Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

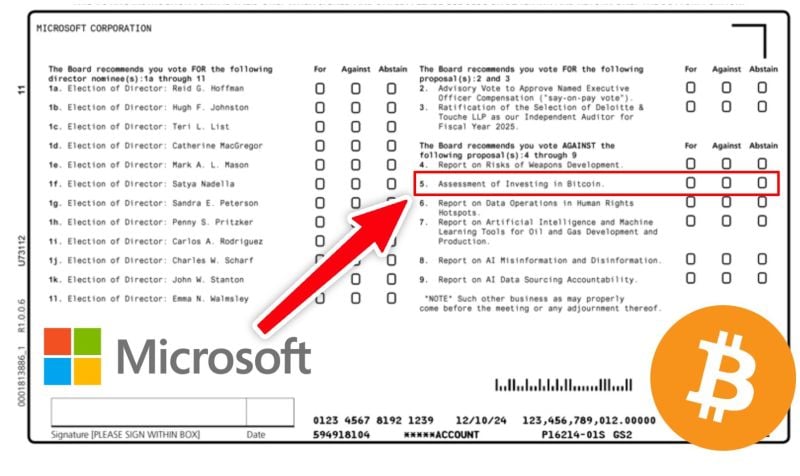

👉 JUST IN: Microsoft asks shareholders to vote on whether to consider investing in Bitcoin!

Source: Swan on X

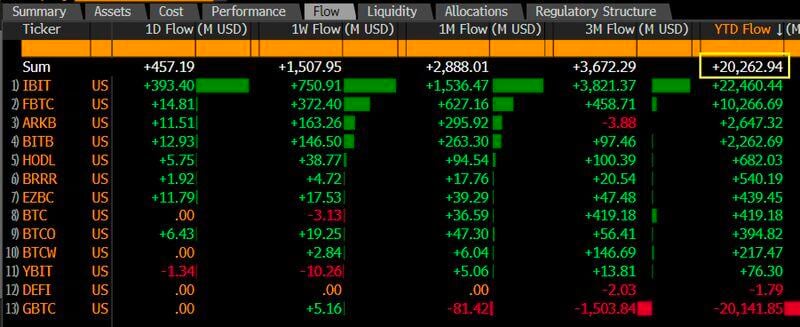

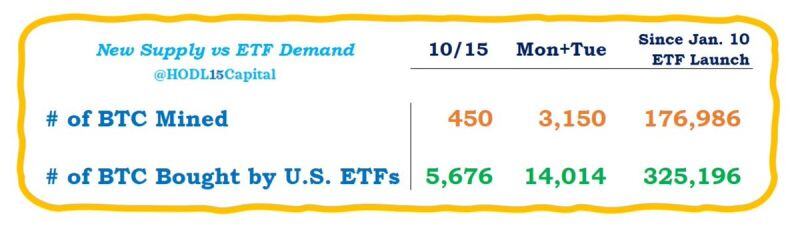

Bitcoin ETFs have crossed $20b in total net flows (the most important number, most difficult metric to grow in ETF world) for first time after huge week of $1.5b.

For context, it took gold ETFs about 5 years to reach same number. Total assets now $65b, also a high water mark. Source: Eric Balchunas, Bloomberg

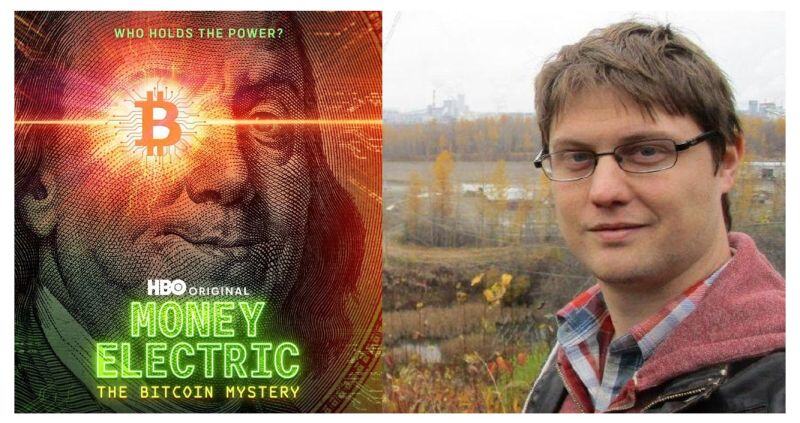

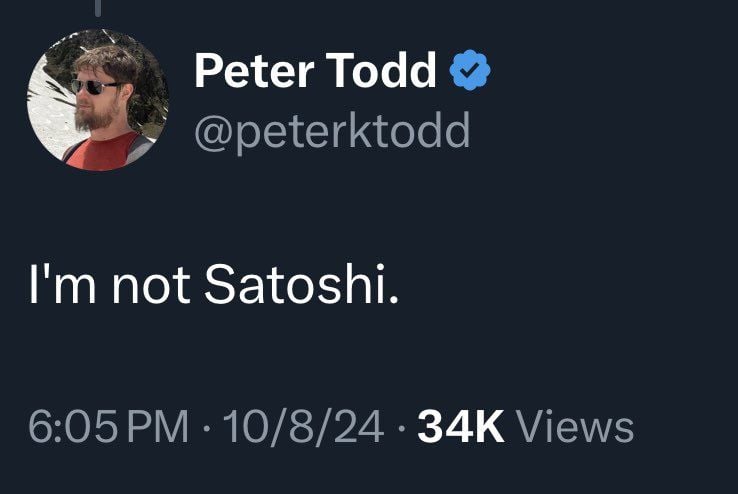

Satoshi Nakamoto

HBO documentary film maker Cullen Hoback has named Peter Todd, a bitcoin core developer who has been involved with bitcoin since 2010, as who he believes to be the real-world identity of Satoshi Nakamoto. If it is true, it means that this man holds about 1.1m BTC tokens (around $70 billion...) in about 22,000 different addresses. Source: Bitcoin Magazine

Exactly what someone who's Satoshi would say ???

Source: Wall Street Silver

Investing with intelligence

Our latest research, commentary and market outlooks