Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

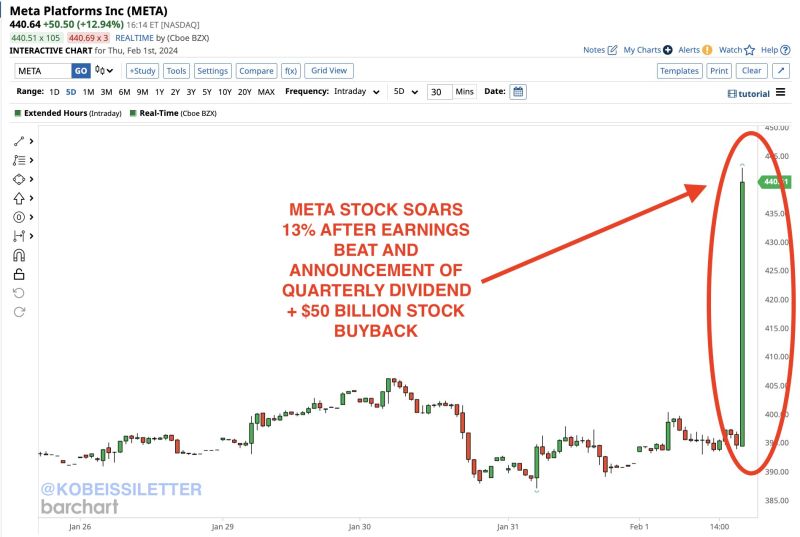

BREAKING: Meta stock, $META, soars 13% after beating earnings expectations and announcing a quarterly dividend with a $50 billion stock buyback.

The stock has added $130 billion in market cap in just 15 minutes. For the first time in history, $META now has a market cap of $1.1 trillion. It is officially the 7th largest public company in the world. Source: Barchart, The Kobeissi Letter

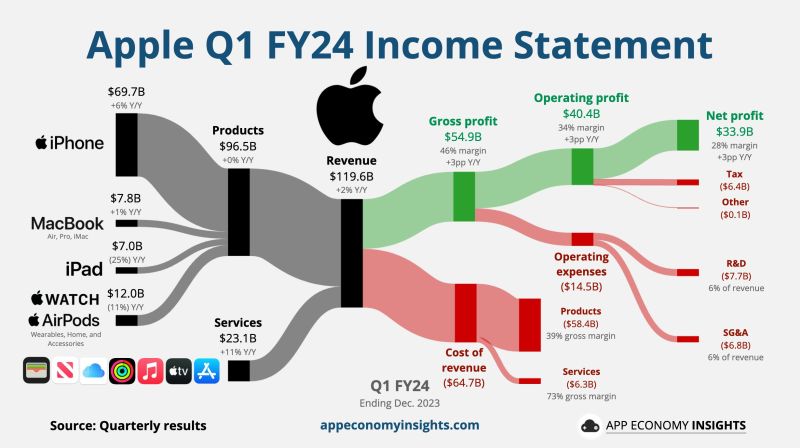

Apple reported fiscal first-quarter earnings on Thursday that beat estimates for revenue and earnings, but Apple showed a 13% decline in sales in China, one of its most important markets.

Apple shares fell over 1% in extended trading. Here’s how Apple did $AAPL Apple Q1 FY24 in a nutshell: • Revenue +2% Y/Y to $119.6B ($1.3B beat). Services +11% Y/Y to $23.1B. Products +0% Y/Y to $96.5B. • Operating margin 34% (+3pp Y/Y). • EPS $2.18 ($0.07 beat). • $20.1B in buybacks and $3.8B in dividends. Source: App Economic Insights

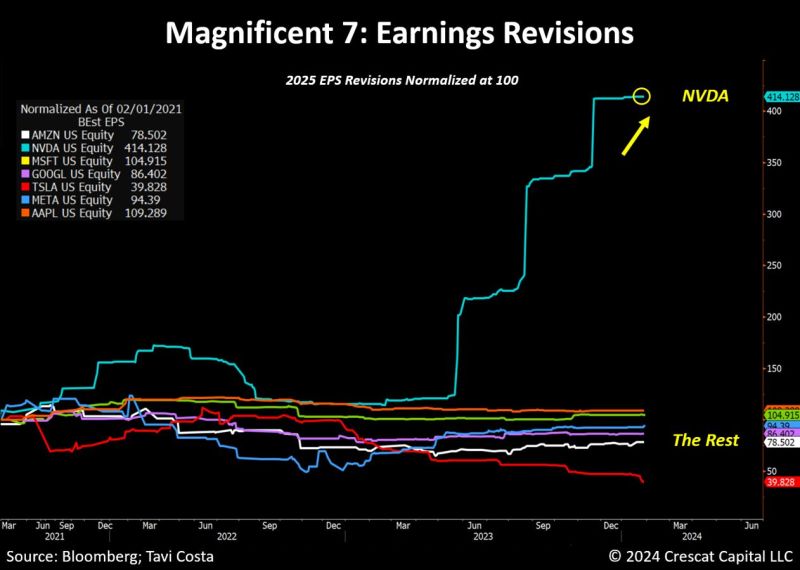

The week is THE week of BIG TECH earnings and it is time for a reality check: NVDA is the only Magnificent 7 stock seeing an increase in earnings revisions.

The company is almost the sole beneficiary of the recent AI advancements, contrasting sharply with others that have only experienced hype without any fundamental improvement. Is the Mag7 acronym already blowing out? Source: Bloomberg, Tavi Costa

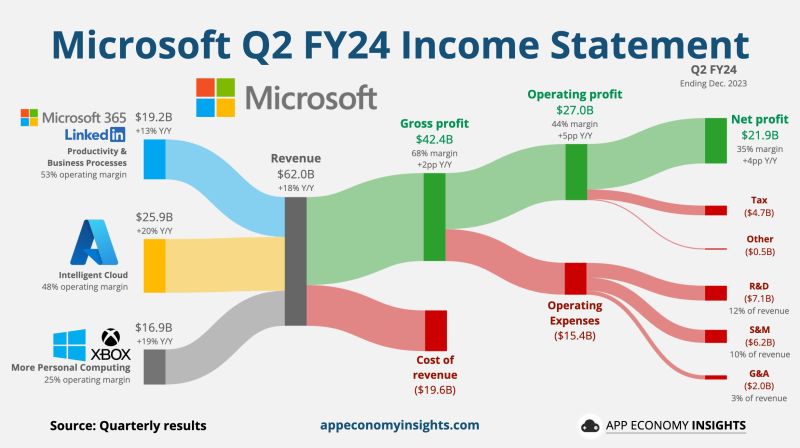

Microsoft $MSFT hitting all-time highs in extended hours trading after blowing out EPS and Revenue expectations

• Revenue +18% Y/Y to $62.0B ($0.9B beat). • Gross margin 68% (+2pp Y/Y) • Operating margin 44% (+5pp Y/Y). • EPS $2.93 ($0.16 beat). Source: App Economy Insights

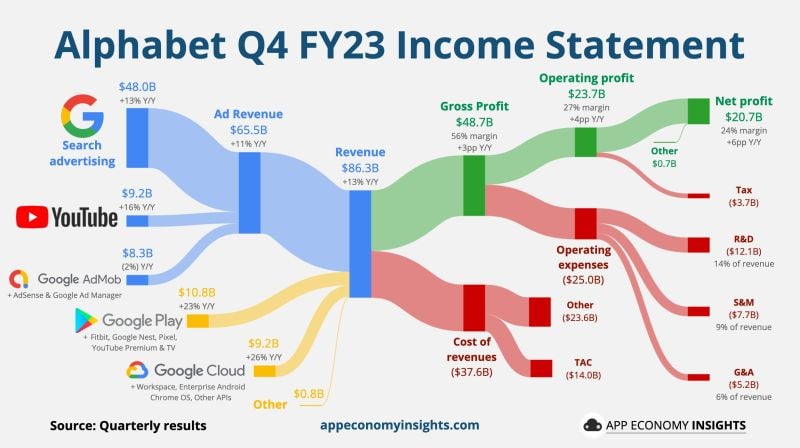

⚠️ Alphabet $GOOGL is down between -3% and -5% in extended hours trading after beating EPS and Revenue expectations

SUMMARY OF ALPHABET $GOOGL EARNINGS: 1. Revenue +13% Y/Y to $86.3B ($1.0B beat). 2. EPS $1.64 ($0.04 beat). 3. The search giant underperformed in its core ad search segment. -> Google’s advertising revenue totalled $65.52 billion, below expectations for sales of $65.80 billion. 4. Operating income also came in below expectations at $23.7 billion, compared to $23.82 billion. 5. On the bright side, Google cloud revenue topped estimates as the company spends heavily to compete with Microsoft’s Azure and Amazon’s AWS. ☁️ Google Cloud: • Revenue +26% Y/Y to $9.2B. • Operating margin 9% (+12pp Y/Y). 6. ▶️ YouTube ads +16% to $9.2B.

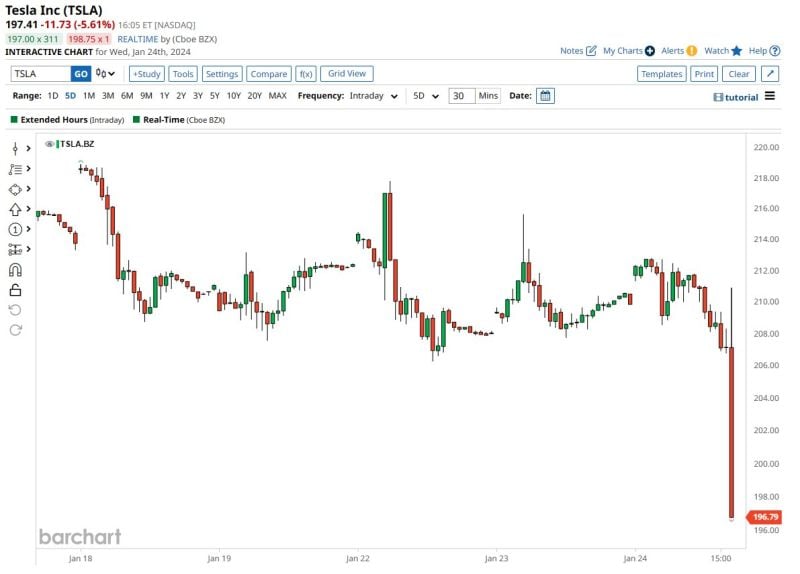

Tesla $TSLA dumped in after hours after reporting an earnings miss

Tesla shares drop 6% on weak auto revenue, warning of slower growth in 2024 Tesla reported revenue growth of 3% in the fourth quarter, trailing estimates. Auto revenue increased just 1% from a year earlier. Vehicle volume growth in 2024 “may be notably lower” than last year’s growth rate, the company warned. Source: barchart

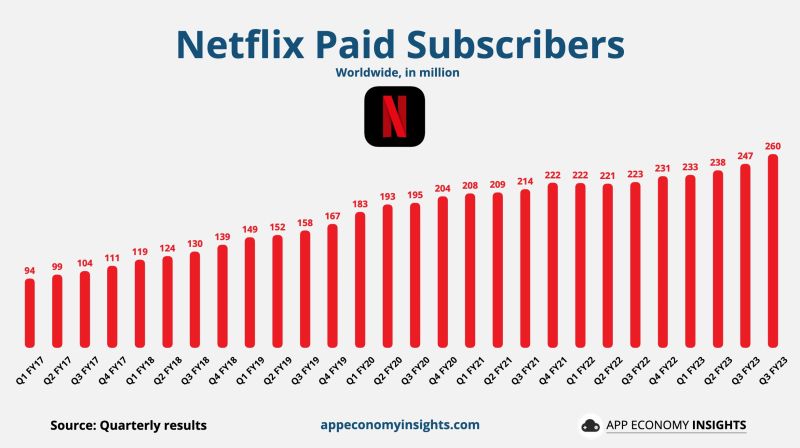

Netflix adds 13.1 million subscribers, tops revenue estimates as membership push gains steam

KEY POINTS -> Netflix added 13.1 million subscribers during the fourth quarter. The company now has 260.8 million paid subscribers. • Subscribers +13M Q/Q to 260M. -> The company also topped Wall Street’s revenue expectations. • Revenue +12.5% Y/Y to $8.8B ($0.1B beat). • Operating margin 17% (+10pp Y/Y). • EPS $2.11 ($0.11 miss). -> Q1 FY24 Guidance: • Revenue +13% Y/Y. • Operating margin 26%. Source: App Economy Insights, CNBC

Tesla is reporting results tonight?

Who wants to play $TSLA earnings call bingo? 😂 Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks