Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. SEC announces new task force to create a "clear regulatory framework for crypto assets” lead by Commissioner Hester Peirce.

Cryptos are moving up Source: Documenting Bitcoin

BREAKING: Donald Trump to designate crypto as a national priority, including the consideration of a "national Bitcoin stockpile"

— Bloomberg

Donald Trump's new SEC to begin overhauling the agency's crypto policies "as early as next week" 👀

Source: Reuters

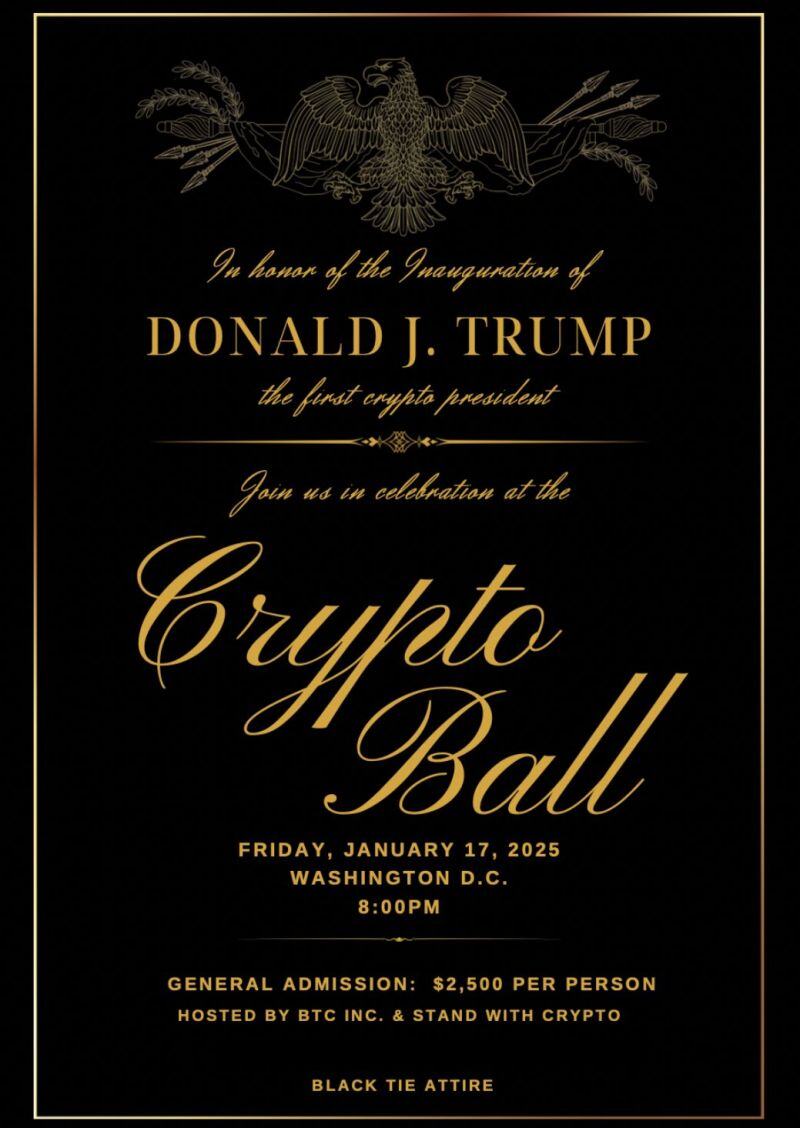

Donald Trump’s inauguration will include a “Crypto Ball,” with technology industry leaders celebrating him as "the first crypto president”.

Here's an extract from Brave New Coin: 👇 "In a move that blends politics and technology, Washington D.C. will host the inaugural “Crypto Ball” on January 17, 2025, in honor of the inauguration of Donald J. Trump as the first "crypto president." The event, poised to be one of the most exclusive celebrations in political history, is set to take place at the historic Andrew W. Mellon Auditorium, a venue befitting the occasion's grandeur and significance. The Crypto Ball is being spearheaded by David Sacks, Trump’s newly appointed AI & Crypto Czar. Known for his deep ties to Silicon Valley and the venture capital world, Sacks’ involvement underscores the administration’s commitment to embracing blockchain technology and digital innovation. This gala event serves not only as a celebration of Trump’s return to the presidency but also as a declaration of intent for a pro-crypto agenda in the United States. Tickets to the event are as exclusive as the concept itself. General admission starts at $2,500, but the true allure lies in the VIP and private packages. For $100,000, VIP guests gain access to exclusive networking opportunities with leading figures in the crypto space. Meanwhile, a $1 million private dinner package with Trump himself offers unparalleled access to the president—a rare opportunity for those deeply invested in shaping the future of the blockchain industry. The event is being sponsored by some of the biggest names in the crypto world, including Coinbase, MicroStrategy, and Galaxy Digital. Their sponsorship not only highlights their support for a crypto-friendly administration but also signals a broader alignment between the private sector and public policy under Trump’s leadership. MicroStrategy’s Michael Saylor, a long-time advocate for Bitcoin, and Coinbase CEO Brian Armstrong are expected to attend, cementing the event’s stature as a convergence point for the world’s crypto elite. As part of the evening’s program, attendees can expect keynote speeches from Trump and Sacks, celebrating the administration’s vision for integrating blockchain technology into national policy. News reporting suggests that President Trump will sign pro-crypto executive orders on day one of his administration, Rumors also hint at the unveiling of a government-backed digital currency initiative, potentially revolutionizing the global financial landscape. Musical performances and an array of high-tech showcases will punctuate the evening, blending entertainment with cutting-edge demonstrations of blockchain applications". Source: Brave New Coin

Donald Trump is expected to issue executive orders on the first day of his presidency regarding Bitcoin and crypto

— The Washington Post

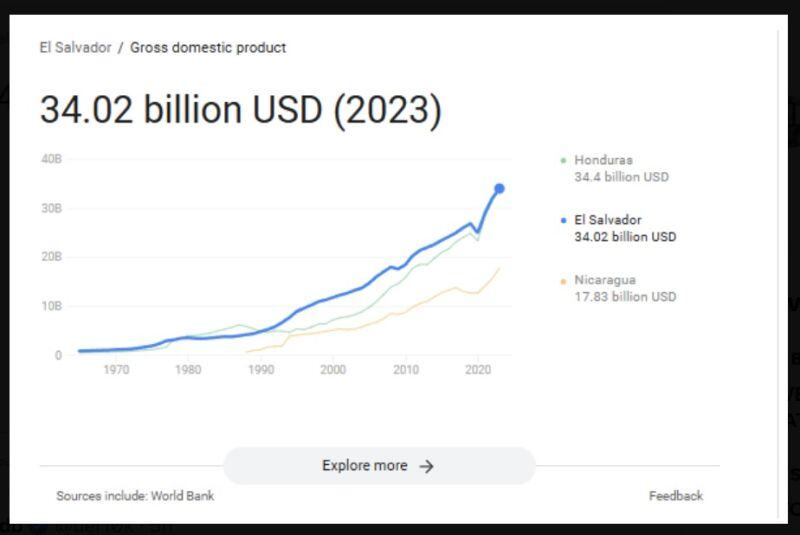

Tether has announced that the entire Tether group is going to be relocating and will now be HQ'd in El Salvador.

This has to have a massive impact on El Salvador. I mean the estimated GDP of ElSalvador was $34 billion in 2023 according to the World Bank. Tether had a net PROFIT of $10 billion in 2024... Source: James Seyffart @JSey

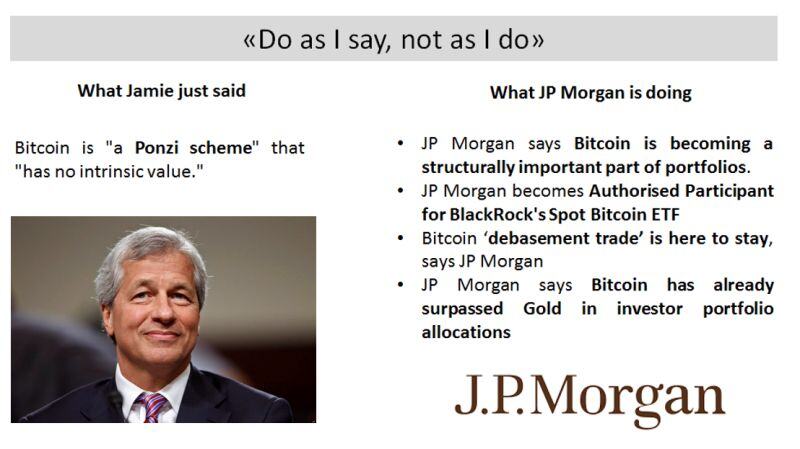

$JPM CEO Jamie Dimon just said that $BTC is "a Ponzi scheme" that "has no intrinsic value."

Meanwhile, the bank he runs is progressively adopting cryptos… Jamie Dimon, CEO of JPMorgan Chase, reiterated his harsh criticism of bitcoin. Despite his negative stance, Dimon concedes that cryptocurrencies might have a role in the future of finance. His views on Bitcoin have fluctuated over time, highlighting a pattern of inconsistency. And his own bank seems to be ignoring what he is saying...

Investing with intelligence

Our latest research, commentary and market outlooks