Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

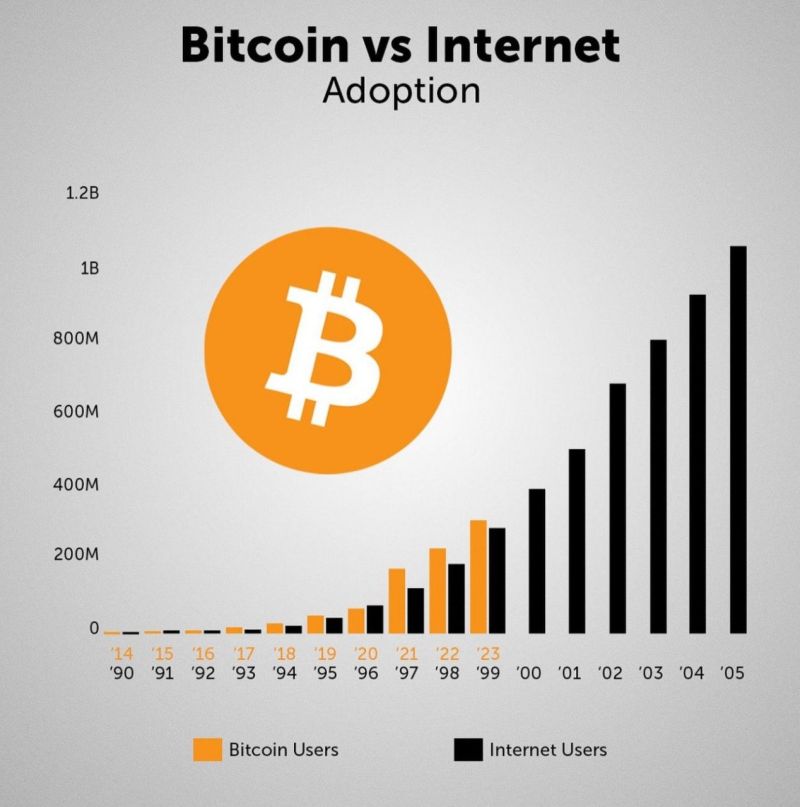

🚨CRYPTO ADOPTION 43% FASTER THAN MOBILE PHONES, 20% FASTER THAN INTERNET

Crypto has hit 300M users in just 12 years—43% faster than mobile phones and 20% faster than the internet, per BlackRock. Younger generations, inflation fears, and Trump’s pro-crypto stance are fueling the surge. With bitcoin ETFs projected to hit $250B and regulatory wins piling up, crypto’s mainstream takeover is accelerating. Source: BlackRock thru Mario Nawfal on X

The PaxGold stablecoin is tradeable 24/7. On the back of Trump's Tariff announcement, it went parabolic trading above $3,000 at some point...

PAX Gold (PAXG) is a commodity-backed, gold stablecoin issued by Paxos. Each token is backed by 1 fine troy ounce of gold kept in Brink’s vaults managed by Paxos. Source: kucoin

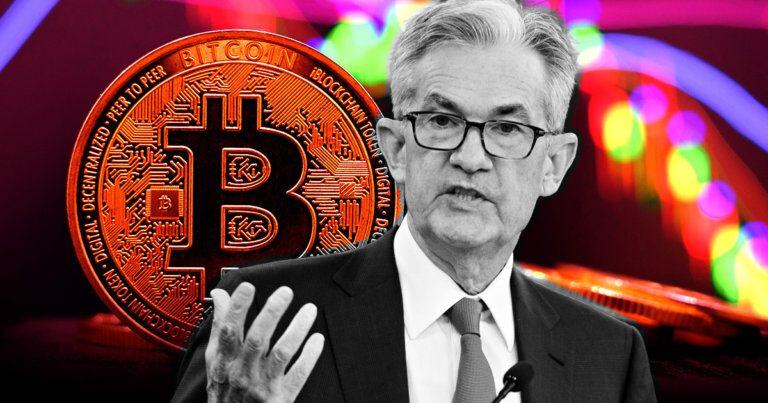

🔴 FED CHAIR POWELL SAYS BANKS CAN NOW SERVE CRYPTO TO CUSTOMERS 🚀

Banks can serve crypto customers as long as they can manage the risk, said U.S. Federal Reserve Chair Jerome Powell, amid allegations that the crypto industry is being cut off from financial institutions. "The threshold has been a little higher for banks engaging in crypto activities and that's because they're so new," Powell said on Wednesday when asked by a reporter during a Federal Reserve press conference about risks associated with cryptocurrency. The central bank is not against innovation, he added. Crypto firms have complained about the difficulty behind establishing and maintaining bank accounts in the U.S. Following the collapse of crypto exchange FTX in late 2022, several governmental agencies, including the Federal Reserve, issued warnings on "crypto-asset risks." Source: The Block

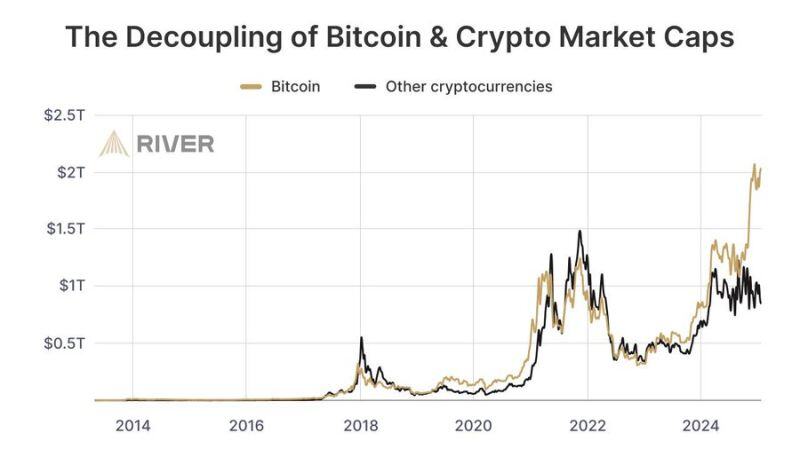

BREAKING: President Trump has signed an Executive Order to develop a “national digital asset stockpile,” per Fox News.

President Trump has also signed an Executive Order to create a “crypto working group,” per Reuters. These are his first crypto-related Executive Orders. Source: The Kobeissi Letter

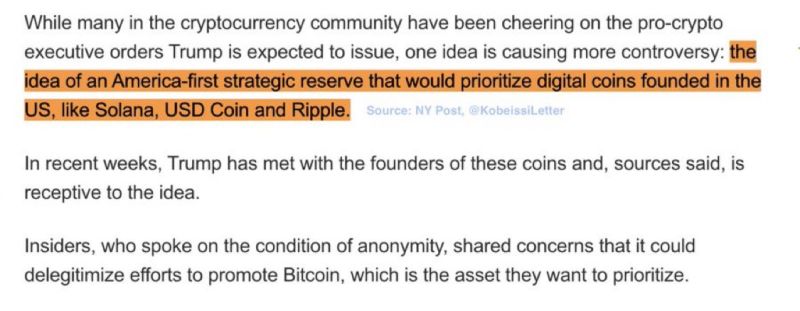

Will the National Digital Asset Stockpile only be denominated in bitcoin?

One week ago, the NY Post reported that President Trump is considering "prioritizing digital coins founded in the US.” This would include coins like Solana, USDC, and Ripple. Source: The Kobeissi Letter

Strategic Bitcoin Reserve legislation is gaining momentum.

11 states, including Florida, Wyoming, and Massachusetts, have introduced bills to secure Bitcoin as part of their state reserves. Source: TFTC @TFTC21

Some very suspicious activity on $TRUMP meme when it was launched on Friday.

At 6:00 PM ET, President Trump says "I don't know very much about it" regarding his memecoin, $TRUMP. 3 minutes later, at 6:03 PM ET, $TRUMP fell over -33% and a wallet purchased $5.09 MILLION worth of it at the EXACT bottom. This is one of the biggest single purchases since the coin launched. 14 minutes later and this trader is now up $2.4 MILLION on this purchase. Did someone know? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks