Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

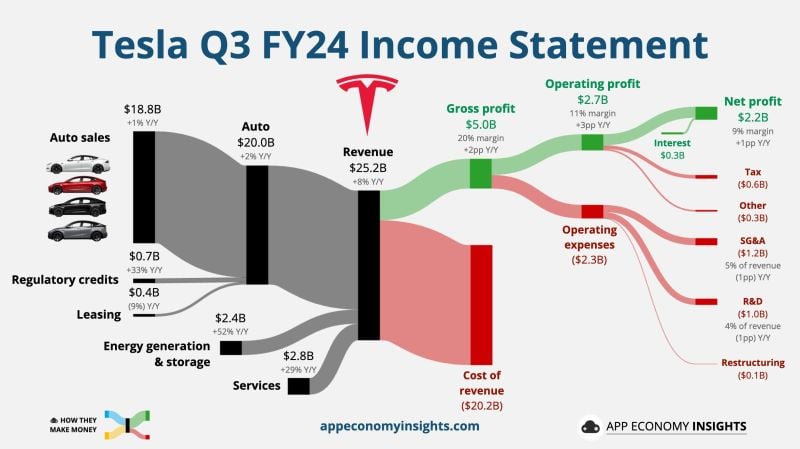

𝗧𝗲𝘀𝗹𝗮 𝗤𝟯 𝟮𝟬𝟮𝟰 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 $TSLA

EPS: $0.72 vs $0.60 est. (beat) Revenue: $25.18B vs $25.67B est. (miss) Gross margin: 19.6% vs 16.8% est. (beat) Free Cash Flow: $2.74B vs $1.61B est. (beat) Outlook 2024: - Slight growth in vehicle deliveries - Doubling of energy storage Outlook 2025: - New vehicles start production with more affordable models leveraging current and next-gen platforms - Over 50% growth in vehicle production compared to 2023 Shares: +6.6% after hours Source: App Economy Insights, The Future Investors

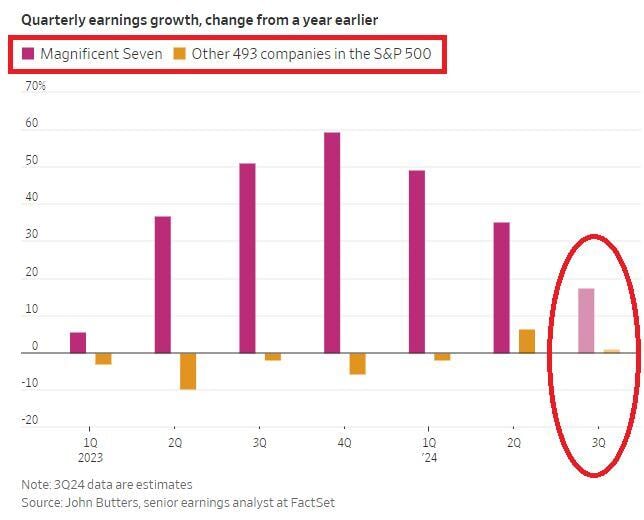

😱 The shocking chart of the day >>> S&P 500 COMPANIES EARNINGS GROWTH DOES NOT EXIST WITHOUT MAGNIFICENT 7😱

In 5 out of the last 6 quarters, the S&P 500 excluding Magnificent 7 profit growth has been negative. It is estimated the Mag 7 net income will grow by 18% in Q3 2024 while the other 493 firms by 1%. Note however 2 changes in trend: 1) The Mag 7 eps growth is slowing down (from a high base); The non-Mag 7 EPS growth is picking up (and turning slightly positive) from a low base. Sometimes the second derivative is more important than the absolute number. Time will tell... Source: The Global Markets Investor

BofA: “today the average EPS growth rate among AI ETF constituents has fallen from 18% to just 5%, below the S&P 500.”

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi via @dailychartbook

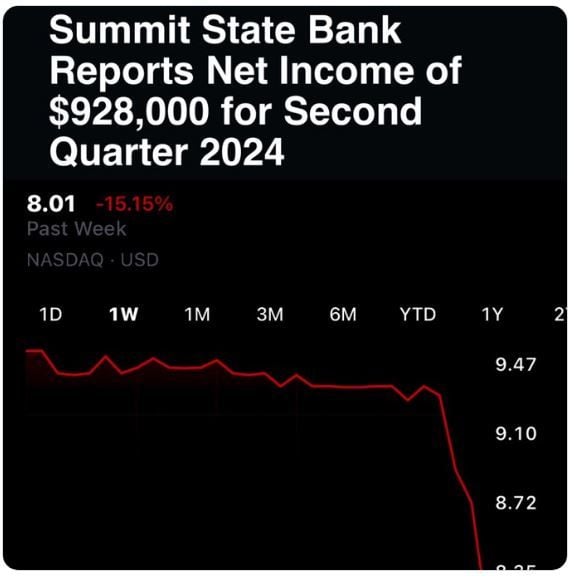

Is the US regional bank crisis worsening?

Summit State Bank's Q2 Earnings Plummet. Q2 2024 Net Income: $928,000 Drops -67% from Q2 2023 Net Income $2,985,000. Earnings Decline: 69%. Stock Drop: -15%. $SSBI. Source: The Coastal Journal

A solid rise in ISM Service dampens growth scare in markets a bit and is another sign that we are currently facing a technical

positioning driven correction instead of one led by hard landing fears. The main ISM services index and orders recorded solid bounce. Meanwhile, the Employment Index is up to highest level for the year. Note that the ISM has been quite volatile and should this not be overemphasized. Nevertheless, it seems premature to call a recession at this stage. Consider that earnings are up 12% YOY vs consensus of 9%. That doesn't happen at a Recession turning point. Source: Rishi Mishra, Ram Ahluwalia

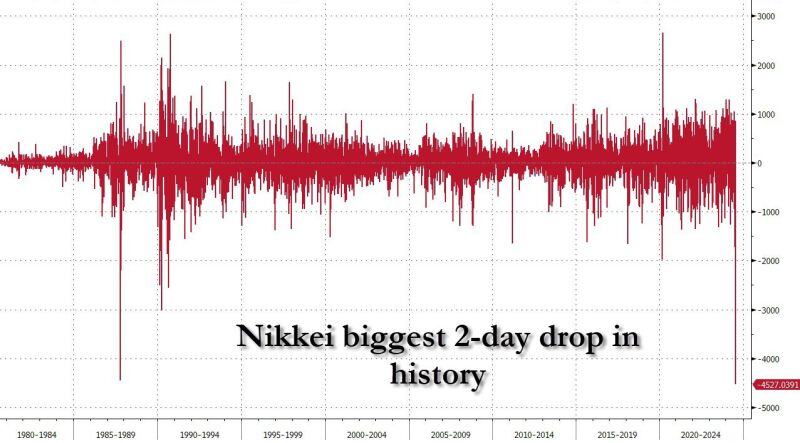

This is the biggest 2-day drop for the Nikkei in history, surpassing Black Monday

Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks