Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The UAE is tokenizing almost all of its real estate.

Dubai Land Department has signed an agreement with Crypto.com to develop procedures that support digital real estate transactions, enabling investors to buy and sell property using digital currencies. The collaboration, which seeks to create a digital ecosystem that enables investor verification, custody, settlement and real estate tokenisation, supports the Dubai Real Estate Strategy 2033 and its Dh1 trillion ($272 billion) transaction target. Source: The National

Article by FT ▶️ Investors pile into tokenised Treasury funds.

Stablecoin issuers and traders are attracted by yields on offer and potential use as collateral in some derivatives transactions. 🔴 Crypto companies and traders are pouring billions of dollars into tokenised versions of money market and Treasury bond mutual funds, as they look beyond stablecoins to other places to park excess cash that can also give them some yield. 🔴Total assets held in tokenised Treasury products — which include funds whose units have been converted into digital tokens as well as some tokenised US government bonds — have jumped 80 per cent so far this year to $7.4bn, according to data group RWA.xyz. 🔴Funds run by BlackRock, Franklin Templeton and Janus Henderson have grown particularly rapidly, with combined assets tripling. Inflows have been driven in part by crypto traders, many of whom are finding tokenised funds a more attractive place than stablecoins to park their money. Some investors are also starting to use these funds as an easy-to-trade form of collateral in crypto derivatives transactions. https://lnkd.in/e25ZwDG5

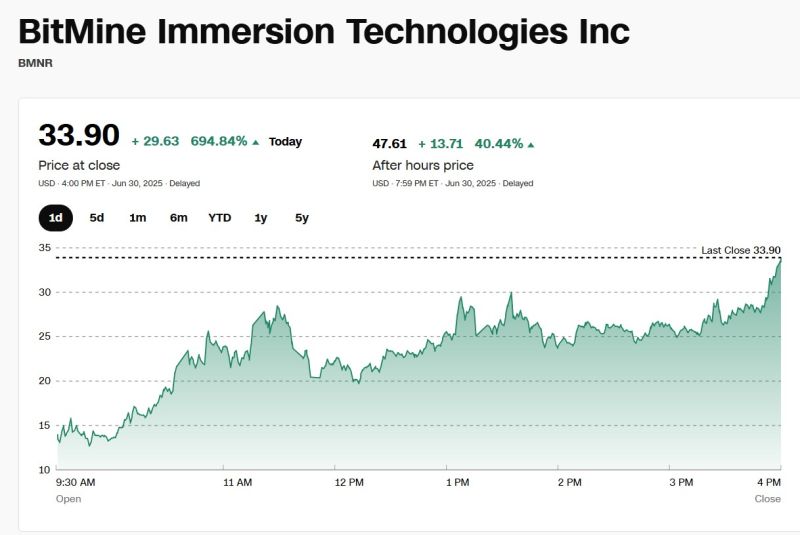

Tom Lee has been appointed chairman on the board of directors for Bitmine, a Bitcoin miner.

Today they announced a $250M private placement to implement buying Ethereum for their $ETH treasury. $BMNR, the public stock for Bitmine, is up 48% in the pre-markets. Tom Lee: “Stablecoins have proven to be the ‘ChatGPT’ of crypto, leading to rapid adoption by consumers, merchants and financial services providers,” Lee said in a statement. “Ethereum is the blockchain where the majority of stablecoin payments are transacted and thus, ETH should benefit from this growth.” Source: @amitisinvesting on X

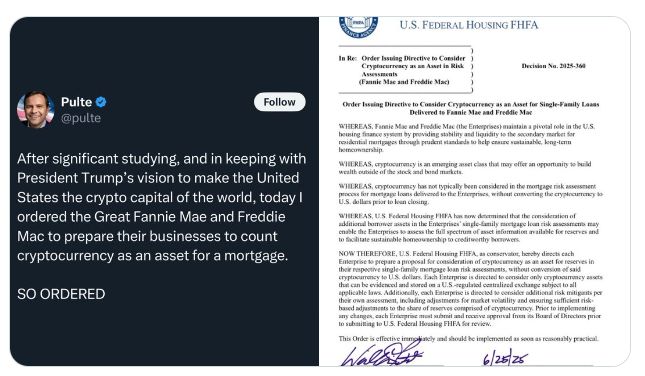

BREAKING: US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility.

Source: Bitcoin Archive @BTC_Archive

Investing with intelligence

Our latest research, commentary and market outlooks