Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

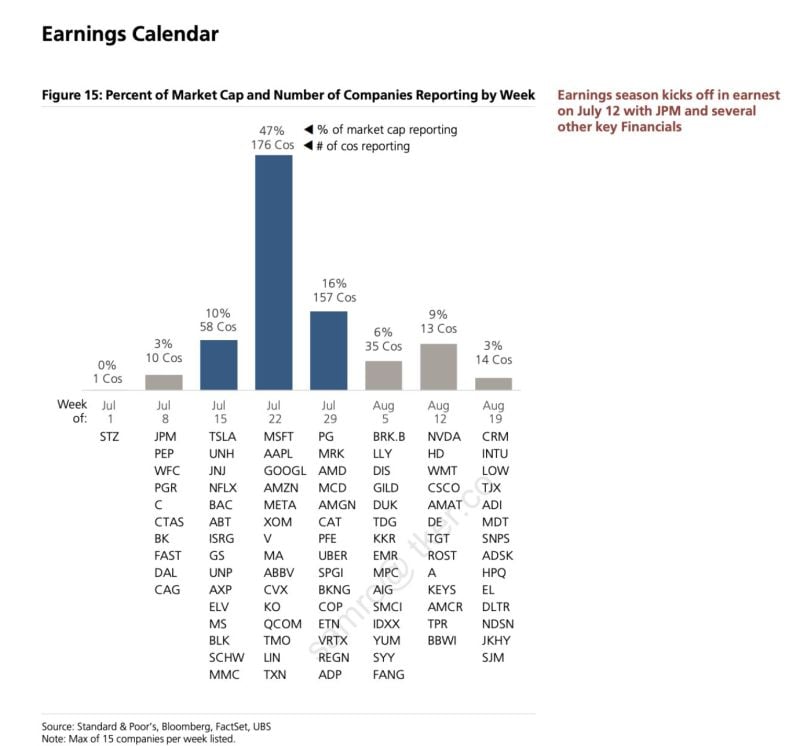

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The combined annual revenue of the 5 highest earnings 🇺🇸 companies is higher than the GDP of Brazil, Italy and Canada

Top 5 US companies based on Revenue (TTM) 🥇 Walmart $WMT: $657.3B 🥈 Amazon $AMZN: $590.7B 🥉 Berkshire Hathaway $BRK.B: $410.9B 4) Apple $AAPL: $381.6B 5) UnitedHealth $UNH: $379.5B Source: Evan

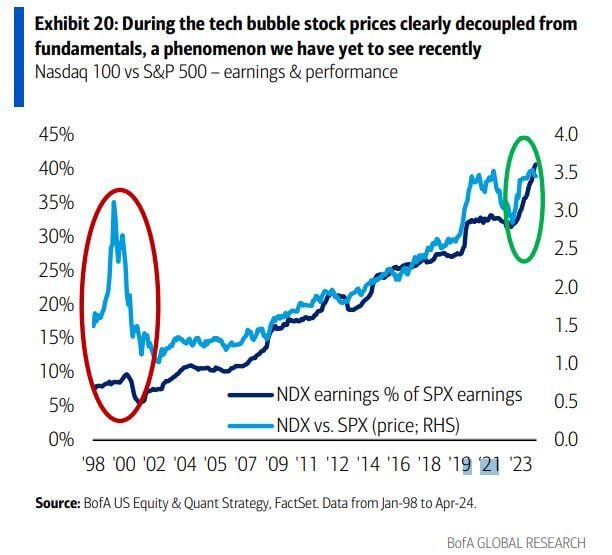

Dot Com Bubble vs. Now - Things don't look similar - at least from an earnings angle

Source: Barchart, BofA

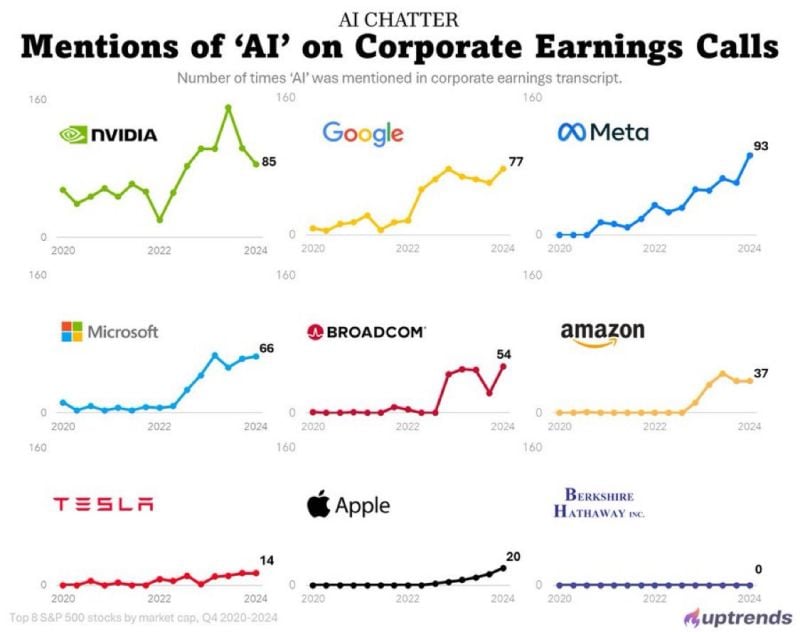

Here’s how many times the word “AI” has been said on the earnings calls of some of the biggest companies in the world

Source: Evan, Uptrends

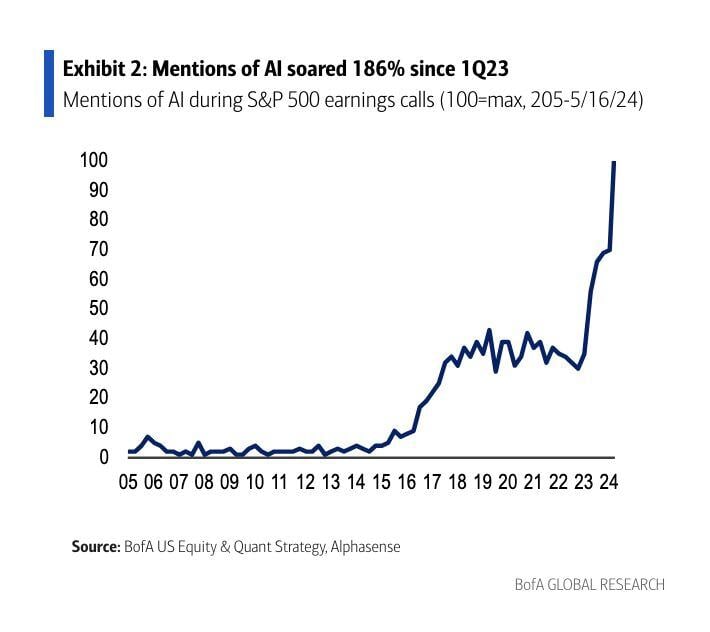

If you're not dropping the word AI in your earnings calls, you must not be playing the game right...

Source: BofA, The Transcript

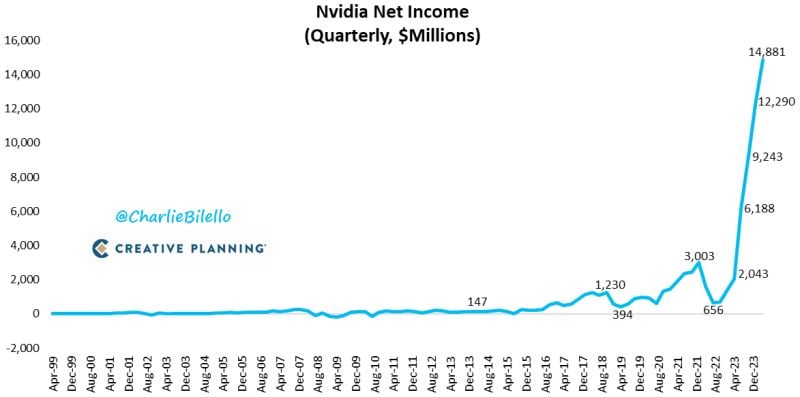

Nvidia's Net Income hit another record high at $14.88 billion in Q1.

That's a 628% increase over last year's Net Income of $2.04 billion. $NVDA Source: Charlie Bilello

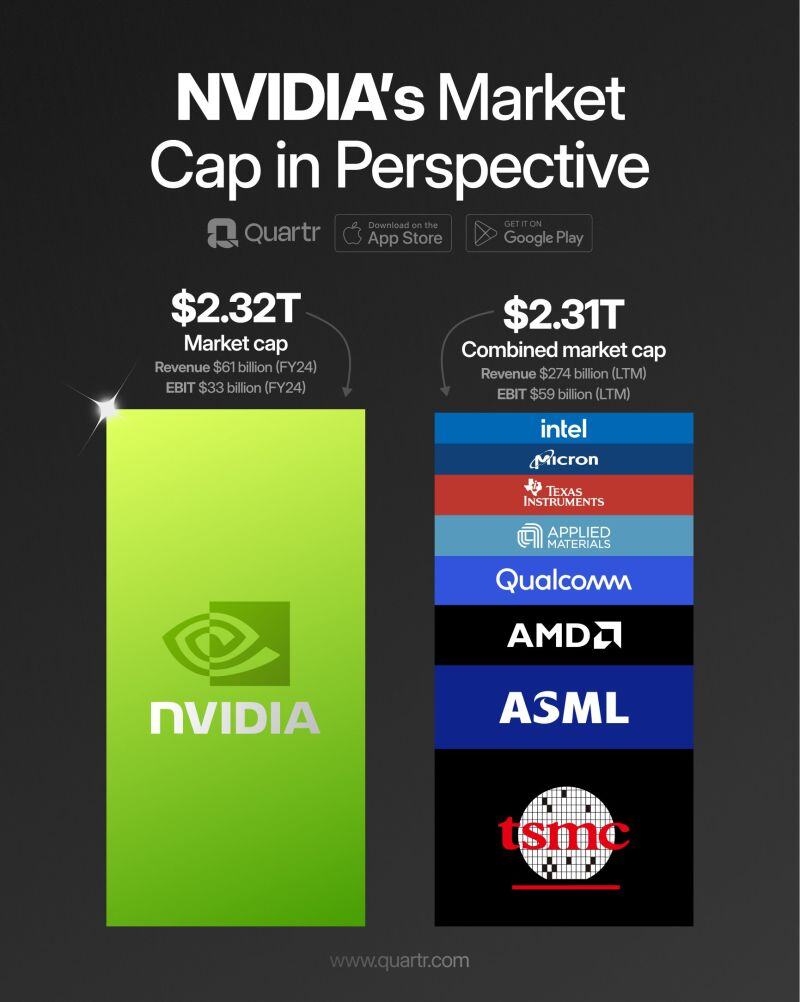

$NVDA publishes its Q1 FY 2025 report today.

The company is now the third-largest in the world, trailing only $MSFT and $AAPL, after seeing its market cap rise by 200% over the last year alone. Will the brutal momentum continue? Source: Quartr

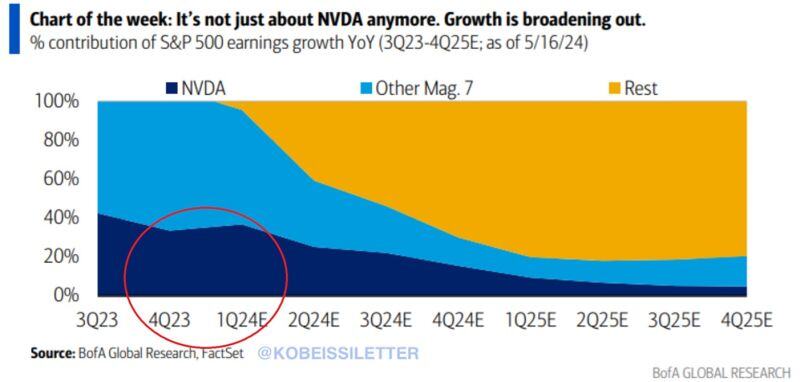

All eyes are on Nvidia this week: Nvidia, $NVDA, earnings alone drove 42% and 37% of the S&P 500 year-over-year EPS growth in Q3 and Q4 2023.

The company also accounted for 11% of the entire S&P 500's return over the last 12 months. In Q1 2024, Nvidia’s contribution to the S&P 500's EPS growth is estimated to reach ~40%. Nvidia's Q1 2024 EPS and revenue are projected to grow by 474% and 241%, respectively. Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks