Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

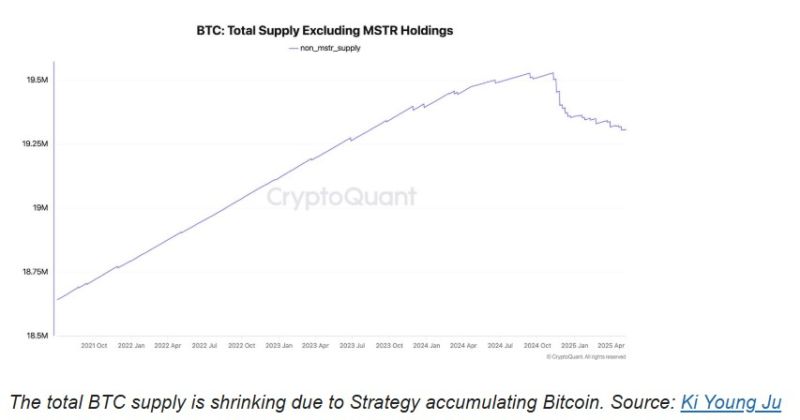

Strategy $MSTR, a Bitcoin treasury company, is accumulating Bitcoin at a faster rate than total miner output, giving the supply-capped asset a -2.33% annual deflation rate

According to CryptoQuant CEO and market analyst Ki Young Ju. 🟩 “Their 555,000 BTC is illiquid with no plans to sell,” the analyst wrote in a May 10 X post. 🟩“Strategy's holdings alone mean a -2.23% annual deflation rate — likely higher with other stable institutional holders,” Ju continued. 🟩Additionally, Strategy acts as a bridge between Bitcoin and traditional financial (TradFi) markets by funneling funds from TradFi investors into Bitcoin through selling corporate debt and equity, which the company uses to finance more BTC purchases. According to Michael Saylor, over 13,000 institutions hold Strategy stock directly in their portfolios. ➡️ Bitcoin investors continue to watch the company and its effect on Bitcoin market dynamics. Strategy leads the charge toward institutional adoption of Bitcoin, further restricting the supply of available coins and raising BTC prices, while dampening volatility. Source: zerohedge, cryptoquant, cointelegraph.com

BREAKING: Cantor Fitzgerald, SoftBank, Tether, and Bitfinex are pooling $3 billion to create 21 Capital, a Bitcoin investment firm.

The initiative mirrors Strategy's Bitcoin plan, with contributions from Tether ($1.5 billion), SoftBank ($900 million), and Bitfinex ($600 million). Brandon Lutnick, current chair and CEO of Cantor Fitzgerald and son of former CEO Howard Lutnick, is at the helm of this venture. The initiative will utilize funds from Cantor Equity Partners, a special purpose acquisition company (SPAC) that raised $200 million earlier this year. The investment contributions to 21 Capital are substantial, with Tether expected to provide $1.5 billion in Bitcoin. SoftBank will contribute $900 million, while Bitfinex plans to supply $600 million worth of the crypto. This collaboration aims to mirror the investment approach pioneered by Michael Saylor's Strategy, which has seen significant success in the Bitcoin market🔥 The report highlights that the Bitcoin holdings from these companies will eventually be converted into shares of 21 Capital, valued at $10 per share, suggesting a valuation of $85,000 per Bitcoin. Additionally, Cantor's vehicle plans to raise $350 million through a convertible bond and an additional $200 million via private equity placements for further Bitcoin acquisitions. The Financial Times notes that an official announcement regarding this venture is expected in the coming weeks, although details may still be subject to changes or cancellation. Source: The Bitcoin Historian @pete_rizzo_

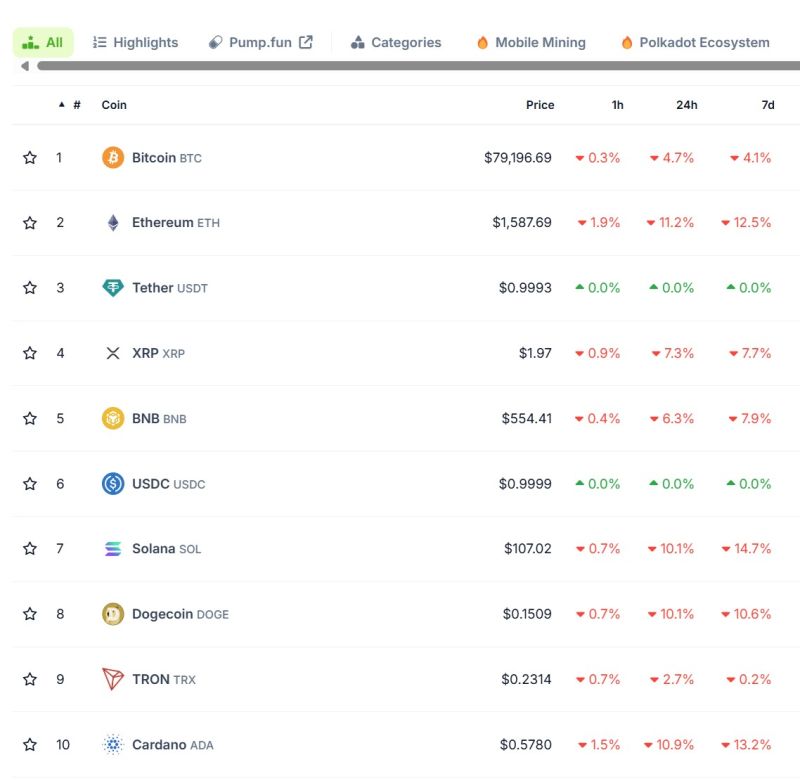

JUST IN: Over $330,000,000,000 added to the cryptocurrency market in the past 4 hours.

Source: www.zerohedge.com

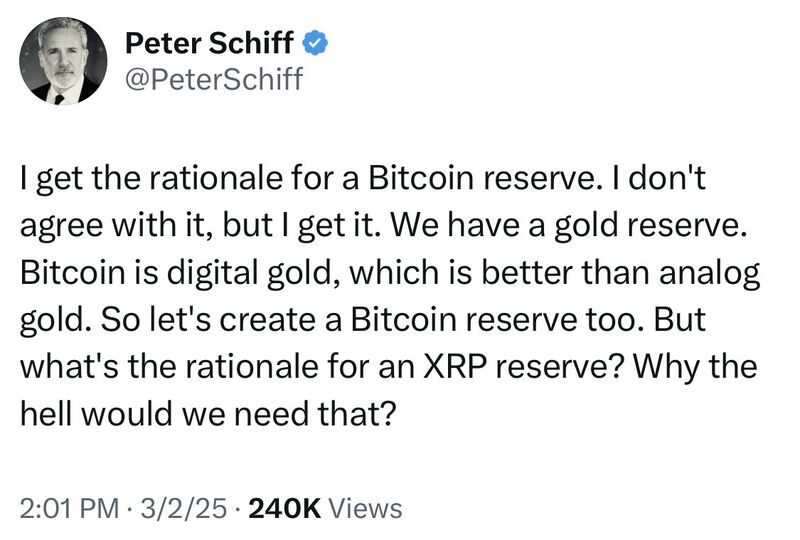

The idea of XRP, SOLANA and CARDANO in a strategic U.S. reserve is so retarded that even Peter Schiff is becoming a Bitcoin maximalist.

Source: The ₿itcoin Therapist @TheBTCTherapist

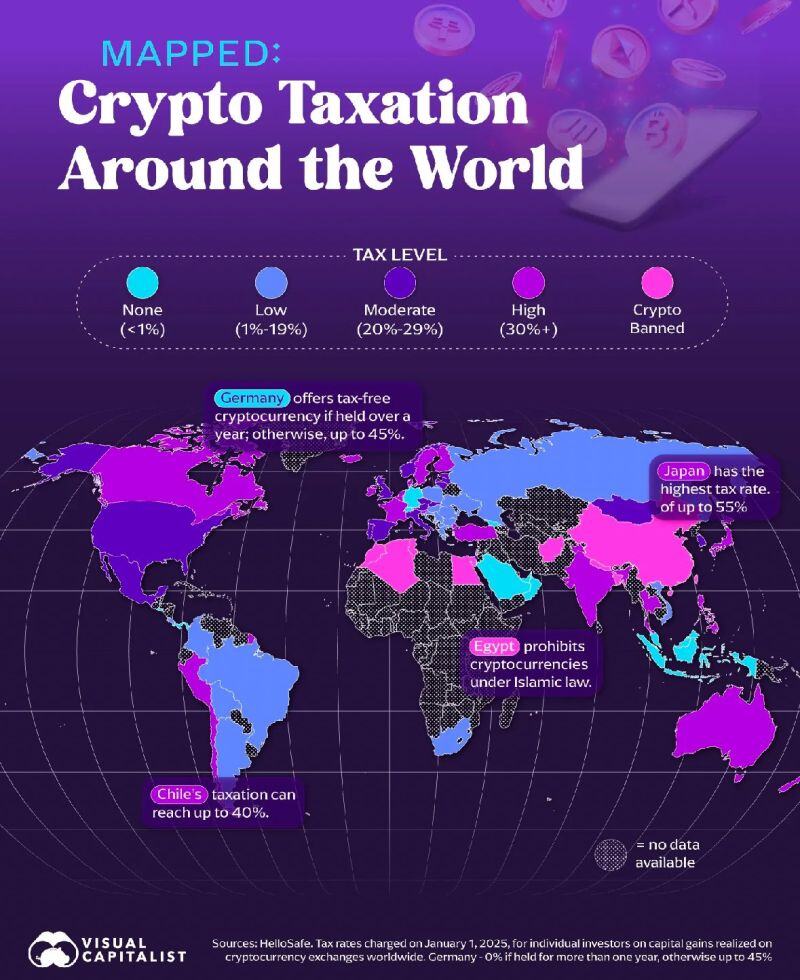

Crypto taxation around the world 🌎

Source: Blossom @meetblossomapp, Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks