Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What will happen to gold if/when Fed cuts and real yields plunge to negative territory?

Source chart: The Macro Guy, Macrobond

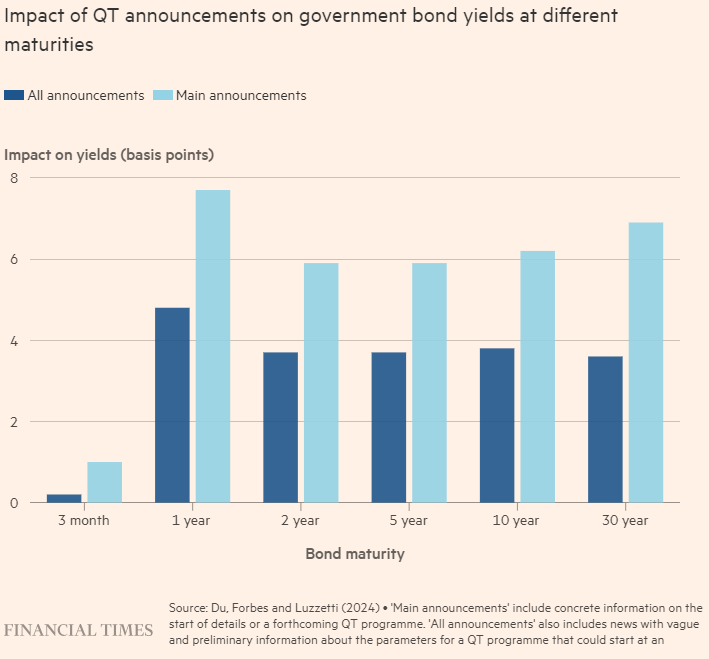

Unveiling the Impact of Quantitative Tightening: Intersting Insights from FT

🌟 Delving into recent insights from the Financial Times sheds light on the impact of Quantitative Tightening (QT) and its implications for financial markets. Let's break it down: 📊 QT's Functionality: Recent evidence from a study involving seven central banks, including the Fed's earlier QT efforts from 2017-2019, reveals that QT operates "in the background," subtly supporting central banks' endeavors to tighten financial conditions without significantly disrupting market functioning or liquidity. 💼 Market Reaction: Announcements of QT's commencement have led to slight increases in government bond yields. However, the actual implementation of QT, including outright bond sales, has had minimal disruptive effects on market dynamics and liquidity. 🔄 Passive vs. Active QT: The distinction between passive and active QT strategies is crucial. While passive QT (letting bonds mature) impacts short-end yields, active QT (outright sales) tends to steepen the yield curve, highlighting the nuanced effects of different QT approaches. 🤝 Market Support: The smooth adjustments observed in response to QT can be attributed partly to domestic nonbanks and, to a lesser extent, foreign investors stepping in to purchase securities as central banks reduce their holdings, maintaining market stability amidst changes in monetary policy. 💡 Navigating Future Challenges: What strategies will central banks employ to navigate the looming challenges posed by high government debt issuance and absorbed pandemic-era liquidity, in light of the insights gleaned from recent evidence on quantitative tightening's impact? #QuantitativeTightening #FinancialMarkets #CentralBanks #EconomicInsights

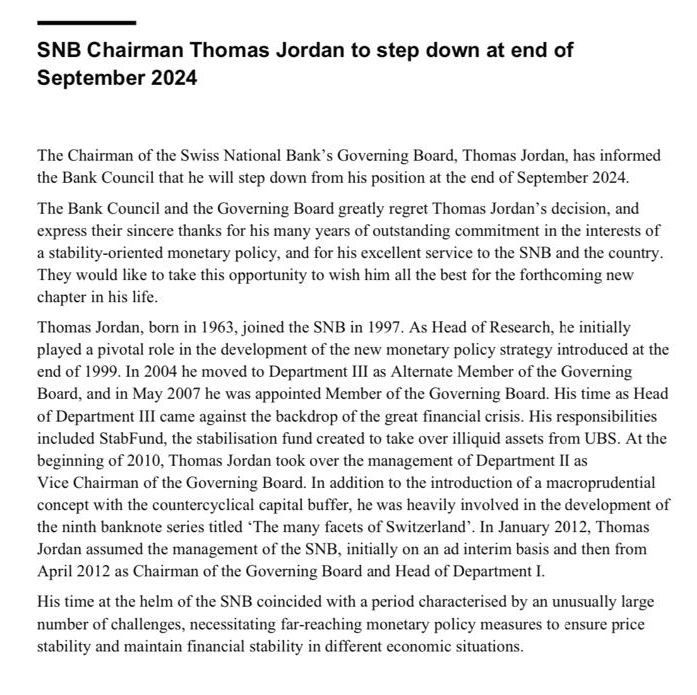

BREAKING >>> SNB Chairman Thomas Jordan to step down at the end of September 2024

.

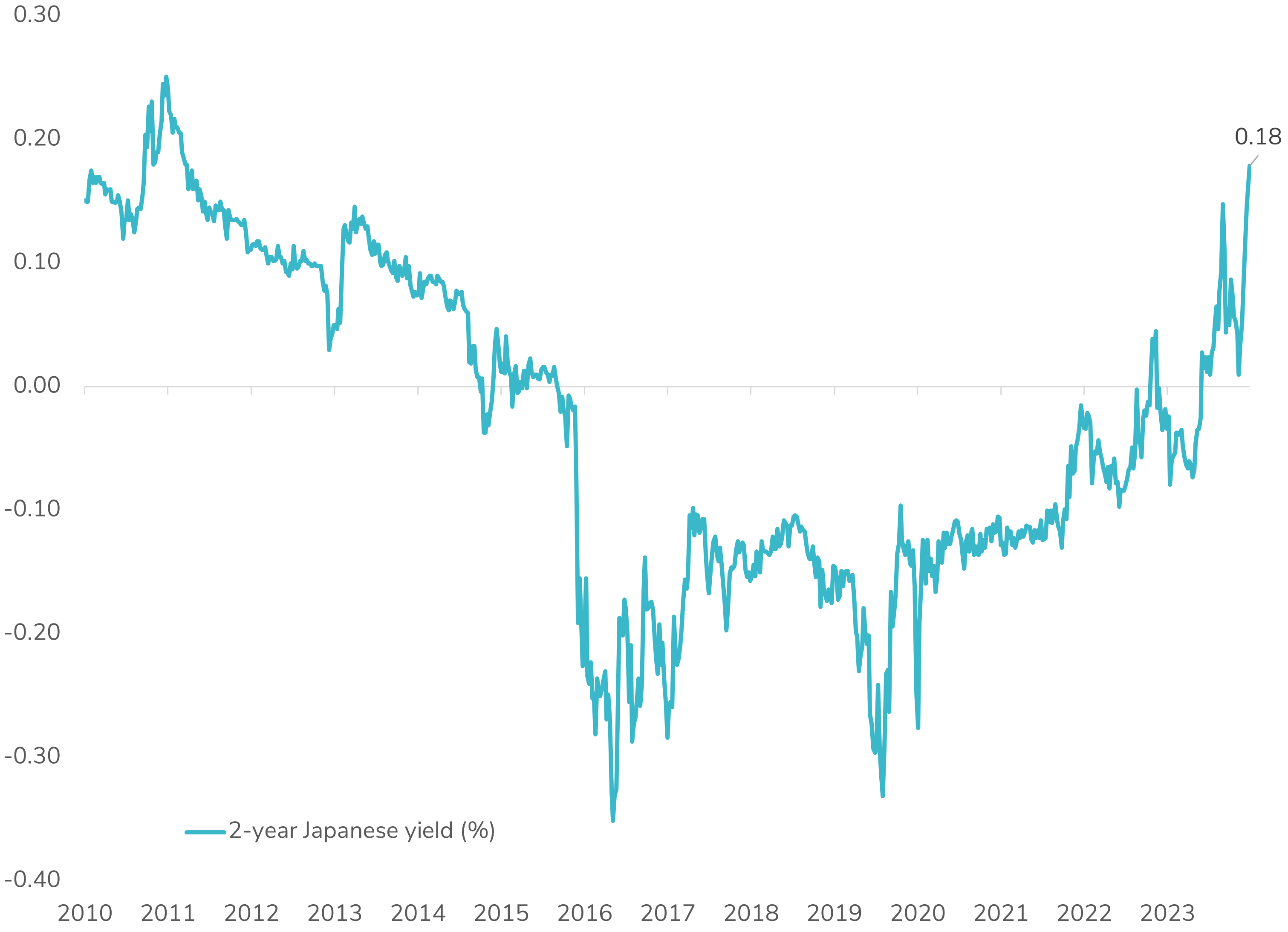

📈 Japanese 2-Year Yield Surges to 14-Year High!

Japanese government bond yields are on the rise across the curve, triggered by Bank of Japan Board Member Hajime Takata's comments hinting at a potential end to the negative interest rate policy. Takata cited progress towards achieving the price target, indicating a possible rate hike—the country's first since 2007—expected in March or April. The front end of the Japanese yield curve is particularly influenced by the BOJ's monetary policy and continues to reprice higher rates. The market anticipates a 0.25% rate hike for the full 2024 year. It appears that Japan will gradually transition away from the negative interest rate monetary policy. 🇯🇵💼 #JapanEconomy #BOJ #MonetaryPolicy #YieldCurve #FinanceNews

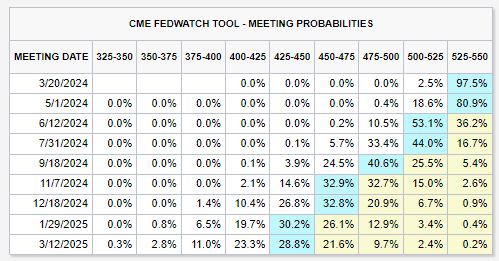

Interest rate cut expectations continue to scale back: Markets now see a ~38% chance of 4 interest rate cuts in 2024

Just over a month ago, the base case showed a 50%+ chance of 6 interest rate cuts in 2024. Meanwhile, odds of a March rate cut are down to 3% and odds of a May rate cut are down to 19%. For the first time in 2024, markets are close to the Fed's latest guidance of 3 cuts in 2024. Source: The Kobeissi Letter

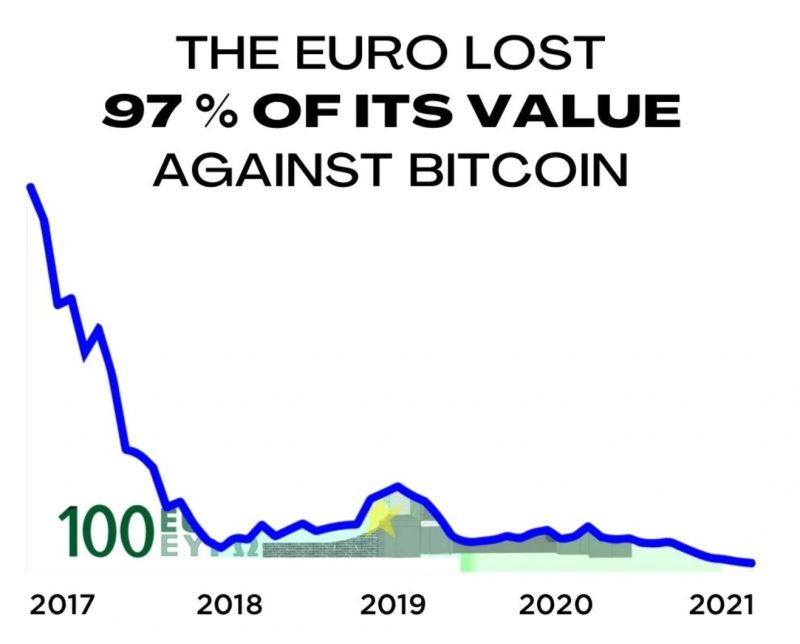

The European Central Bank claims "Bitcoin has failed to become a global decentralised digital currency, instead falling victim to fraud and manipulation (...)"

"The recent approval of an ETF doesn’t change the fact that Bitcoin is costly, slow and inconvenient." Whatever Lagarde and the ecb say, the harsh reality is that the euro has collapsed againt bitcoin as all fiat currencies did. Source: Aries V., Senior Investment Data analyst at Fidelity

Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year.

"Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, the comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%." source : goldmansachs, reuters

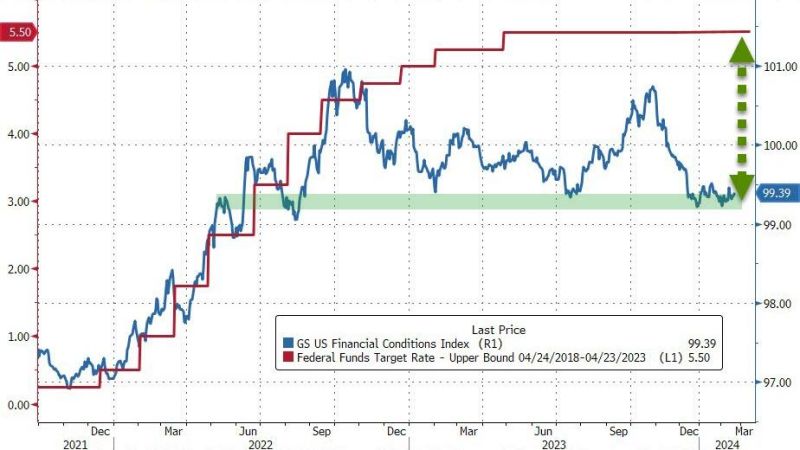

US financial conditions are very easy compared to Fed Funds...

Too easy? Bear in mind what the FOMC said in the Minutes on Wednesday: "Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall." Could this lead the fed to keep rates higher for longer? How long will the market be able to shrug off high rates and higher bond yields? Source: www.zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks