Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

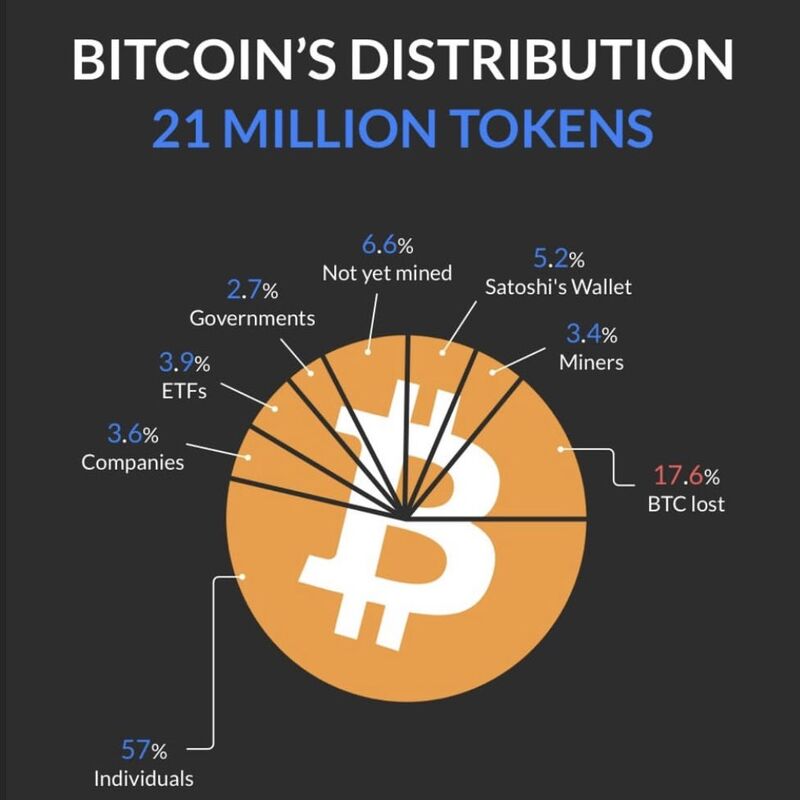

JUST IN: MICHAEL SAYLOR AND MICROSTRATEGY $MSTR BOUGHT 15,350 MORE BITCOIN $BTC

MicroStrategy spent ~$1.5 billion to buy the 15,350 at an average price of ~$100,386 per Bitcoin, boosting total holdings to 439,000. $MSTR 📈 +3.50% in pre-market. Source: Michael Saylor Tracker

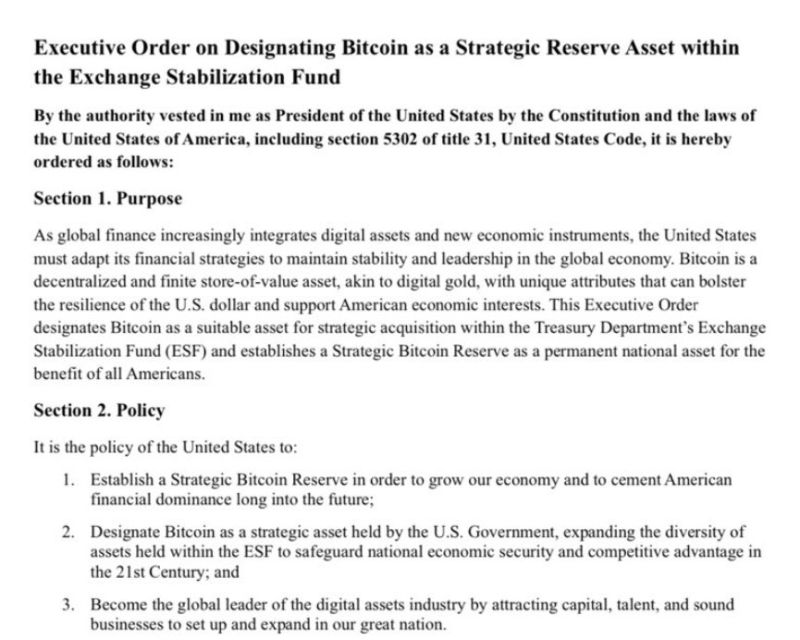

TEXAS GOES ALL IN ON BITCOIN WITH STATE RESERVE PLAN!

Texas just made a bold crypto power move! State Rep. Giovanni Capriglione has filed a bill to create a Strategic Bitcoin Reserve, setting the stage for Texas to lead the Bitcoin revolution. This is a visionary step toward making Texas the ultimate Bitcoin hub. Source: Watcher Guru, @VoteGiovanni thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks