Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The YOLO crowd is back.

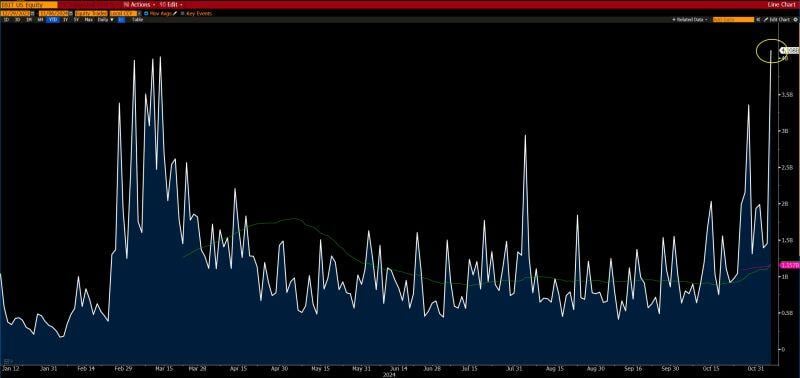

Retail investors were clearly in the driver's seat today, with Bitcoin-sensitive names finishing +19.7% and Goldman Sachs Meme Basket (GSXUMEME Index) closing +7%! Source: Bloomberg, HolgerZ

2 months before the bear-market bottom, the Wall Street Journal felt safe enough to kick Saylor with this WRONG headline.

There were ignorant calls on 𝕏 that MicroStrategy would be liquidated, even though there were no margin calls on the debt, which were mostly long duration 5-6 year terms. Source: Bitcoin Archive

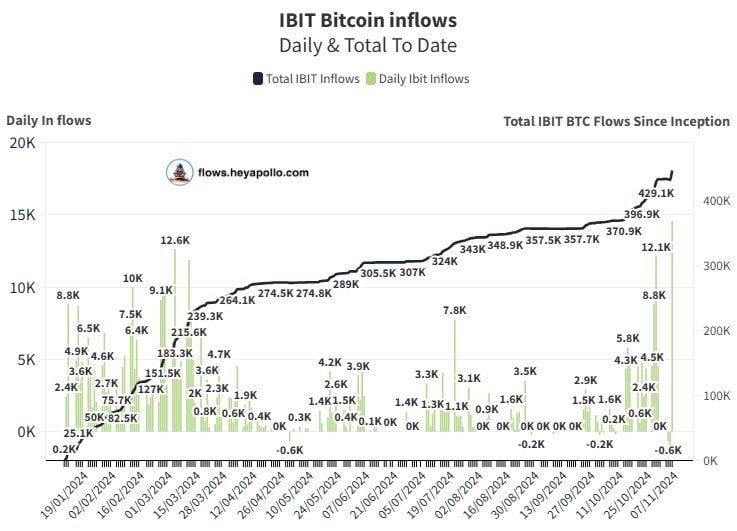

BlackRock had its LARGEST inflow in history with 14,588

Only 450 $BTC were mined...

Investing with intelligence

Our latest research, commentary and market outlooks