Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

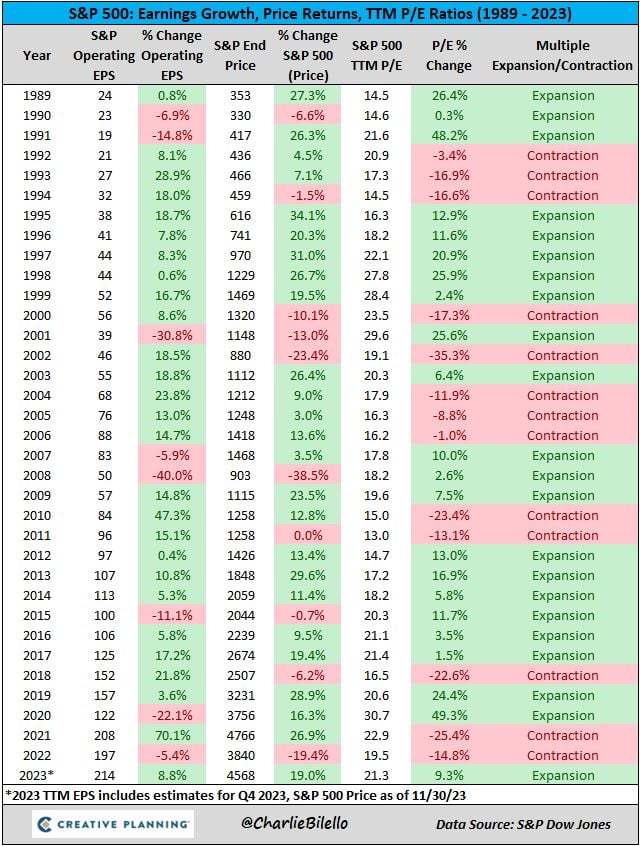

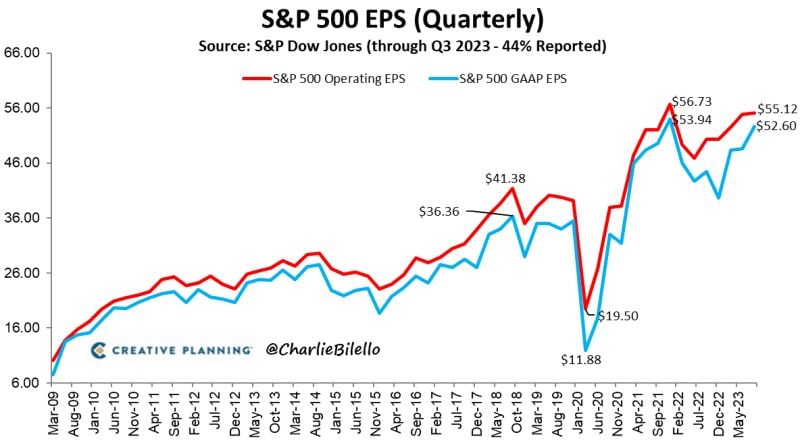

The P/E ratio on the S&P 500 is currently 21.3, with a multiple expansion of 9% in 2023

The average P/E ratio for the S&P 500 since 1989 is 19.2. Source: Charlie Bilello

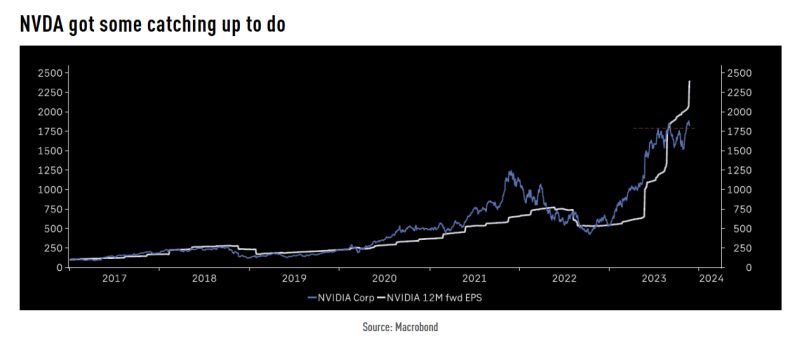

Nvidia quarterly report lifts earnings estimates support for mega-cap tech valuations, i.e nvdia / "mag 7" are trading cheaper AFTER Nvidia blowout results

Source: Macrobond, TME

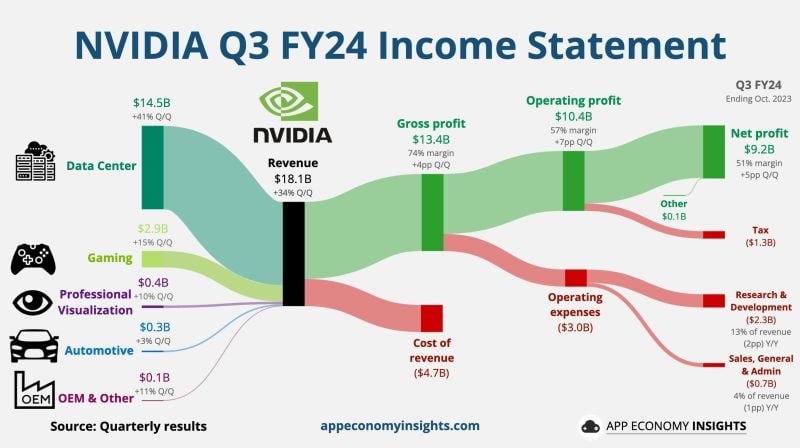

$NVDA Q3'24 Highlights

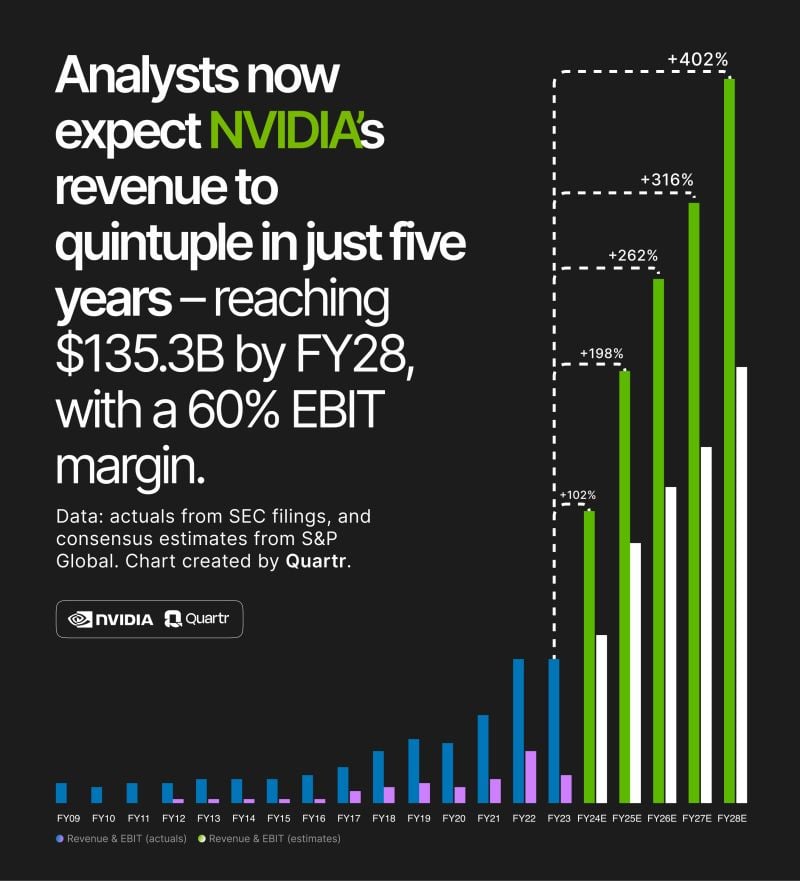

"NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off" – Co-founder & CEO, Jensen Huang Revenue +206% *Data Center +279% *Gaming +81% *Professional Vis. +108% *Automotive +4% EBIT +1,633% *marg. 64% (26%) EPS +1,274% Source: Quartr

Moments ago nvidia reported blowout Q3 earnings with revenue tripling as AI chip boom continues

However, it warns of "significant" China slowdown, guidance matches whisper range; stock is down 1% after-hours... The blowout earnings were certainly good news... but the warning about declining China sales and the guidance which only tagged the top end of the whisper guidance, that was not quite as exciting, and as a result, the stock initially dumped as much as $30 after hours, before recovering most of its losses, but has since resumed drifting 1% lower, setting up the stock for its first post-earnings drop since the advent of ChatGPT almost exactly one year ago. Source: App Economy Insights

Today is the BIG DAY with Nvidia ($NVDA) earnings results after the bell

With the Nasdaq up more than 13% from the lows, $NVDA at all-time-high, 95% of sell-side analysts with a BUY rating on $NVDA (!) sentiment of AI probably at record optimistic level after Microsoft "aqui-hire" of openai and the $VIX historically low at 13.5, there is indeed room for a short-term pullback... Source: www.investing.com, kakashiii111

Nvidia stock hits All-Time High ahead of earnings:

The stock has gained 24% in November, on pace for its best month since a blowout earnings report in May. Nvidia has gained 245% in 2023, pushing its market value above $1.2tn. Source: Bloomberg, HolgerZ

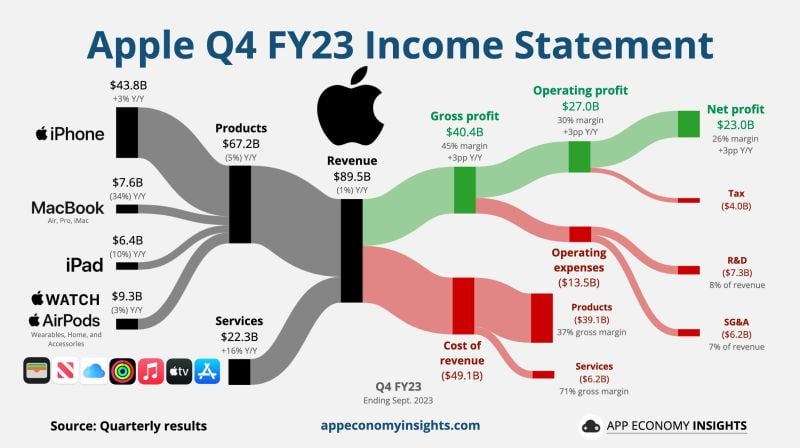

Apple Earnings:

While the numbers were mixed, with revenue of almost $82 billion coming above expectations thanks to strong service revenue offsetting iPhone print and a miss on Products, Macs and wearables, what the market did not like (again) is that this was another quarter without revenue growth and the 4rd consecutive quarter of annual revenue declines: the first time for AAPL since 2001. Here are some key number from FY Q1 2024 Apple: • Revenue -1% Y/Y to $89.5B (in-line). Services +16% Y/Y to $22.3B. Products -5% Y/Y to $67.2B. • Operating margin 30% (+3pp Y/Y). • EPS $1.46 ($0.07 beat). • Returned $93B to shareholders in FY23 ($78B in buybacks and $15B in dividends). Source: App Economy Insight, www.zerohedge.com

S&P 500 Q3 GAAP earnings per share are 18% higher than a year ago, the 3rd straight quarter of positive YoY growth. Quarterly earnings are now just 2% below the record high from Q4 2021

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks