Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Robinhood $HOOD has acquired cryptocurrency exchange Bitstamp for $200 million

Source: Barchart

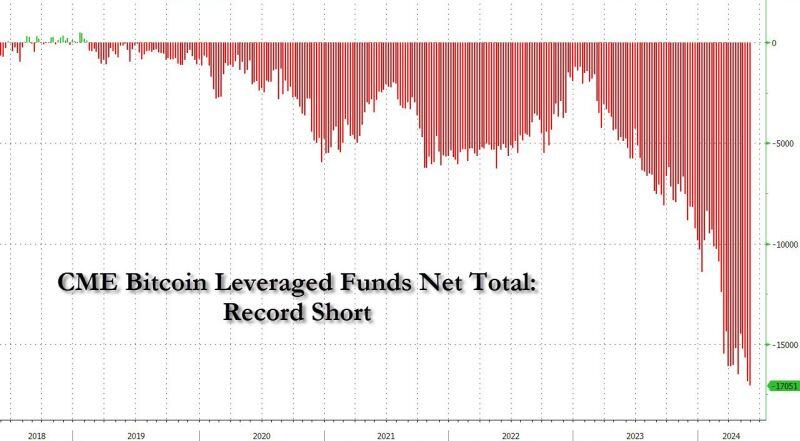

Hedge funds are betting big against Bitcoin in the futures markets, possibly looking to profit from elevated funding rates, as the most valuable cryptocurrency continues to trade sideways.

Funds have built up record short positions in Bitcoin futures, according to data shared by zerohedge.

Investing with intelligence

Our latest research, commentary and market outlooks