Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

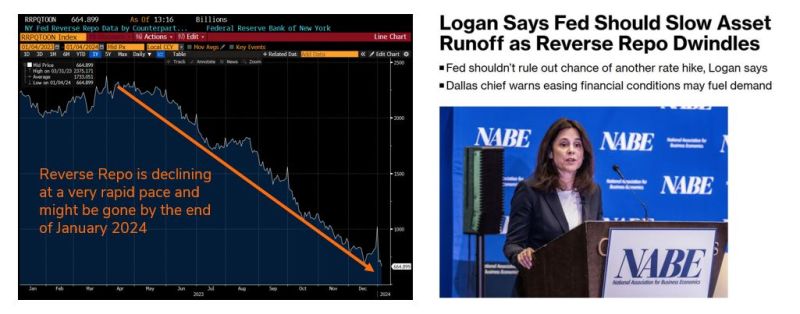

Is this the reason why the Fed might be forced to cut rates in March?

We could have: 1. Reverse repo ends (see chart below) 2. BTFP expires 3. Fed cuts (allegedly) 4. QT ends (allegedly) I.e 3 and 4 could counter-balance 1 and 2

The Fed balance sheet expanded last week by $5.7BN - the most since March's SVB crisis...

Source: Bloomberg, www.zerohedge.com

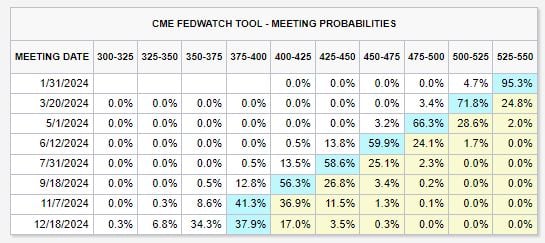

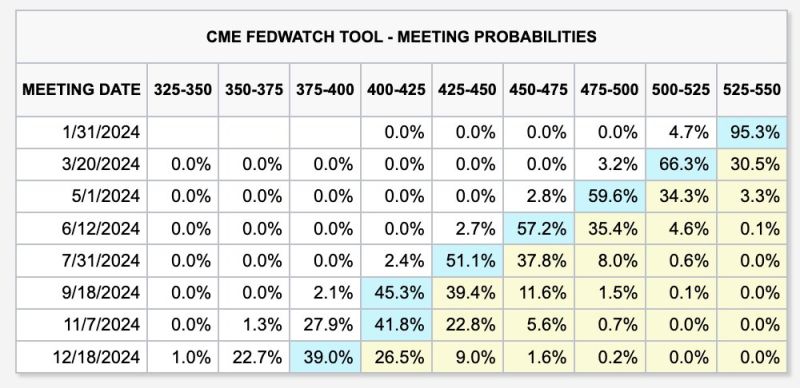

Surprise, surprise... Even with a hot jobs report and inflation rising to 3.4%, market expectations regarding timing and number of rate cuts have shifted more dovish.

Markets are now pricing-in a rate cut at EVERY Fed meeting this year beginning in March 2024 until December 2024. Effectively, markets are saying that us interestrates will move in a straight-line lower. Source: The Kobeissi Letter

Headline CPI Hotter Than Expected In December, Food Costs Hit Record High

>>> Headline Consumer Price Inflation printed hotter than expected in December, +0.3% MoM vs +0.2% exp and +0.1% prior, pushing the YoY headline CPI up to +3.4% (from +3.1% prior and hotter than the +3.2% exp)... >>> US Core CPI (ex-Food/Energy) rose 0.3% MoM as expected, dropping the YoY change below 4.00% (3.93%) for the first time since May 2021. This was also above estimates of 3.8% yoy. >>> Goods deflation has stalled as the used cars and trucks index rose 0.5 percent over the month, after rising 1.6 percent in November. Food costs stand at record highs. Fuel costs are on the rise again. >>> More problematically for The Fed is the fact that Core CPI Services Ex-Shelter (SuperCore) rose 0.4% MoM, upticking the YoY rise to +4.09%...(see chart below). All the subsectors of SuperCore rose MoM with the shelter index increased 6.2 percent over the last year, accounting for over two thirds of the total increase in the all items less food and energy index. >>> Market reaction: 10Y hit 4.06% and sp500 futures are sligthly down. Prediction markets are severely discounting a March rate cut. We started 2024 with a 70%+ chance that interest rate cuts begin by March. After the strong jobs report and a hot inflation reading, odds have nearly HALVED. Still, markets are pricing in 6 rate cuts in 2024, DOUBLE what the Fed is guiding. Source: Bloomberg, The Kobeissi Letter, www.zerohedge.com

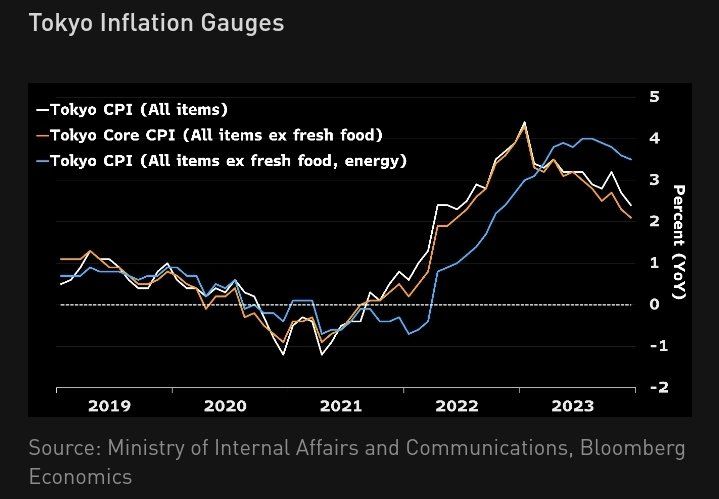

Tokyo CPI down again supports BOJ dovish stance for now

Source: Bloomberg

Fed member Bostic just said that he sees just 2 interest rate cuts in 2024 for a total of 50 basis points

As highlighted by the Kobeissi Letter -> This ONE THIRD the amount of rate cuts that futures are currently pricing-in. Bostic also said that he is "not comfortable declaring victory" against inflation at this point. Meanwhile, markets see a base case of 150 basis points in rate cuts in 2024. There is even a ~24% chance of 175 basis points in rate cuts. The Fed to market disconnect is widening. Source: The Kobeissi Letter

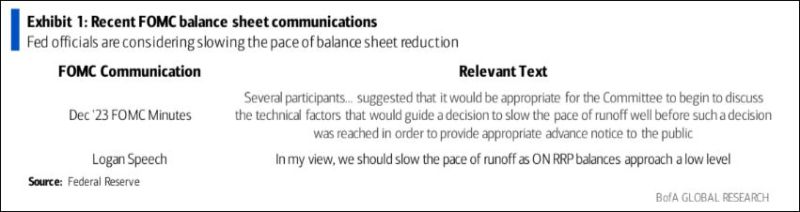

Bank of America Corp. expects the Federal Reserve to announce plans to begin tapering the runoff of its Treasuries holdings in March, coinciding with its first 25 basis points interest-rate cut.

- The Reverse Repo ("RRP") is de facto QE-infinity $ printed during 2020-21 that was sitting dormant. It's now being used to buy up US Treasuries. Problem: it is declining at a very rapid pace and might be gone by the end of January 2024. - Something needs to be done to preserve QB / liquidity. - This is why the Fed is now thinking about slowing down the pace of QT. Over the week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles - 2024 is an election year and we expect net liquidity to be supportive for the economy, bond markets and risk assets

Investing with intelligence

Our latest research, commentary and market outlooks