Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

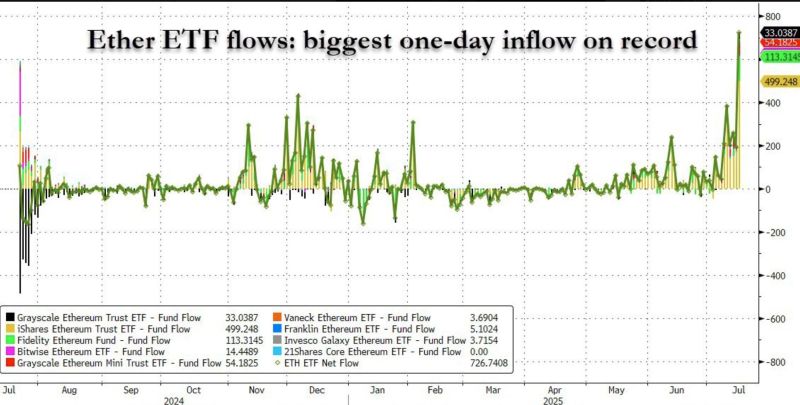

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The U.S. Senate has approved the GENIUS Act with an overwhelming bipartisan vote.

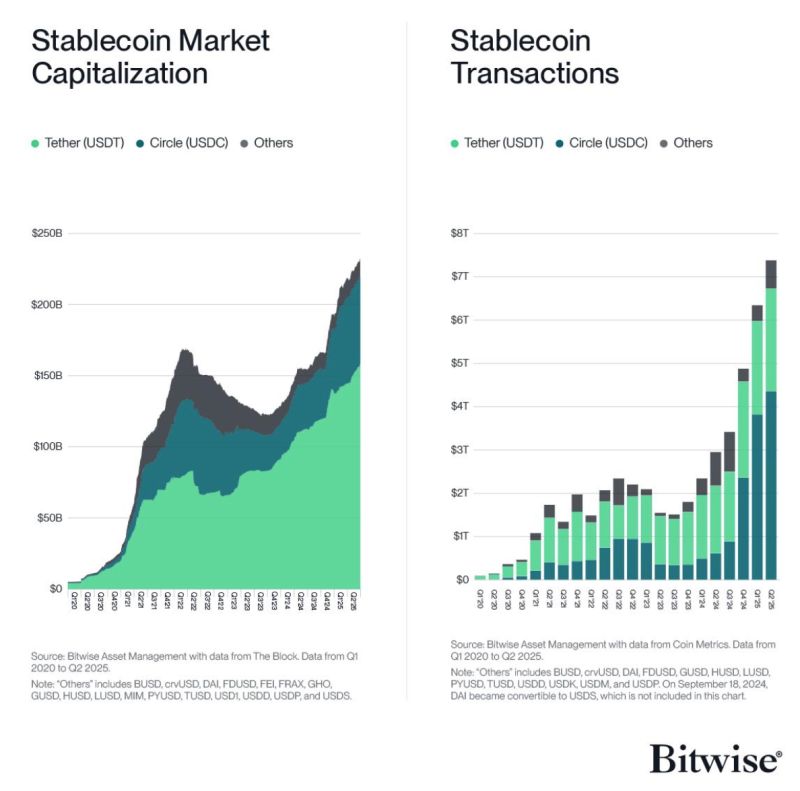

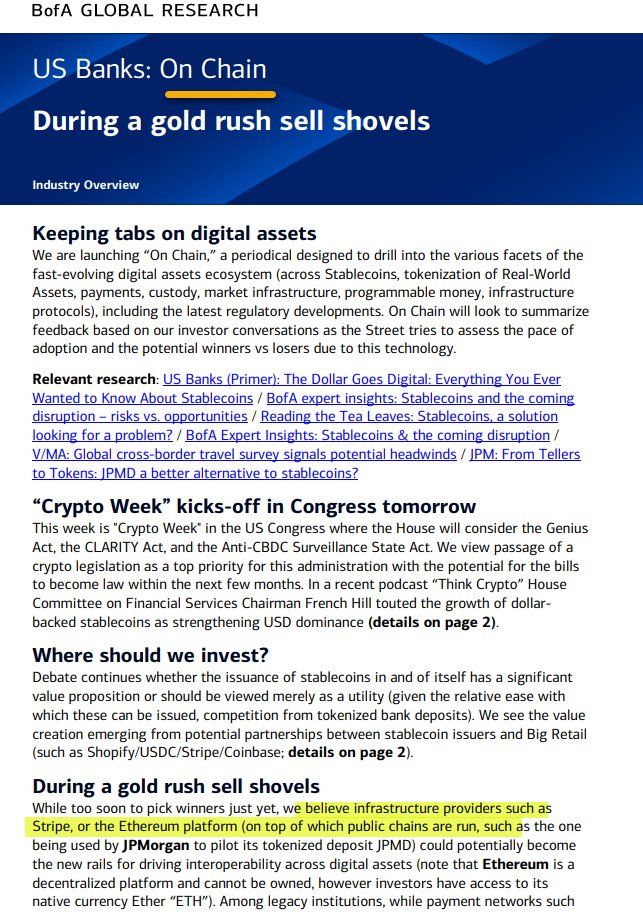

👉This marks the first time the Senate has ever cleared a major piece of crypto legislation after years in which key Democratic members blocked the advancement of such legislation. 👉The bill heads to the House of Representatives, where its next steps remain uncertain while leading lawmakers work out a strategy for passage. The overwhelming bipartisan passage of the U.S. Senate's hashtag#stablecoin bill, with a 68-30 final vote that saw a huge surge of Democrats joining their Republican counterparts on Tuesday, sets a new high-water mark of hashtag#crypto policy efforts in the U.S. as the legislation now heads to the House of Representatives. The major Democratic backing for the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS) Act helps give it momentum as it lands in the other chamber, where House lawmakers can either vote on it as written or pursue changes that will require a final round in the Senate before it can head to President Donald Trump's desk. As written, the bill would set up guardrails around the approval and supervision of U.S. issuers of stablecoins, the dollar-based tokens such as the ones backed by Circle, Ripple and Tether. Firms making these digital assets available to U.S. users would have to meet stringent reserve demands, transparency requirements, money-laundering compliance and regulatory supervision that's also likely to include new capital rules. Source: coindesk

Cryptocurrency-related bills backed by US President Donald Trump failed to clear a key procedural step in the House of Representatives on Tuesday, despite the president’s public push for action.

Trump had urged Republican lawmakers to “get the first vote done this afternoon” on legislation to regulate payment stablecoins as part of a larger effort to pass crypto legislation before the August recess. In a Tuesday post on his social media platform Truth Social, Trump ordered all Republicans to vote yes on the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, a bill designed to regulate payment stablecoins in the US. House Speaker Mike Johnson reportedly said the chamber would take up another vote “this afternoon.”

JPMorgan $JPM CEO Jamie Dimon said today he doesn’t get the appeal of hashtag#stablecoins, but he also can’t afford to stay on the sidelines - CNBC

Source: Evan

Tether, the issuer of the world’s largest stablecoin, has its own vault in Switzerland to hold an $8 billion stockpile of gold, with an eye to growing those stores.

The El Salvador-based crypto company now holds nearly 80 tons of gold, it said. The vast majority of that is owned by Tether directly, making it one of the largest gold holders in the world outside of banks and nation states. The private vault is based in Switzerland and is fully owned by the company. The exact location hasn’t been disclosed. Chief Executive Paolo Ardoino told Bloomberg that this decision was about ownership, scale, and cost. The company is based in El Salvador and is best known as the issuer of USDT, the world’s largest stablecoin. Tether now holds $159 billion worth of tokens in circulation, which are backed by various reserves, including US Treasuries and precious metals. Paolo made it clear that the move to physical gold storage is strategic and intended to reduce long-term costs. “If you have your own vault, eventually, with the size, it gets much cheaper to do custody,” he said. As of March 2025, Tether’s own reports show that nearly 5% of its total reserves are now held in precious metals, with the vast majority being gold. With the value of its bullion holdings now on par with UBS Group AG, one of the few major banks that discloses its precious metal reserves, Tether is pushing into a category usually reserved for nation states and central banks. Source: Binance, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks