Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Jeff Bezos never focused on earnings, EPS, or "profit". Why? He knows those numbers are flawed.

Source: Brian Feroldi

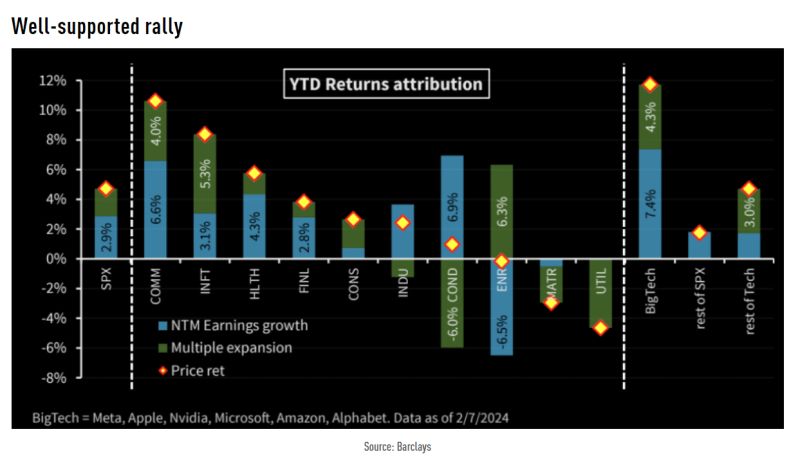

The us equity rally is being supported by better NTM earnings as well as multiple expansion, the latter driven mostly by Tech.

Source: Barclays, TME

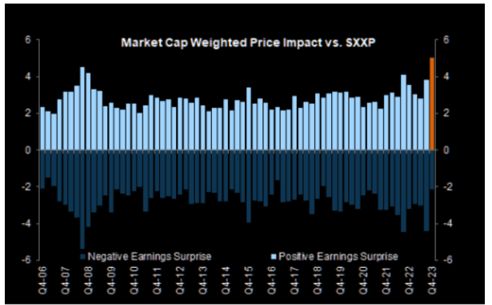

US Earnings season UPDATE

Q4 GAAP EPS +16% higher than a year ago after 46% of S&P 500 companies have reported. Note that Beats are rewarded like never before. We have seen sharp moves for positive surprises led by large cap constituents. Source. Factset, TME

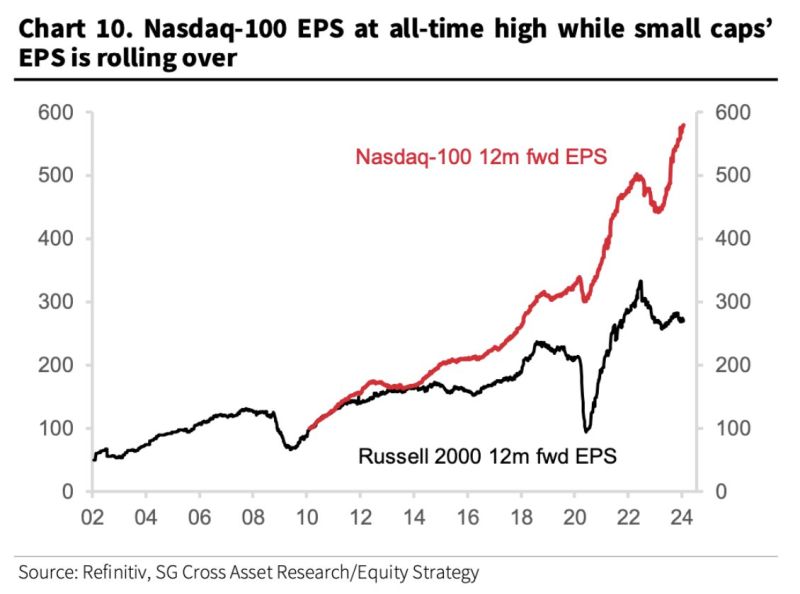

The performance differential between Nasdaq 100 (Tech) and Russell 2000 (us small-caps) is extreme.

Yet the earnings gap between Mega Cap Tech Stocks and Small Caps has widened to all an all-time high. Source: Barchart

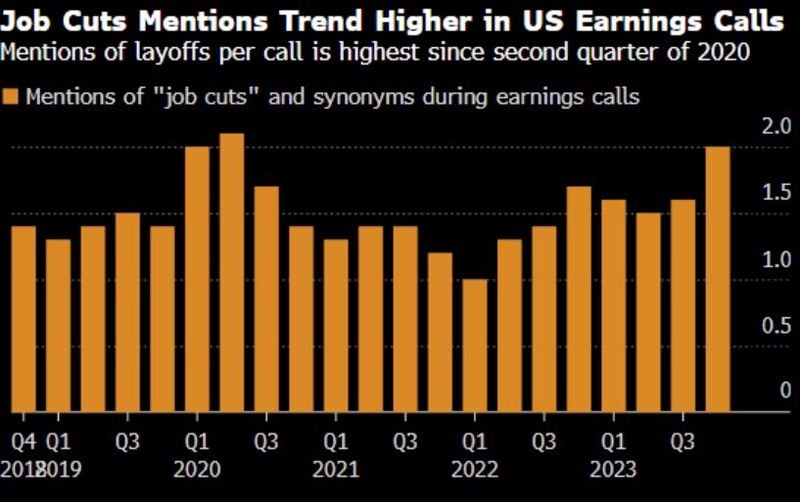

Mentions of Job Cuts in Earnings Calls Hits Pandemic Peak

Layoffs are being mentioned on US earnings calls at the HIGHEST rate since the pandemic, according to Bloomberg. Source: Bloomberg, Genevieve Roch-Decter, CFA

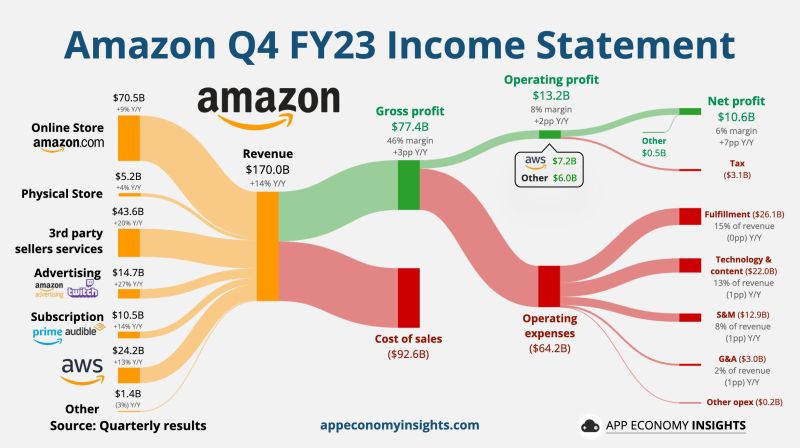

Amazon on Thursday reported fourth-quarter results that sailed past analysts’ estimates, and gave strong guidance for the current quarter.

The stock climbed more than 8% in extended trading. $AMZN Amazon Q4 FY23: • Revenue +14% Y/Y to $170B ($3.7B beat). • Operating margin 8% (+2pp Y/Y). • FCF $37B TTM. AWS: • Revenue +13% Y/Y to $24.2B. • Operating margin 30% (+5pp Y/Y). Q1 FY24 Guidance: • Revenue ~$138-$143B ($142B expected).

Investing with intelligence

Our latest research, commentary and market outlooks