Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

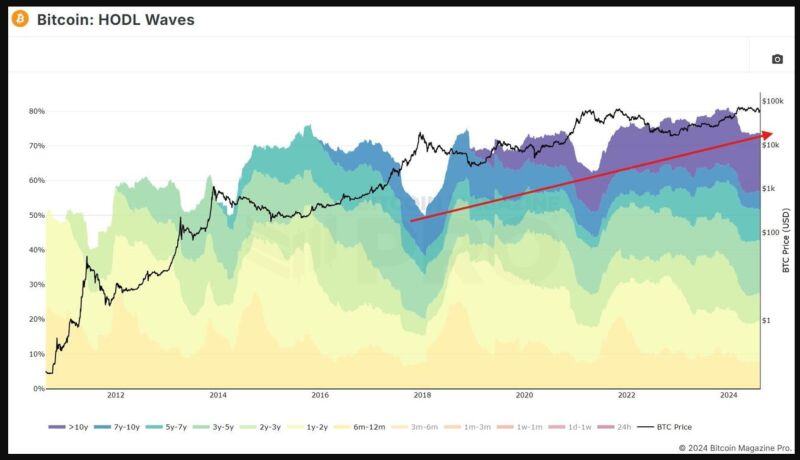

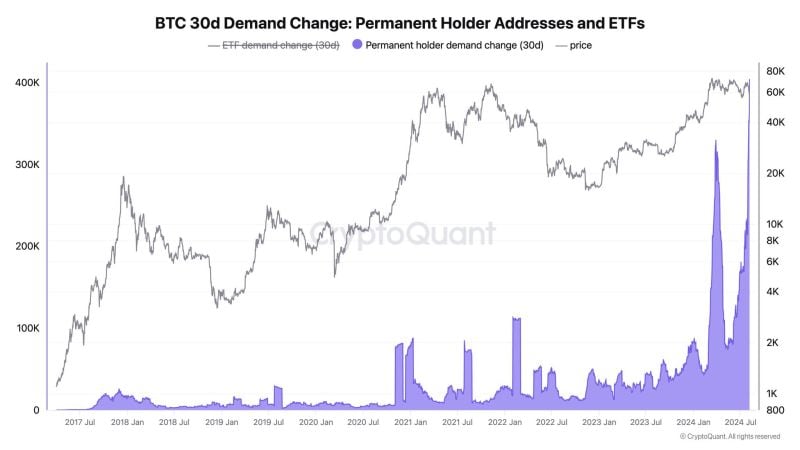

Recent data from Bitcoin Magazine Pro shows a significant trend among Bitcoin holders: nearly 75% of all circulating Bitcoin has remained dormant for over six months.

This strong HODLing behavior reflects a steadfast belief in Bitcoin's long-term value, despite market fluctuations. Source: www.zerohedge.com

JUST IN: President Putin signs law legalising Bitcoin and crypto mining in Russia.

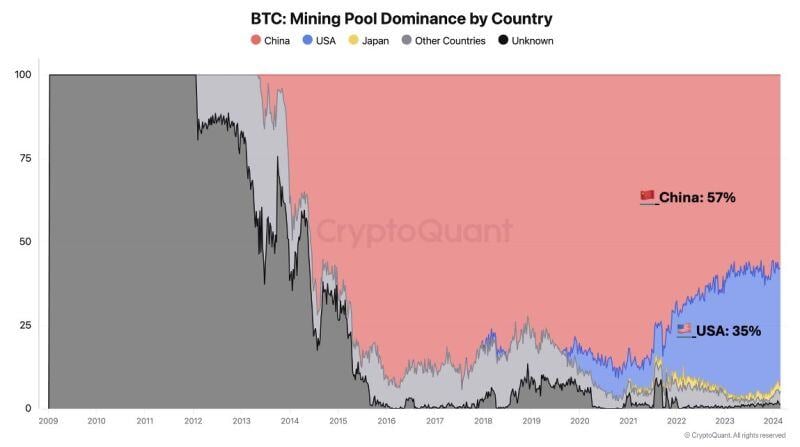

Russia seems to be acting to keep up with the US. Nation-level as Bitcoin FOMO is heating up. Their entry will boost the hash rate, strengthen network fundamentals, and diversify miner politics. Chinese mining pools control 57% of the BTC hash rate, while the 🇺🇸US has 35%. Source: Cryptoquant, Ki Young

Bitcoin $BTC reaction following the news that Biden is leaving the race was heavily scrutinized by market participants for 2 reasons

1/ It is the only risk assets traded 24/7 and thus reacting to news over the week-end; 2/ Bitcoin is now seen as a "pro-Trump" asset (i.e of it goes down that means that markets see a lower chance for Trump to be re-elected). While the initial reaction to the news was BTC going down almost $1,000 in a matter of minutes, BTC bounced back later on to trade at the highest level of the week-end (around $68k). So if Bitcoin is any guide, the Trump election trade does not seem to have been damaged... Source chart: coingecko

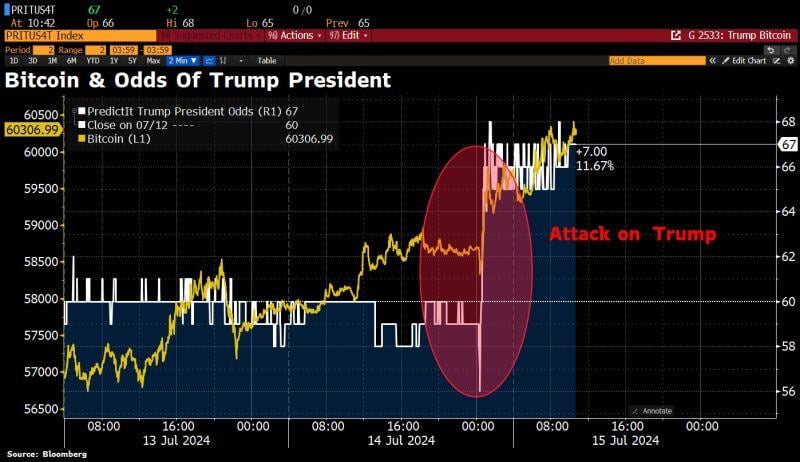

Bitcoin jumps >$60k as Trump shooting boosts Trump election odds.

Cryptos are the only assets trading 24/7. This could indicate a positive market reaction tomorrow. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks