Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

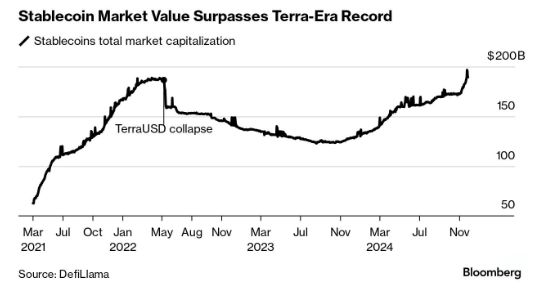

Crypto Stablecoin market value reaches $190 Billion, an all-time high 🚨

"Cash on the Sidelines" Source: Bloomberg

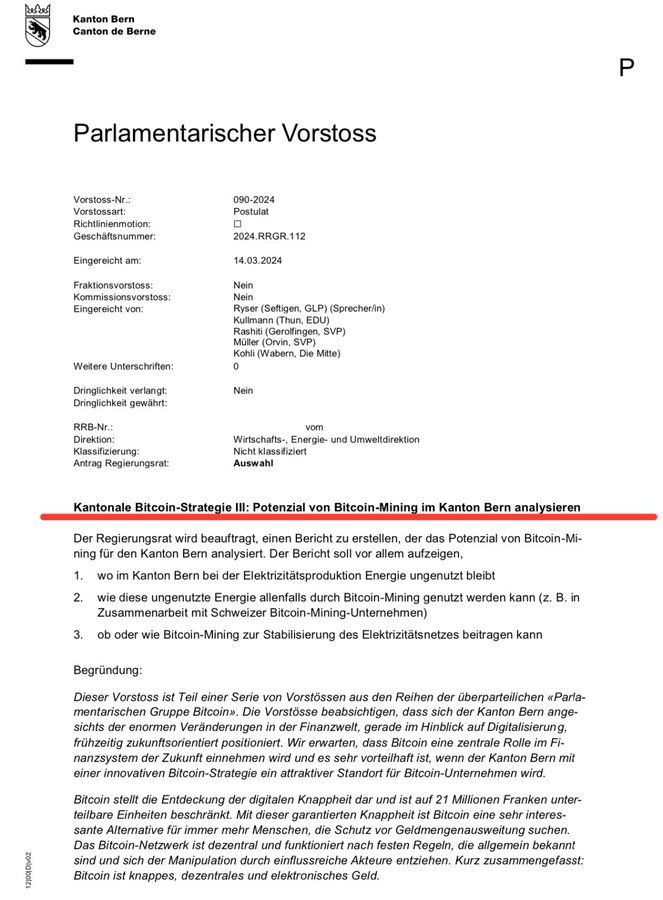

BREAKING: Switzerland passes legislation to study how Bitcoin mining can balance the grid and use wasted energy

[Dennis Porter] - Bitcoin Archive

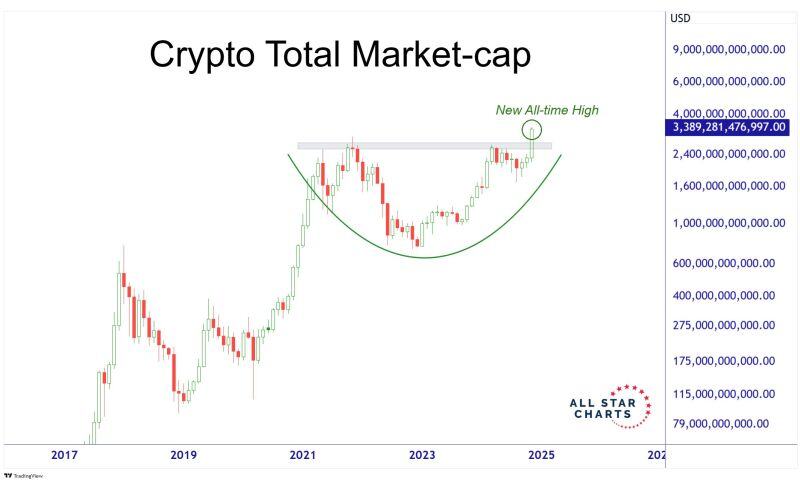

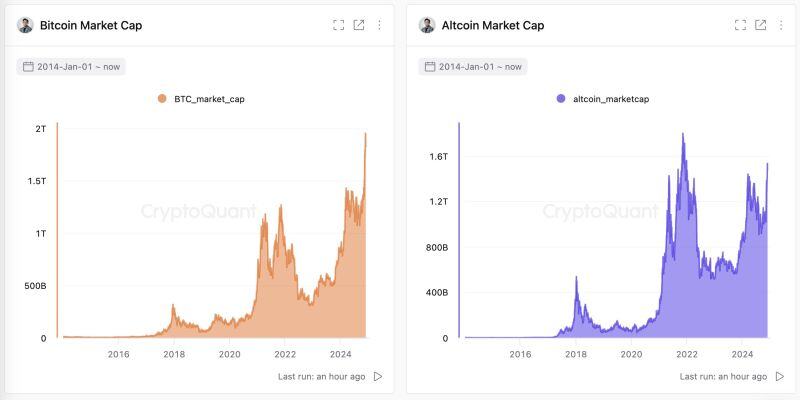

Why is altcoin season delayed?

Here's the view by Ki Young Ju on X: "Compared to the last cycle, the nature of capital flowing into Bitcoin has shifted. The current Bitcoin rally is primarily driven by demand from institutional investors and spot ETFs. Unlike crypto exchange users, institutional investors and ETF buyers have no intention of rotating their assets from Bitcoin to altcoins. Moreover, as they operate outside of crypto exchanges, asset rotation becomes inherently less feasible. While institutional investors might allocate funds to major altcoins via ETFs or investment vehicles, minor altcoins still rely on crypto exchange users to buy them. For altcoins to reach a new all-time high market capitalization, they will require a significant influx of fresh capital to crypto exchanges. The altcoin market cap below its previous ATH indicates reduced fresh liquidity from new exchange users. If Bitcoin retail FOMO reignites, exchange user activity might increase, potentially setting the stage for an altcoin season. However, Bitcoin's future growth is expected to come from ETFs, institutions, and maybe govts, rather than retail traders on crypto exchanges".

He did it again... Over $495,100,000 have been liquidated from the crypto markets within the last 24 hours.

This is the single largest Bitcoin liquidation event in history, just days after Jim Cramer told investors to buy and called $BTC a winner... More seriously some pullback / profit taking was long due... but the market is taking the habit of going short Jim Cramer's view Source: Jacob King

JUST IN: 'America elected the most pro-crypto Congress ever with almost 300 pro-crypto elected to the House and Senate - CNBC

Crypto execs, investors and evangelists saw the election as existential to an industry that spent the past four years simultaneously trying to grow up while being repeatedly beaten down. In total, crypto-related PACs and other groups tied to the industry reeled in over $245 million, according to Federal Election Commission data. Nearly 300 pro-crypto lawmakers will take seats in the House and Senate, according to Stand With Crypto, giving the sector unprecedented influence over the legislative agenda. Link to CNBC article >>> https://lnkd.in/euj8FDqN

Should pension funds invest in Crypto?

The Times @CoinCornerDanny makes the case for YES!! The "Times" are changing... Source: Bitcoin Magazine

Investing with intelligence

Our latest research, commentary and market outlooks