Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

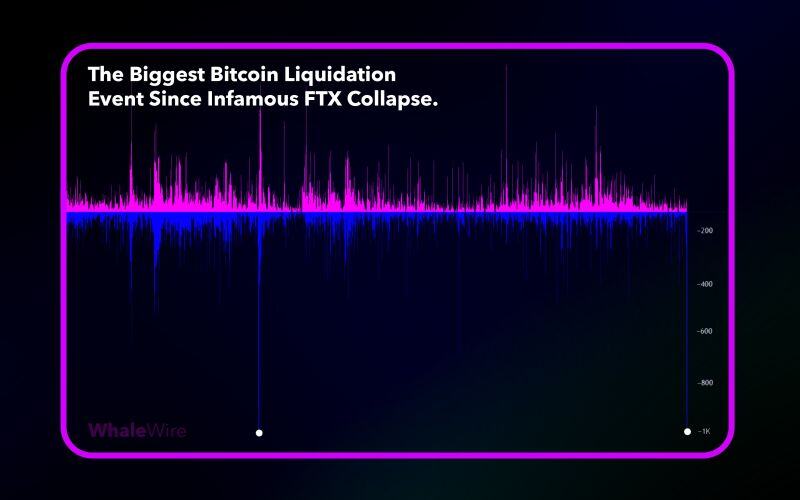

JUST IN: On-chain data confirms this is the second-largest liquidation event in Bitcoin's entire history, right after the FTX collapse in November 2022.

This comes amidst news that Germany is selling $3.5B worth of seized $BTC, and Mt. Gox begins paying back $8.5B to creditors, with the majority expected to be sold. Source: WhaleWire on X

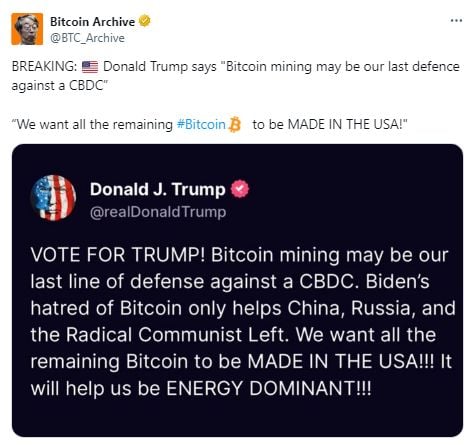

BREAKING: Donald Trump is reportedly in talks to speak at the 2024 Bitcoin convention in July.

This would make Trump the first presidential candidate to speak at a crypto event. Most recently, Trump said he "will end Biden's war on crypto" at a rally in Wisconsin. Source: The Kobeissi Letter

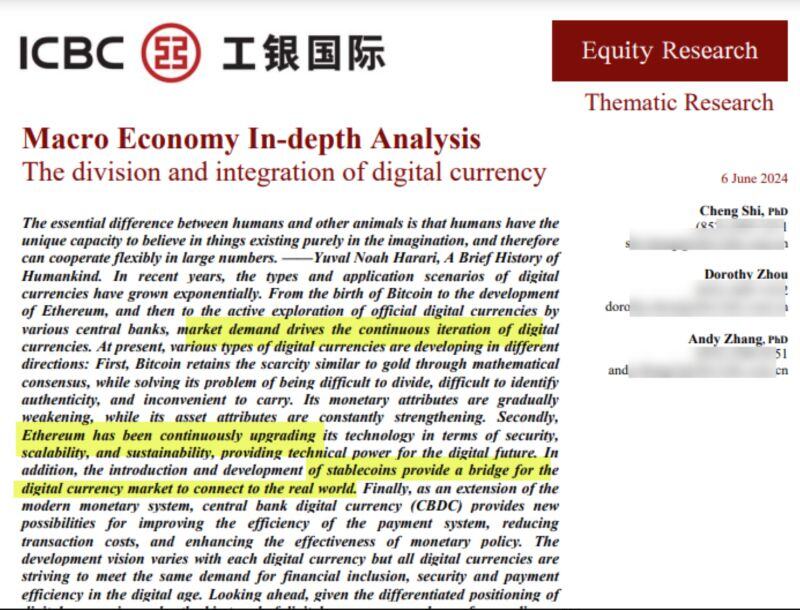

🚨WORLD'S LARGEST BANK, ICBC, CALLS ETHEREUM "DIGITAL OIL"

ICBC: “Ethereum has been continuously upgrading its technology in terms of security, scalability and sustainability, providing technical power for the digital future. In addition, the introduction and development of stablecoins provide a bridge for the digital currency market to connect to the real world.” ICBC described Ethereum as the “digital oil.” Being Turing-complete and having its own programming language, Solidity, allows developers to deploy complex smart contracts and dApps. This has made Ethereum the mainstay in inventive new fields such as NFTs and DeFi “and is gradually extending to the physical infrastructure network.” Source: Crypto News Flash thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks