Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

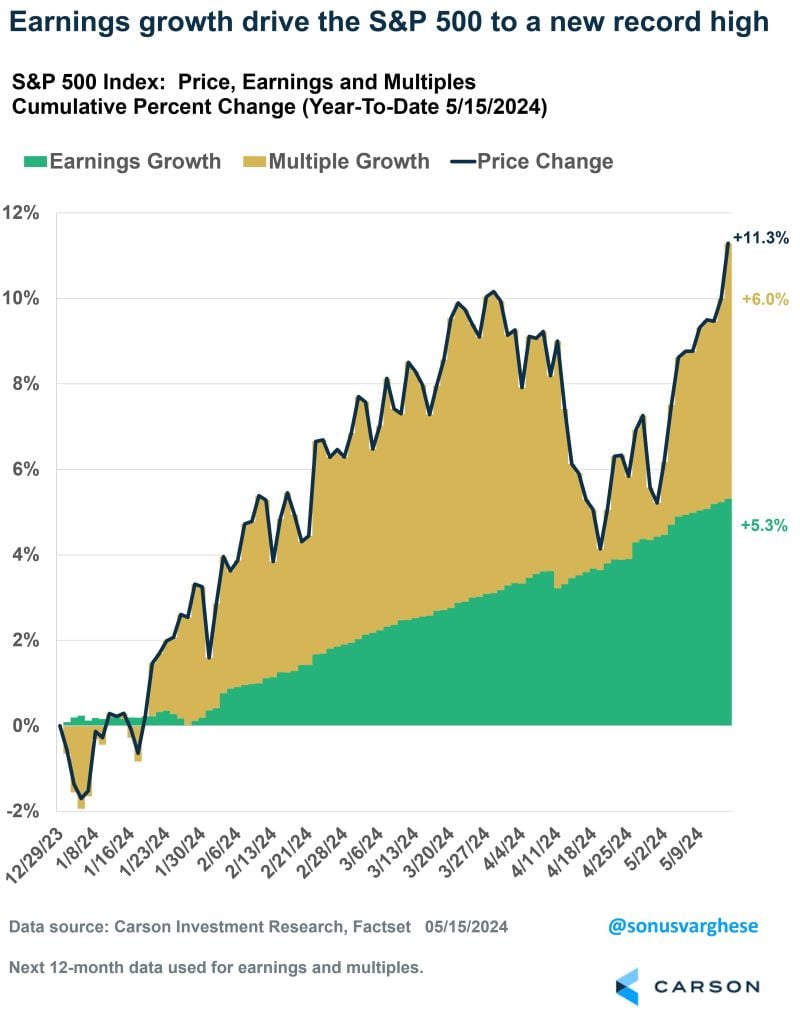

Not all new highs are the same.

Awesome chart from @sonusvarghese thru Ryan Detrick here. End of March, SPX up 10.2% YTD. Only 3.1% from EPS growth and the rest (7.1%) was from multiple expansion. On 5/15, SPX up 11.1% YTD. Now 5.3% from EPS growth and 6.0% from multiple expansion.

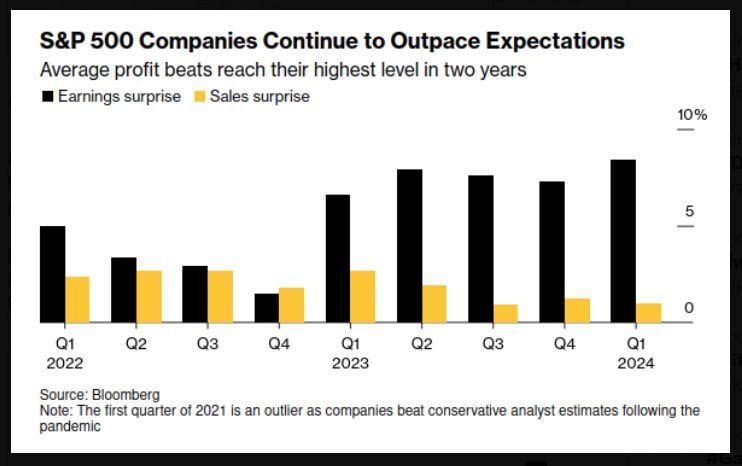

S&P 500 companies continue to outpace earnings expectations, but not quite as much on the sales side.

But now we are seeing these expectations rise, so the quarters ahead may become a bit more challenging as we may see earnings growth slowing at the same time. Source: Bloomberg, Markets & Mayhem

"Power Up America" theme is Goldman's top performing basket year-to-date w/+37.5% driven by global data centers' eye-popping demand for power.

17 of the 22 companies from the basket that have reported earnings have beat estimates by an average of +29%. Source: HolgerZ, Bloomberg

Earnings for the week of May 13, 2024

https://lnkd.in/eEaHXwcK $BABA $WMT $NU $HD $AMAT $BIDU $NXT $CSCO $JD $STNE $TTWO $SE $DE $OTRK $MNDY $LEGN $OCGN $WULF $DT $LUNR $GRAB $PBR $PSFE $SONY $NICE $HUT $TME $MNSO $OGI $DFLI $CPA $DHT $BITF $BKKT $HUYA $NOTV $QUIK $MAXN $KOPN $LSPD $HBM $ARQT $DDL $CGAU $CRLBF $DOCS $DOLE $ACXP $AGYS $GROY

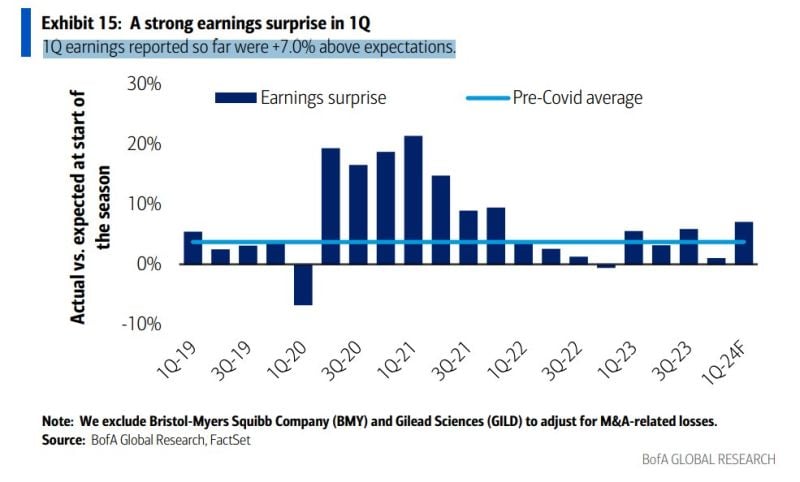

US earnings season UPDATE: 1Q earnings reported so far are +7.0% above expectations. (Clone)

Source: Mike Zaccardi, BofA

US earnings season UPDATE: 1Q earnings reported so far are +7.0% above expectations.

Source: Mike Zaccardi, BofA

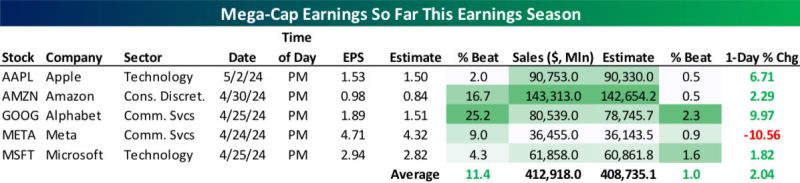

The five $1+ trillion market cap companies that have reported Q1 earnings so far posted sales of more than $412 billion combined during the quarter.

All five beat both EPS and sales estimates. $AAPL $AMZN $GOOGL $META $MSFT Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks