, biggest number in 6 months, which is a bit odd because $BTC was up 4% (typically ETF volume spikes in a downturn/crisis). Occasionally though volume can spike if there a FOMO-ing frenzy (a la $ARKK in 2020)". Given the surge in price past few days, his guess is this is latter, which means that inflows could be even bigger this week. Source: Eric Balchunas on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks