Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Tesla stock, $TSLA, surges over 8% after releasing Q1 2024 earnings results despite missing by nearly $1B on the top line and missing on EPS

Tesla Q1 revenues fell 8.7% over the last year, the biggest decline since 2012. Net Income fell 55% YoY to $1.1 billion. Gross margins moved down to 17.4% in Q1 from 19.3% a year ago and 29.1% two years ago The company said in the deck that it’s accelerating the launch of “new vehicles, including more affordable models,” that will “be able to be produced on the same manufacturing lines” as Tesla’s current lineup. Tesla is aiming to “fully utilize” its current production capacity and to achieve “more than 50% growth over 2023 production” before investing in new manufacturing lines. NB: The company also revealed that NONE of their Bitcoin was sold despite recent speculation. Source: The Kobeissi Letter, CNBC

This week is a big one for earnings with Microsoft, Alphabet and Meta all reporting their Q1 numbers.

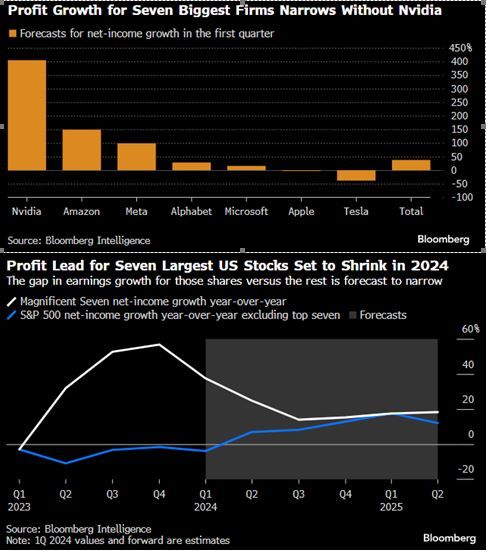

Note that ex-Nvidia, profit growth for the Mag7 narrows in Q1 and is expected to shrink in 2024 Source: Bloomberg

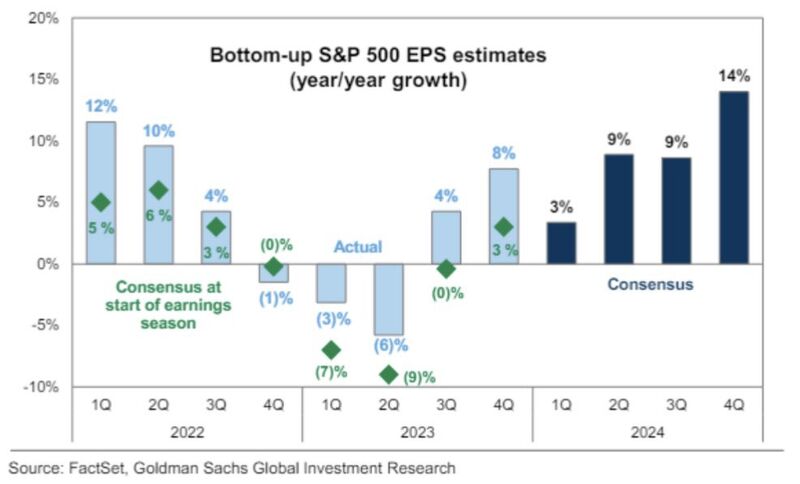

Consensus earnings estimates are projecting +3% YoY EPS Growth for the $SPX in Q1.

Last quarter, Wall Street was also modelling +3% EPS Growth and the realized number came in at +8%. Source: David Marlin, Goldman Sachs

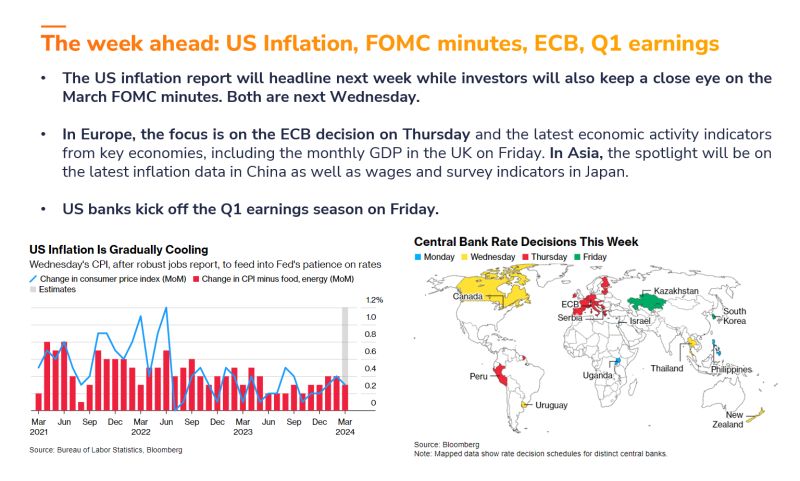

The Q1 reporting us earnings season kicks off next week with the banks reporting on Friday.

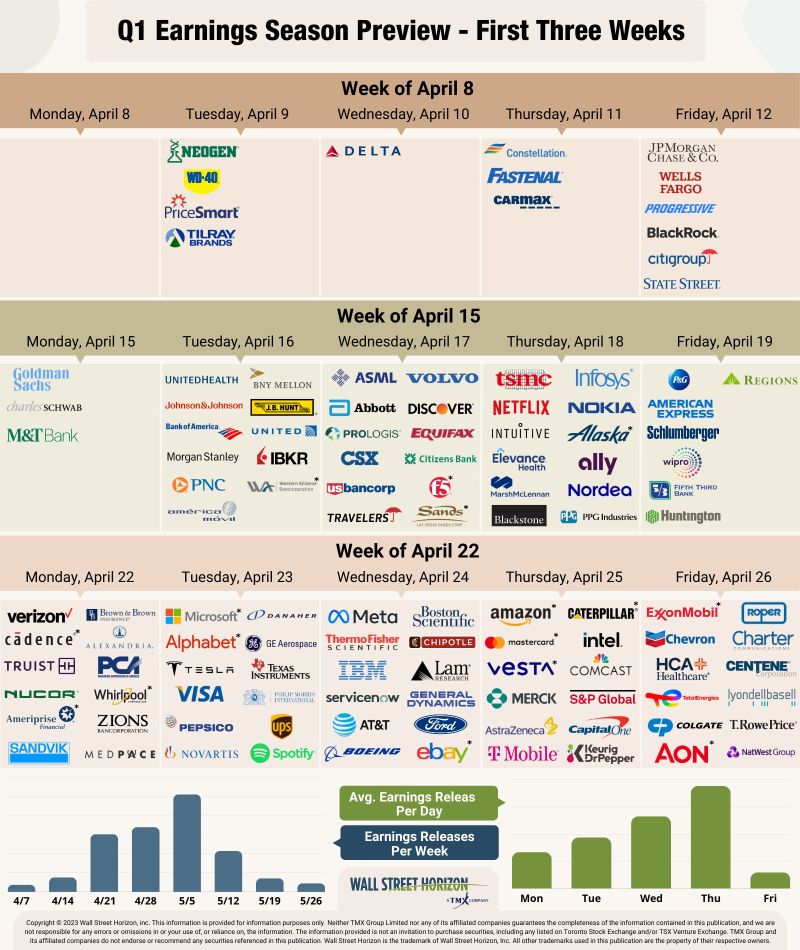

Below is a sneak preview of what's to come during the first three weeks. Note: companies marked with * are currently unconfirmed. Watch for: $MSFT, $TSLA, $AMZN, $GOOGL, $META, $TSM, $JPM, $XOM, $MA, $V, $NFLX, $CAT, $ASML and more Source: Wall Street Horizon

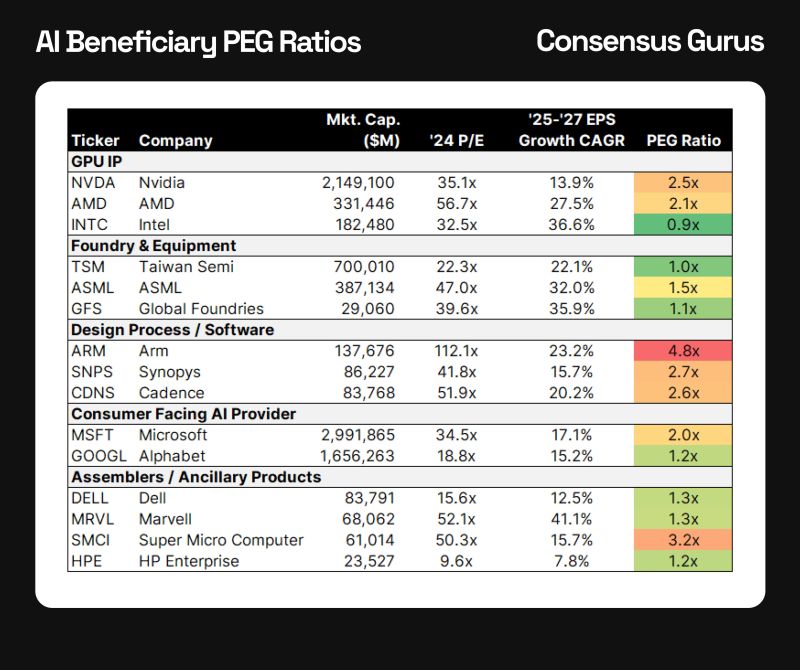

AI Beneficiary PEG Ratios - Locating the Value

Will nvidia $NVDA really plateau at 14% earnings growth after this year? Will arm $ARM come back to earth or will earnings rocket? Source: Consensus Guru

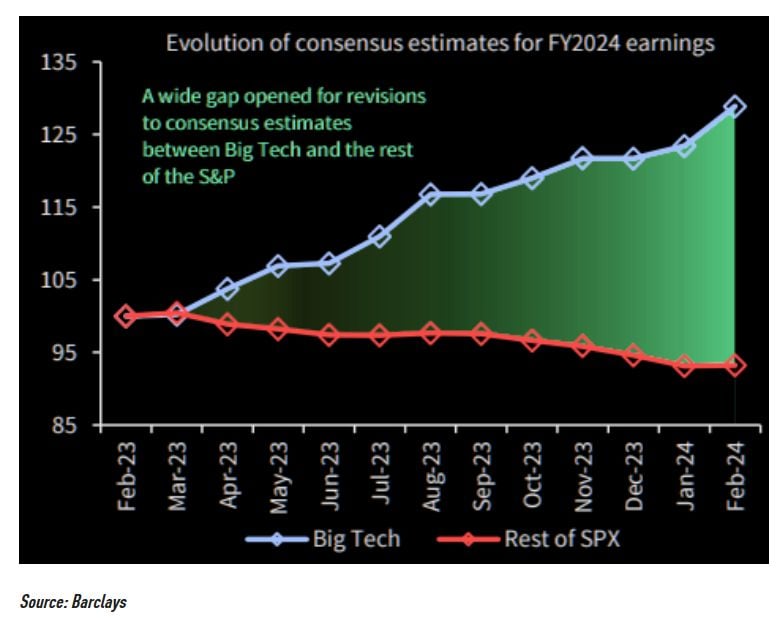

Thanks God for tech! Big tech is the only space seeing upward revisions

Source: TME, Barclays

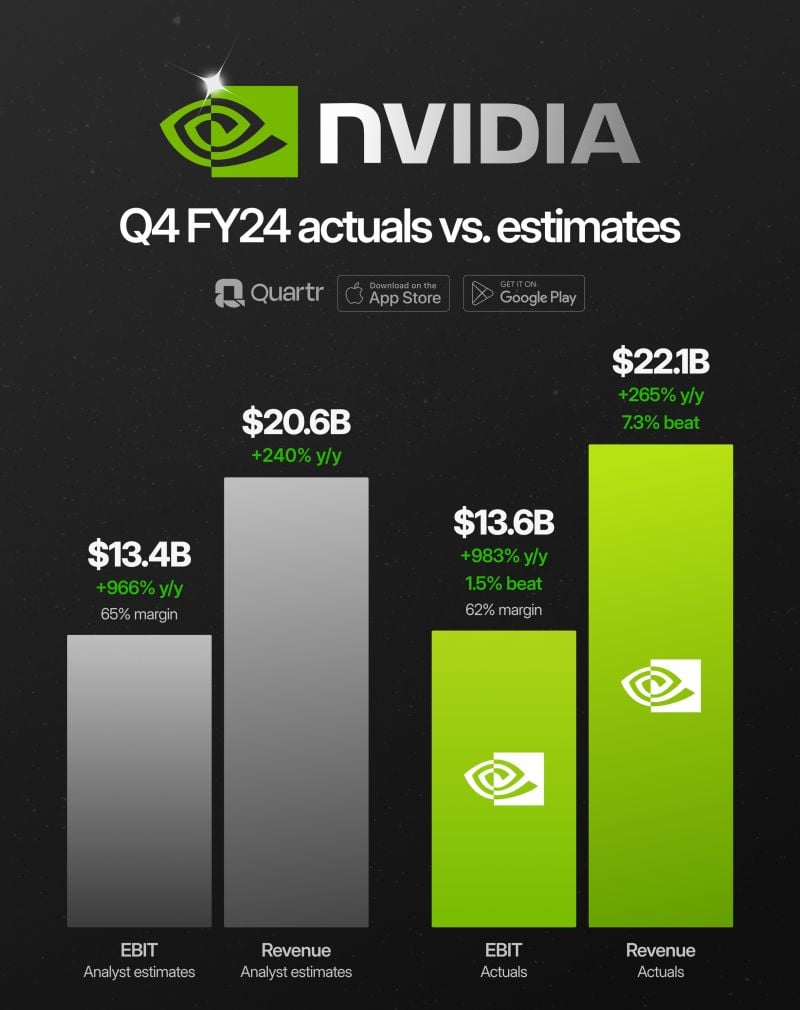

Nvdia results are out - $NVDA beats in revenue & earnings - the stock is up more than 8% after hours.

"Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations." – Co-founder & CEO, Jensen Huang Nvidia reported fourth fiscal quarter earnings that beat Wall Street’s forecast for earnings and sales, and said that revenue during the current quarter would be better than expected, even against elevated expectations for massive growth. Revenue +265% *Data Center +409% *Gaming +56% *Professional Vis. +105% *Automotive -4% EBIT +983% *marg. 62% (21) EPS +765% Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks