Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Alphabet slipped 1% after-hours in spite of a beat on both top and bottom lines in the second quarter.

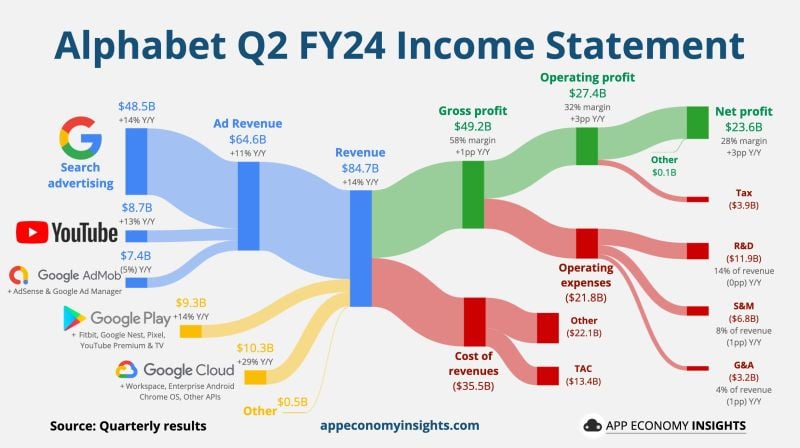

Alphabet earned $1.89 per share on $84.74 billion in revenue. Consensus estimates had called for earnings of $1.84 per share on $84.19 billion in revenue. However, revenue at its Youtube advertising segment missed forecasts. $GOOG Alphabet Q2 FY24 by App Economy Insights: • Revenue +14% Y/Y to $84.7B ($0.5B beat). • Operating margin 32% (+3pp Y/Y). • EPS $1.89 ($0.04 beat). ☁️ Google Cloud: • Revenue +29% Y/Y to $10.3B. • Operating margin 11% (+6pp Y/Y). ▶️ YouTube ads +13% to $8.7B.

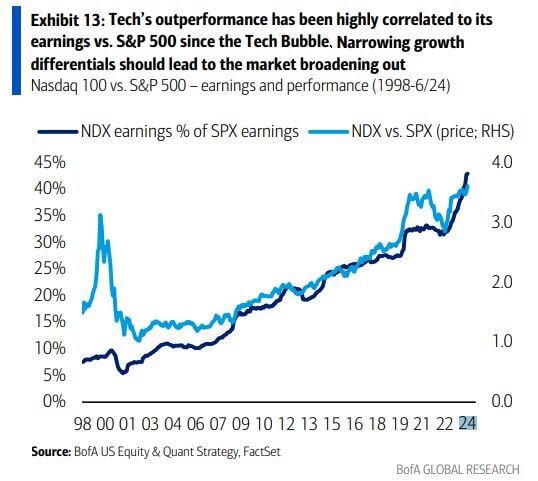

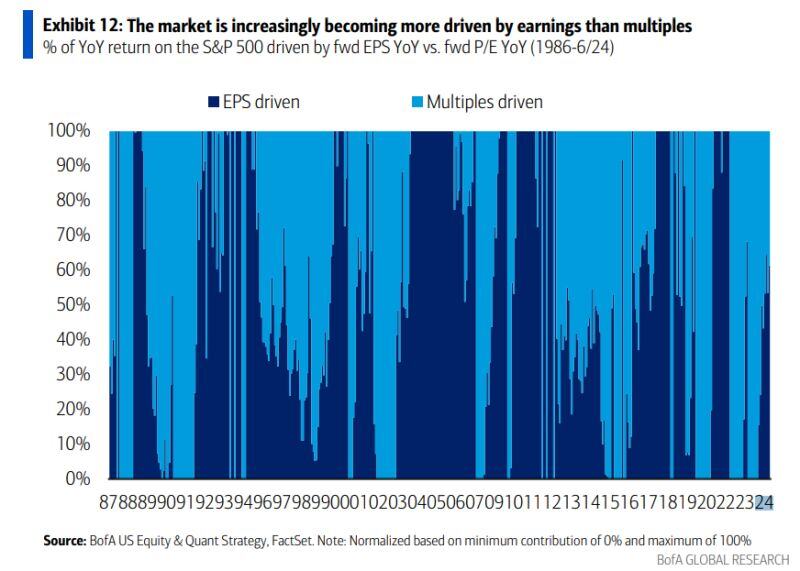

Tech’s outperformance has been highly correlated to its earnings vs. S&P 500 since the Tech Bubble

Source: BofA, Mike Z.

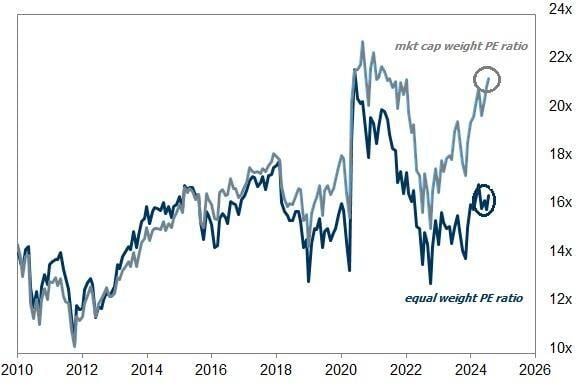

Equal weight S&P 500 (ETF $RSP) is considerably cheaper than the market cap weighted ETF, just as we may see earnings growth broaden out to a wider swath of companies.

Does that spell opportunity? Source: Markets & Mayhem, GS

Netflix, $NFLX, officially kicks off big tech earnings season with a MASSIVE swing in price.

The stock just swung over 10% in a matter of minutes after reporting results. The company reported Q2 2024 EPS of $4.88, above expectations of $4.76. They also added 8.05 million subscribers, crushing expectations of 4.5 million. Big tech earnings season has officially begun. Source: The Kobeissi Letter

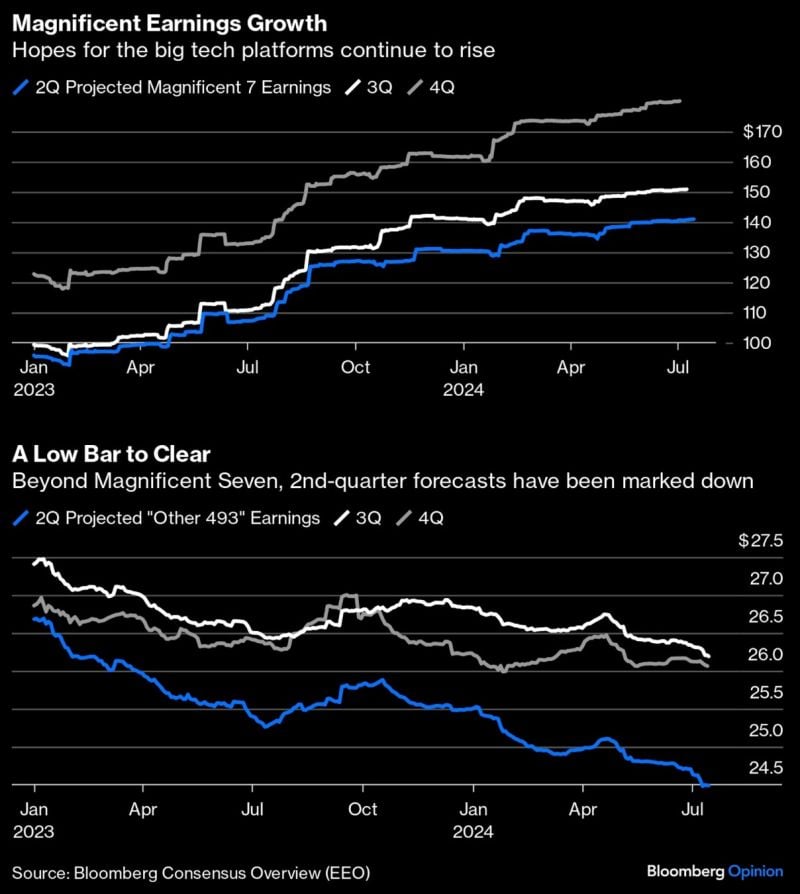

There are 2 ways to look at this chart:

1/ Mag7 outperformance is justified by positive earnings revision (vs. negative revision for the rest); 2/ The bar has been raised quite high for the Mag7 (so beware if they disappoint) while the bar is low for the other 493 stocks (there is room for positive surprise) Source: Bloomberg, RBC

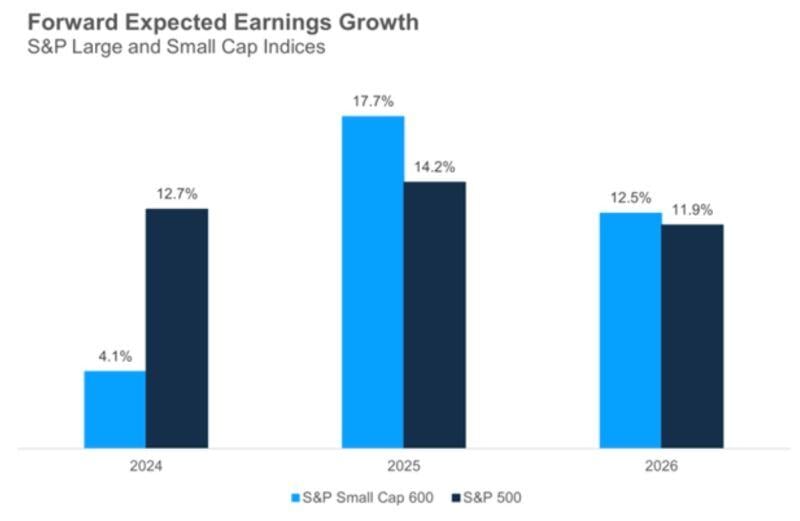

2025 and 2026 look much better for US small caps earnings, relative to large caps

Source: JPM, RBC

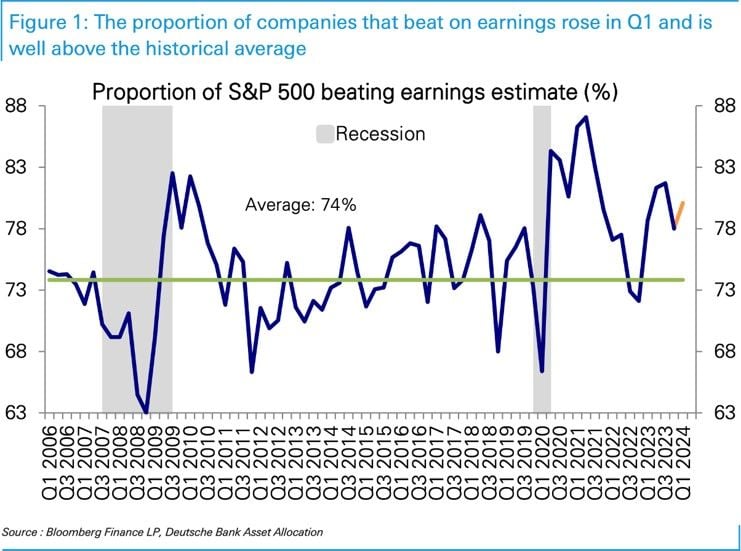

As we get into the heat of EPS season...

DB notes that more companies have been beating and by a larger amount in recent quarters. If this continues, it is tough to bet against this market... Source: Deutsche Bank, RBC

Investing with intelligence

Our latest research, commentary and market outlooks