Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚀 JPMorgan analysts said the "debasement trade" is far from a passing trend, with both gold and bitcoin gaining structural importance in investor portfolios.

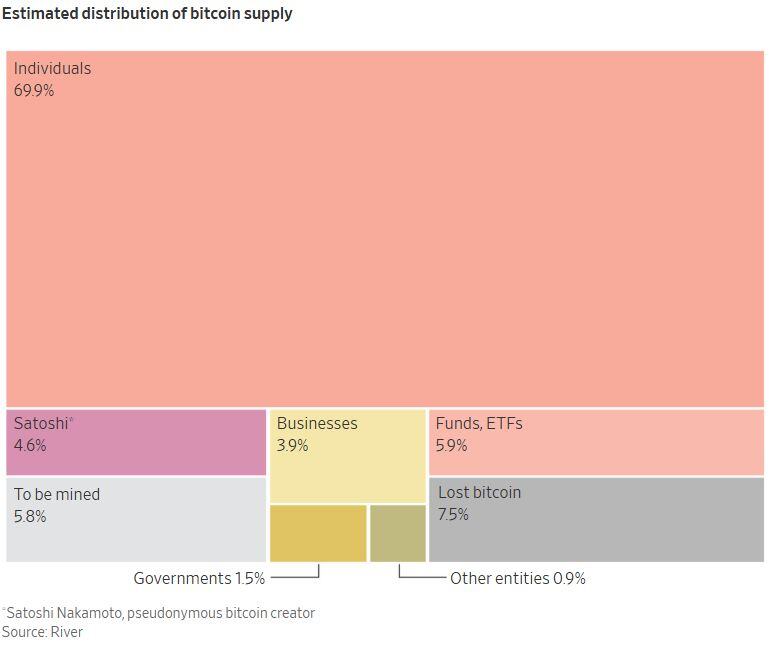

🚨 "The gold price appreciation over the past year has gone well beyond the moves implied by dollar and real bond yield shifts, and likely reflects the re-emergence of this 'debasement trade,'" JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a report on Friday. Meanwhile, a record capital inflow into crypto markets in 2024 suggests that bitcoin is also becoming "a more important component" of investors' portfolios, they added. 👉 The debasement trade refers to a strategy where investors turn to assets like gold and bitcoin to hedge against the devaluation of fiat currencies, often driven by factors such as inflation, rising government debt and geopolitical instability. 🔴 Overall, with both gold and bitcoin gaining structural importance, the debasement trade is here to stay, according to the analysts. Last October, the analysts expressed bullishness on crypto heading into 2025, citing factors such as the debasement trade and growing institutional adoption, among others. Source: The Block Disclaimer: These are not investment recommendations. Cryptoasset investments can be complex and high risk.

Bitcoin vs. fiat

Source: ₿itcoinTeddy @Bitcoin_Teddy Disclaimer: These are not investment recommendations. Cryptoasset investments can be complex and high risk.

BREAKING: Tether has burned over $1 billion overnight—their largest single burn in history. This marks the 4th major burn in 10 days.

Source: Jacob King

DOGE lead Vivek Ramaswamy’s fund, Strive files for “Bitcoin Bond” ETF 🤯

👉 Strive Asset Management is launching a new ETF that will provide exposure to Bitcoin through convertible securities, primarily focusing on MicroStrategy’s holdings. 👉The Strive Bitcoin Bond ETF will invest at least 80% of its assets in “Bitcoin Bonds” and related derivative instruments, including swaps and options. 👉The actively managed fund will hold both direct positions in Bitcoin-linked convertible securities and derivatives, with allocation decisions based on cost and return potential. 👉The fund will maintain cash positions in short-term US Treasury securities and may invest in other Bitcoin-focused investment vehicles. 👉As a non-diversified fund, it can concentrate holdings in single issuers like MicroStrategy and allocate more than 25% of assets to software and technology sector companies. 👉Operating under a “manager of managers” structure, the ETF will be advised by Empowered Funds, LLC, which can appoint and replace sub-advisers without shareholder approval. 👉The fund’s shares will trade on the New York Stock Exchange and be held through the Depository Trust Company. Source: Vivek⚡️on X, Cryptobriefing

IRS Says Crypto Staking is Taxable

Staking a cryptocurrency should induce a tax liability as soon as it is done, the US government says. The IRS rebuffed a suit brought by Joshua Jarrett, a cryptocurrency investor who has sued in the US District Court for the Middle District of Tennessee source : bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks