Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST NOW FROM THE WSJ: Donald Trump will be meeting privately with Coinbase $COIN CEO Brian Armstrong to discuss cabinet appointments.

The President of the USA speaking to the CEO of a major crypto exchange to figure out who are the best people to put in position of power that make decisions around crypto? This could be one of the most amazing four years of innovation for crypto with an entire White House ready to support the ecosystem. Source: Anit on X

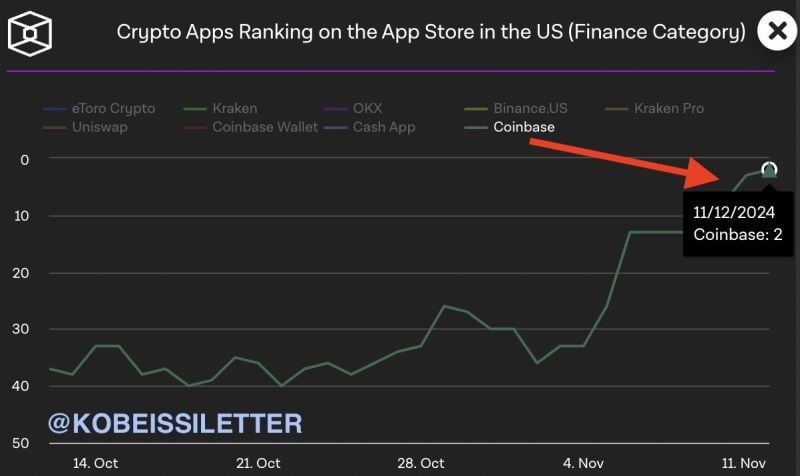

🚨 In case you're wondering how real the FOMO is in crypto:

Coinbase, $COIN, just became the 2nd most downloaded finance app in the app store. Just last week, it was the 33rd most downloaded finance app. All as Bitcoin just hit $90,000 for the first time in history. Tomorrow, will Coinbase become #1 ??? Source: The Kobeissi Letter

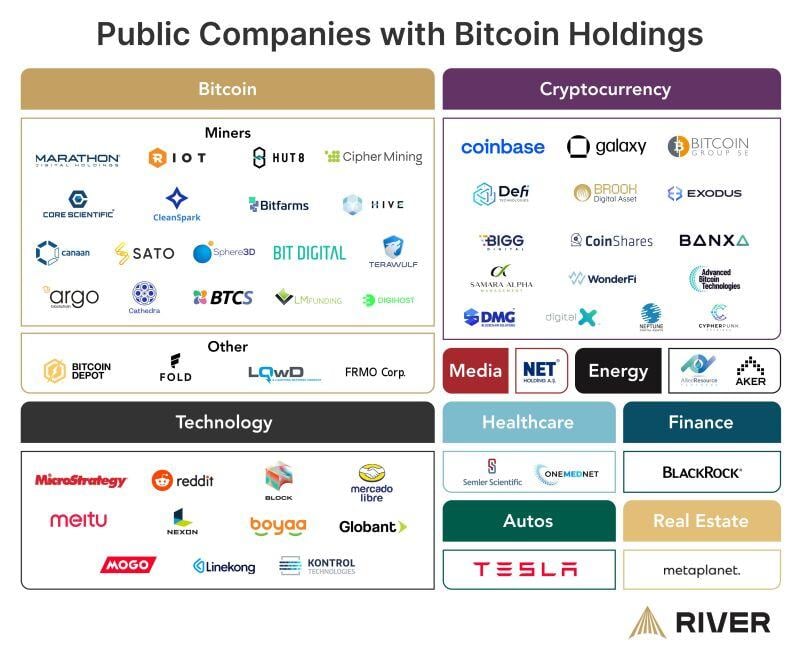

BREAKING: Ai company Genius Group adopts Bitcoin as its primary treasury asset and will buy $120m $BTC

Genius Group will also start accepting Bitcoin payments. "We see Bitcoin as being the primary store of value that will power these exponential technologies" Source: Bitcoin Archive

Investing with intelligence

Our latest research, commentary and market outlooks