Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The "multipolar world" will remain a major topic in 2024 as the rewiring of the global commerce system creates geopolitical risks & business model shifts that will last decades

The Dollar’s & Euro's share in global CenBank reserves dropped. Greenback accounted for 59.2% of globally allocated FX reserves in Q3 2023, down from a revised 59.4% in Q2, lowest since Q4 2022. Euro’s share in reserves also fell to 19.6% from 19.7%, while the participation of Japan's Yen rose to 5.5% from 5.3%. Source: HolgerZ, Bloomberg

While many economists and financial analysts look at the 1970s as a potential playbook for the current decade, the 1940s could be an interesting reference to consider as well

The 40s was a decade of war and high budget deficit and rising debt level in the US. Monetary policy was mainly about financial repression, i.e keeping rates low despite temporarily high inflation. Overall, it was positive for risk assets. Source: Win Smart, FRED

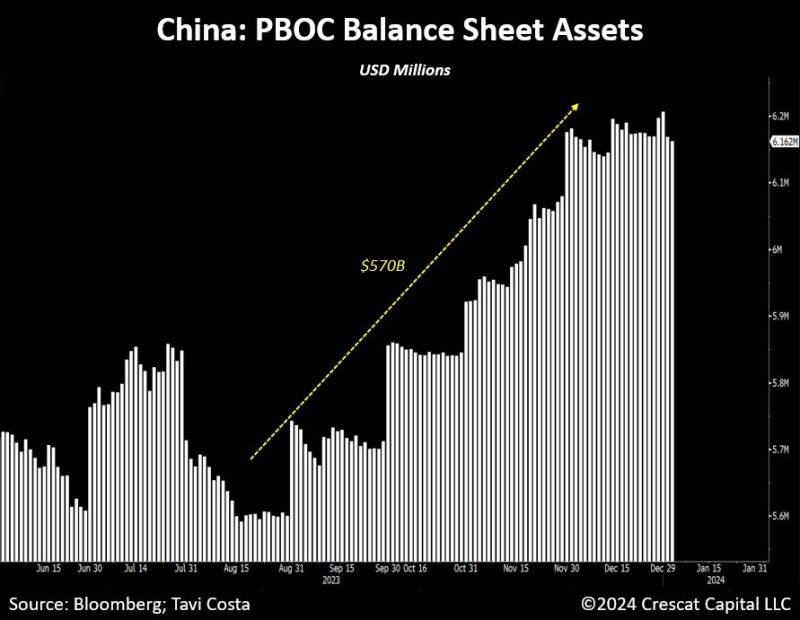

China’s central bank assets have surged by nearly $600B in the last 4 months

In yuan terms, this was the largest 4-month increase in the history of the data. The issue of a bloated government deficit and significant debt is not exclusive to the US; it resonates globally. Source: Tavi Costa, Bloomberg

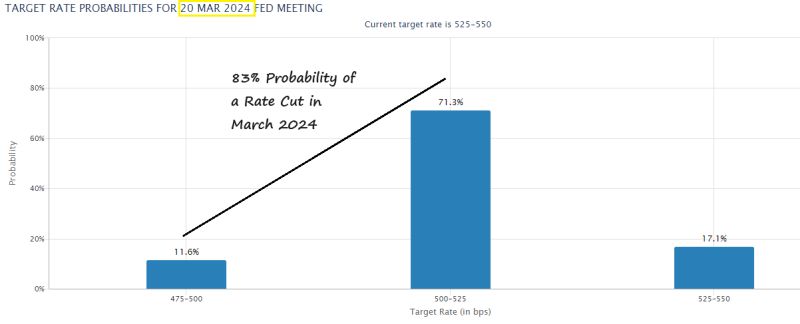

FED meeting minutes key takeaways:

1) rates likely at or near their peak 2) 2pct inflation target is maintained 3) monetary policy is likely to stay restrictive for some time 4) clear progress has been made on inflation (dixit the Fed) 5) see rate cuts by the end of 2024 FOMC views continue to diverge from market expectations (2x more rate cuts are currently priced vs. Fed guidance) Source: CNBC, The Kobeissi Letter

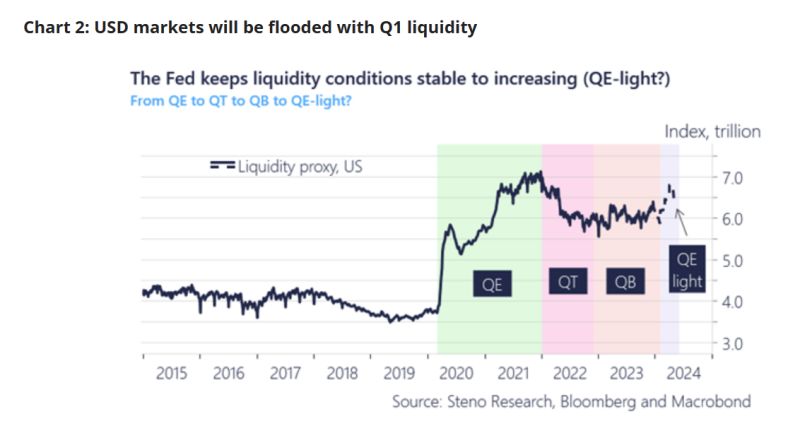

LIQUIDITY MATTERS... From QE (Quantitative Easing) to QT (Quantitative Tightening) to QB (Quantitative Balancing) to QE Light

Some interesting views by Andreas Steno Larsen (Steno Research / Macrobond): 2024 Q1 -> While we are celebrating our inflation-progress, Powell and Yellen intend on handing out "Stealth QE / QE light" gifts to the banking system in Q1-2024. Steno Research view is that USD liquidity is likely going to increase massively in Q1 due to a series of technicalities surrounding the BTFP, ON RRP and TGA facilities. These three liquidity adding mechanisms will more than outweigh the QT program (running at a little less than $95bn a month on average), leaving a very benign liquidity picture ahead for Q1-2024. By their estimates, liquidity will increase with $8-900bn until end-March, which almost resembles a QE-light / stealth QE scenario. This will in case be one of the fastest liquidity additions on record, only outpaced during the early innings of the pandemic! If this happens, such a liquidity injection might be a massive tailwind for risk assets...

The probability of a Fed rate cut in March 2024 has jumped up to 83%. A month ago the odds were only 29%.

Source: Charlie Bilello

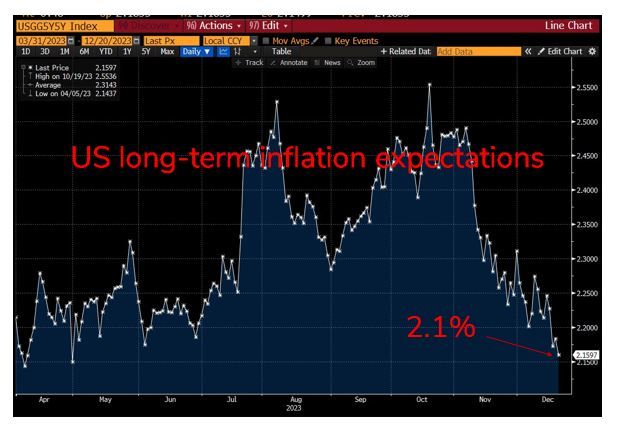

Longer-term US inflation expectations have fallen dramatically over the past two months, to close to the Fed's 2% target

Source: Bloomberg

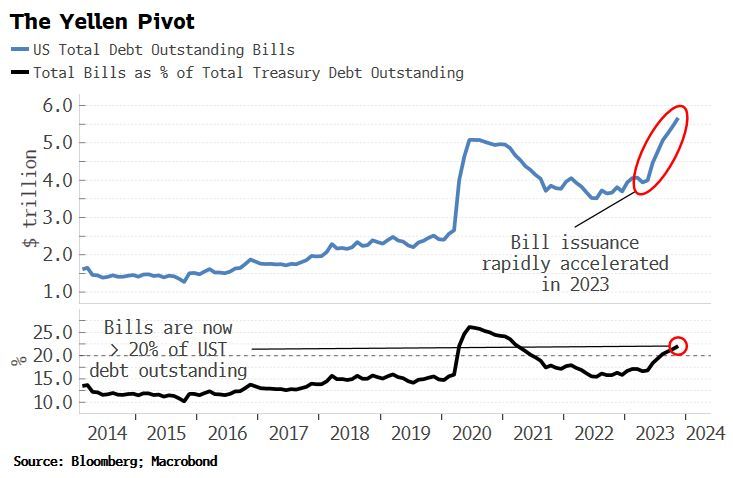

Simon White posted an excellent chart showing the potential short-term gain / long-term pain of the dual Yellen / Powell pivot

Phase 1: The Yellen Pivot. Early 2023, she decided skewing the Treasury's issuance towards bills. This bought time for risk assets, allowing Fed reserves to rise despite QT Phase 2: The Powell Pivot last week -> His dovish turn should buy more time for risk assets next year. He is literally trying to limit the growing amount of liquidity sucked from the government's ballooning interest-rate bill While this leads to short-term gain, there is a huge risk of long-term pain as these dovish operations have significantly increased long-term inflation risks and the prospect of even higher yields in the near-future. Source: Bloomberg, Macrobond

Investing with intelligence

Our latest research, commentary and market outlooks