Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

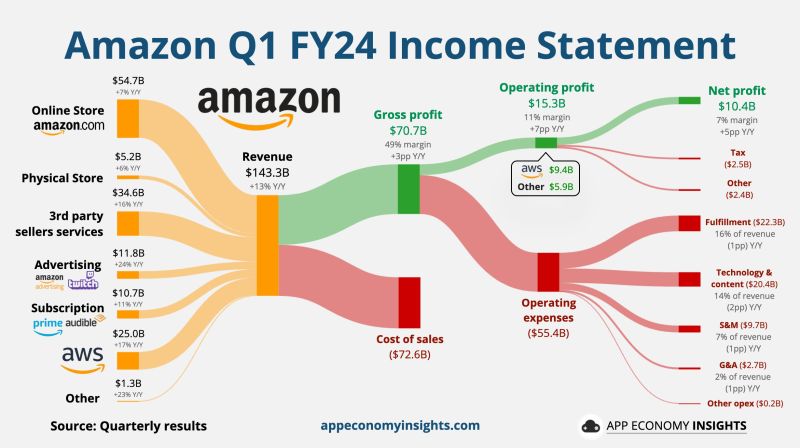

Amazon beats on top and bottom lines. Guidance is mixed.

Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. The stock was volatile in extended trading. Amazon expects a continued jump in profitability for the second quarter but at a more measured pace. The company said operating income will be $10 billion to $14 billion, up from $7.7 billion a year earlier. $AMZN Amazon Q1 FY24: • Revenue +13% Y/Y to $143B ($0.7B beat). • Operating margin 11% (+7pp Y/Y). • FCF $50B TTM. • Earnings per share: 98 cents vs. 83 cents expected by LSEG AWS: • Revenue +17% Y/Y to $25.0B. • Operating margin 38% (+14pp Y/Y). Q2 FY24 Guidance: • Revenue ~$144-$149B ($150B expected), representing growth of 7% to 11%. Source: App Economy Insights

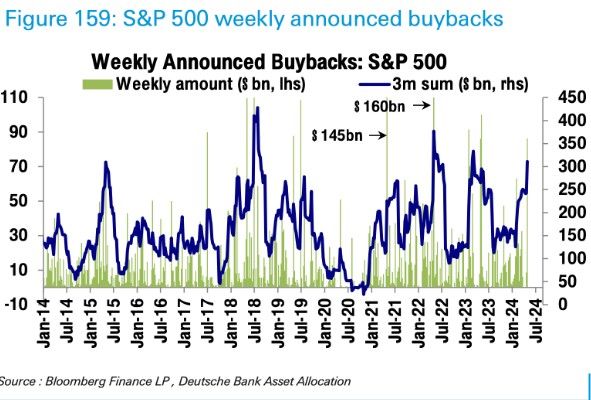

Halfway thru earnings season and buyback announcements are ticking up..

DB notes $85B announced last week. Source: DB

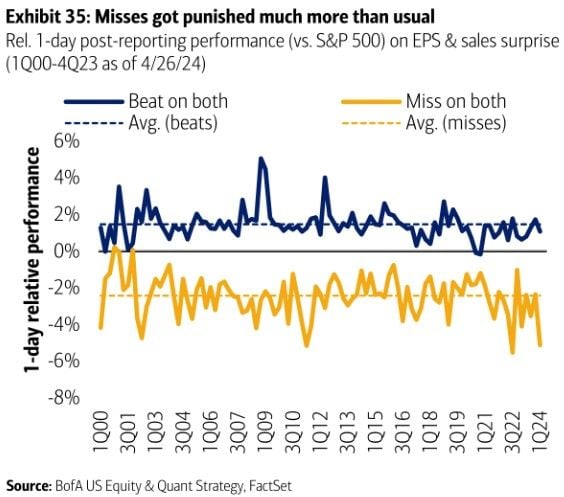

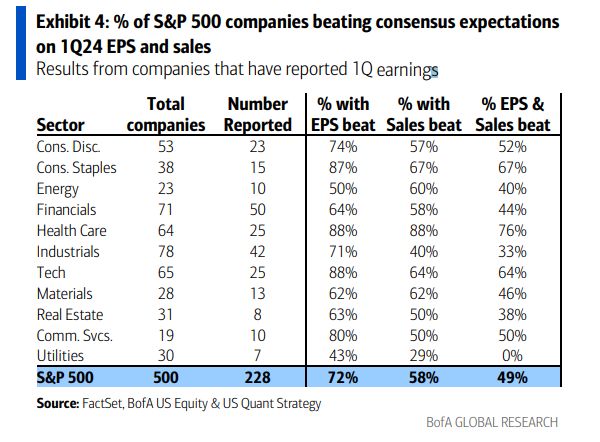

US earnings season update >>>

Double beats are being rewarded by less than the historical average while double misses are being punished by more than usual. Source: BofA

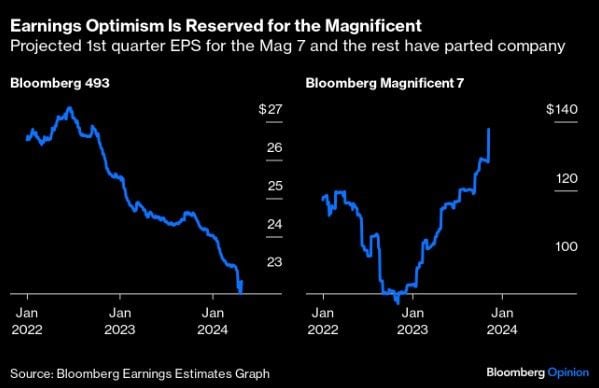

Projected Q1 earnings for the S&P 500 ex-Mag 7 (left-hand chart) vs. Projected Q1 earnings for the Mag 7...

Source: Bloomberg

72% EPS beat rate so far

6.6% EPS growth SPX ex-Fins & Energy Source: Mike Zaccardi, BofA

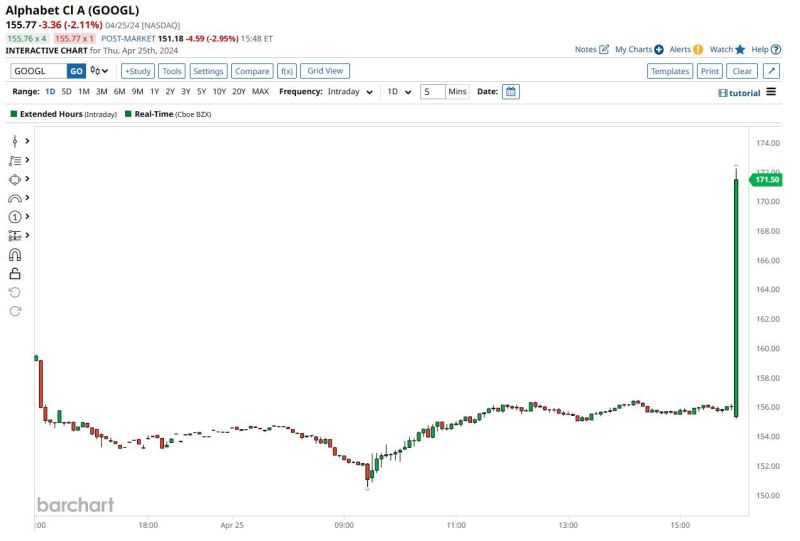

BREAKING: Google parent company Alphabet GOOGL soars over 12% in extended trading

after the company reported results that topped analysts’ estimates, showed soaring profits in its cloud division and announced its first dividend. The company reported revenue of $93.5 billion and EPS of $$1.89. Google also declared a $0.20 dividend for the first time in history and issued a $70 billion stock buyback. In a nutshell: $GOOG Alphabet Q1 FY24: • Revenue +15% Y/Y to $80.5B ($1.8B beat). • Operating margin 32% (+7pp Y/Y). • EPS $1.89 ($0.38 beat). ☁️ Google Cloud: • Revenue +28% Y/Y to $9.6B. • Operating margin 9% (+7pp Y/Y). ▶️ YouTube ads +21% to $8.1B. Source: The Kobeissi Letter, App Economy Insights

"The solid sales growth in the first quarter reflects the loyalty of our clients worldwide"

- Axel Dumas, Executive Chairman of Hermès $RMS Q1 2024 revenue growth by business line: Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks