Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

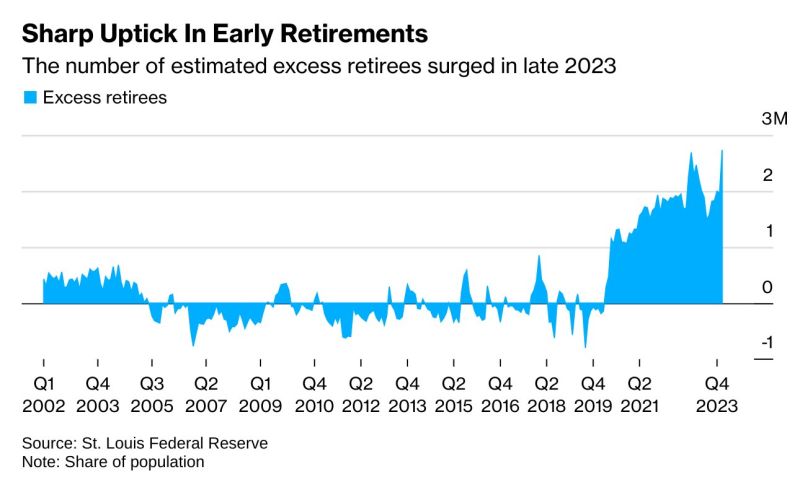

Another wave of early retirements is hitting as the stock market surges

This complicates the Fed's goals for the labor market to some degree, as it means there are more exiting the workforce. There's already 1.45 jobs available for every unemployed person seeking work. Source: Bloomberg, Markets & Mayhem

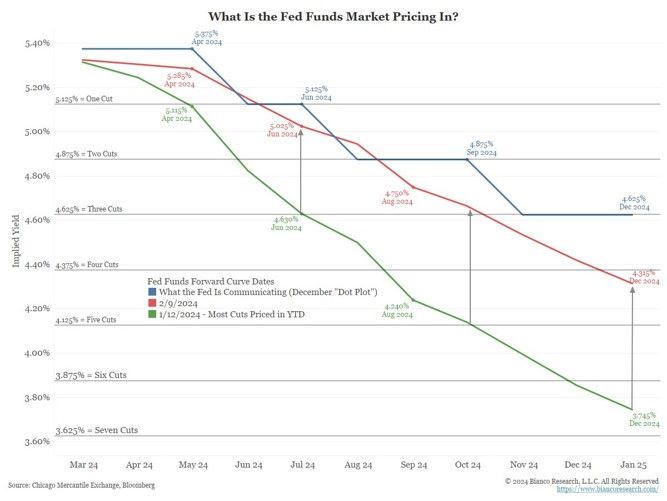

Four rate cuts are now priced in for 2024 (red), the LEAST number of cuts YTD.

This is down from seven rate hikes on January 12 (green), the MOST number of cuts (YTD). Source: Bianco Research

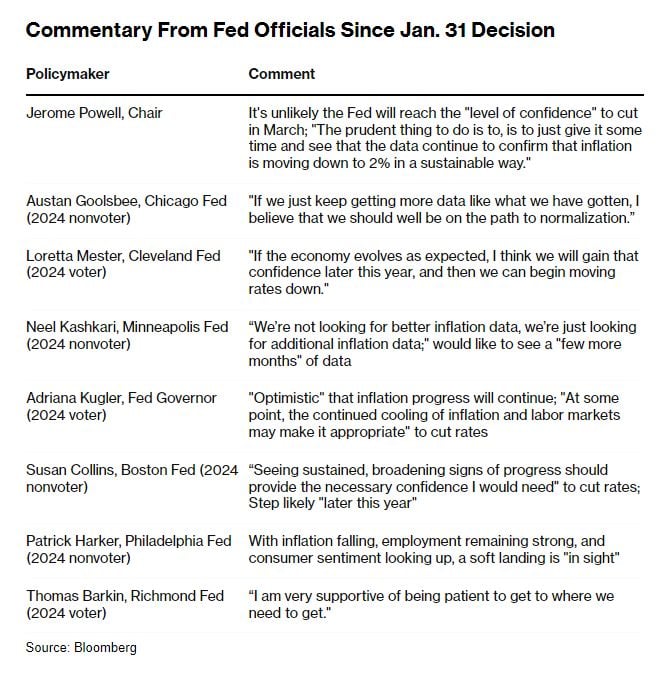

Here's the current expectation on Wall Street regarding the actions of the US Federal Reserve in 2024.

source : wsj, ntimiraos

A nice summary of Fed officials speeches since January 31st decision

Source: Bloomberg

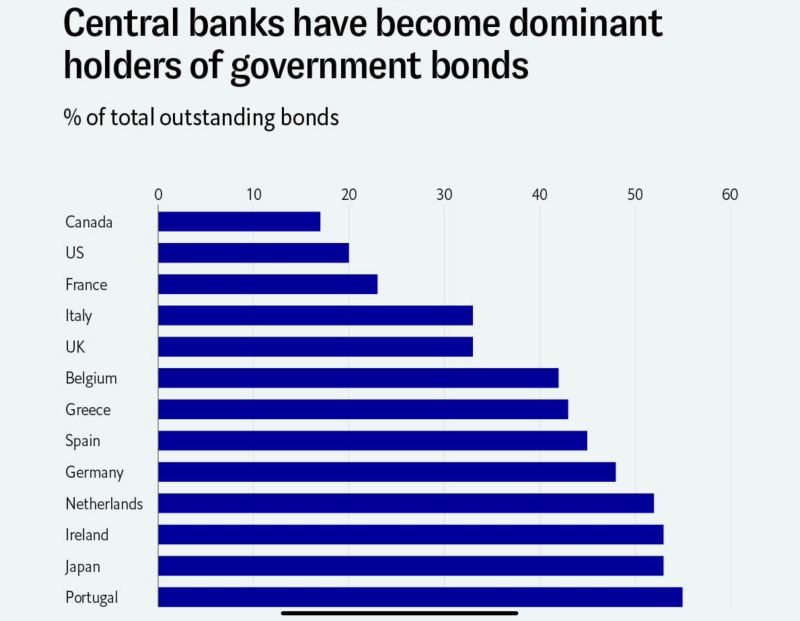

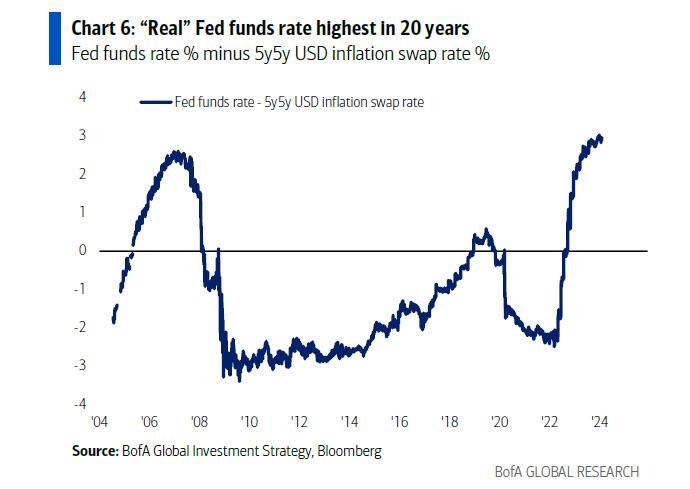

One reason the Fed is a bit nervous and signalling and end to their hiking cycle?

Real Fed Funds rates are the highest in over 20 years... Source: Markets & Mayhem, BofA

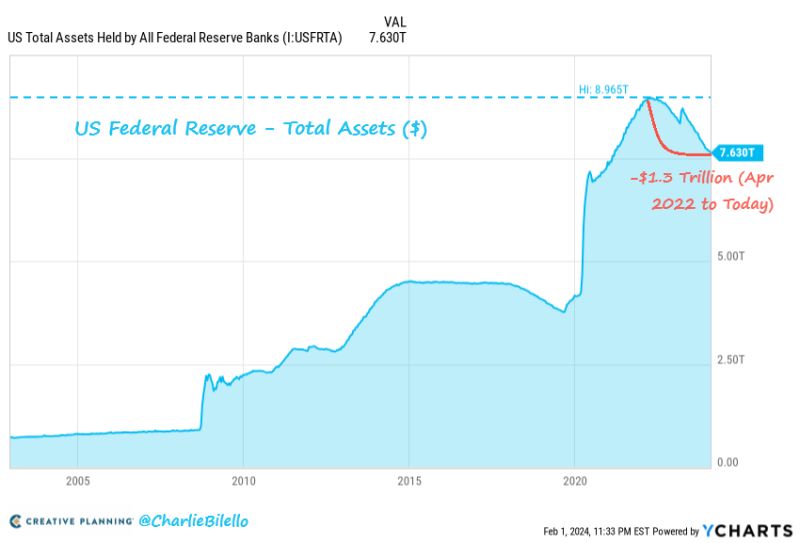

The Fed's balance sheet is now at its lowest level since March 2021, down $1.3 trillion from its peak in April 2022.

How much more QT is needed to unwind the massive QE from March 2020- April 2022? $3.5 trillion. Source: Charlie Bilello

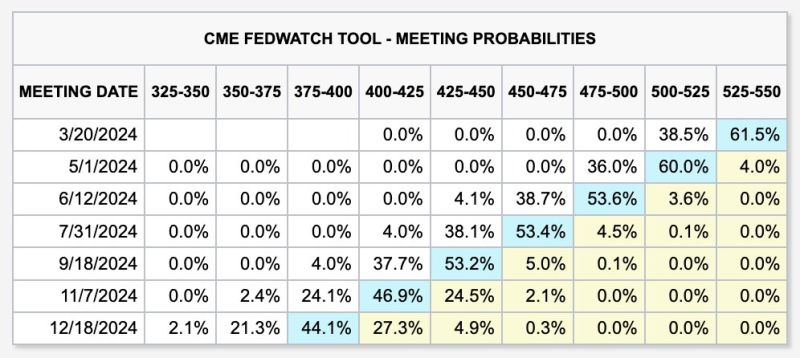

The Fed said that a March rate cut is "unlikely," yet futures are still pricing in a 39% chance it happens

Even as the Fed said they cannot cut rates until inflation is comfortably moving to 2%, markets still see 6 cuts in 2024. There's even a growing 23% chance of 7 interest rate cuts this year. Markets are pricing in a rate cut at EVERY remaining Fed meeting this year. As highlighted by the Kobeissi Letter, if the Fed is on track for a "soft landing," why do we need to many rate cuts? Source: The Kobeissi Lette

Investing with intelligence

Our latest research, commentary and market outlooks