Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

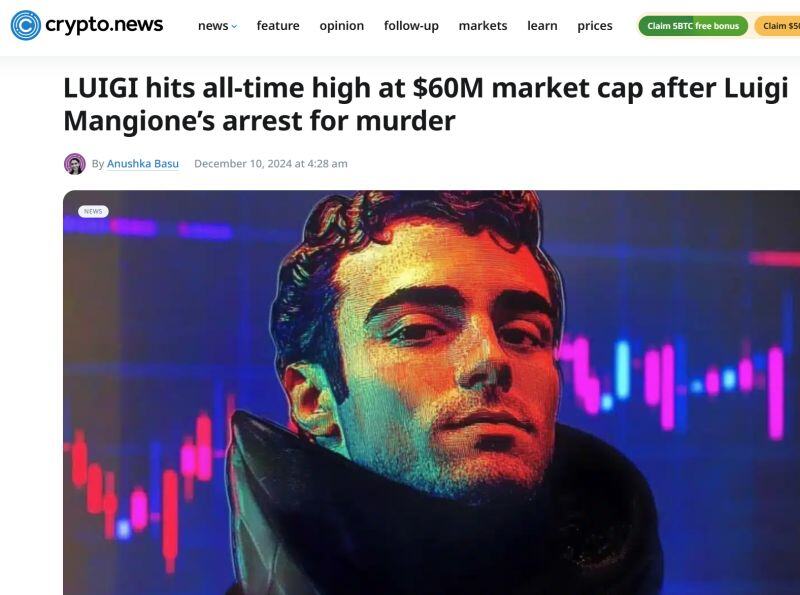

After the suspected United Healthcare CEO shooter Luigi Mangione was captured, "Luigi Coin" jumped +35,000%.

Luigi Coin hit a market cap of $60 MILLION with $100 million+ in volume over the last 24 hours... Source: The Kobeissi Letter

BREAKING >>> Trump has appointed David Sacks as the White House "AI & Crypto Czar."

Sacks will create a legal framework for the U.S. crypto industry to provide clarity and foster growth. Sacks is a known Solana ($SOL) bag holder Source: Truth Social, Bloomberg @DavidSacks

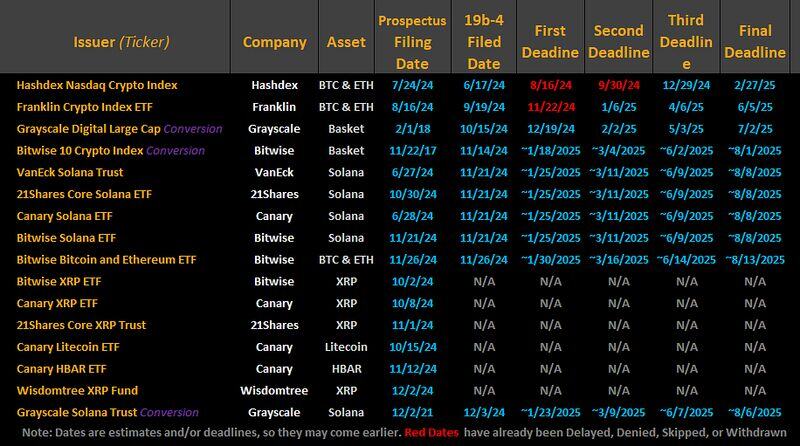

SOL ETF first approval deadline is 3 days after Gary Gensler leaves office and 3 days after Trump takes over

Source: gum on X, Bloomberg

BREAKING: Alex Mashinsky of Celsius Network pleads guilty to:

1. Inducing investor to sell their Bitcoin to Celsius with false statements about its EARN program. 2. Manipulating the price of CEL Sentencing is Tuesday, April 8, 2025 at 11:30 with a max sentence of 30 years. Source: Aaron Bennett @AaronDBennett on X

Ripple $XRP forms a God Candle as it becomes the world's 3rd largest cryptocurrency, valued at almost $140 Billion

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks