Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

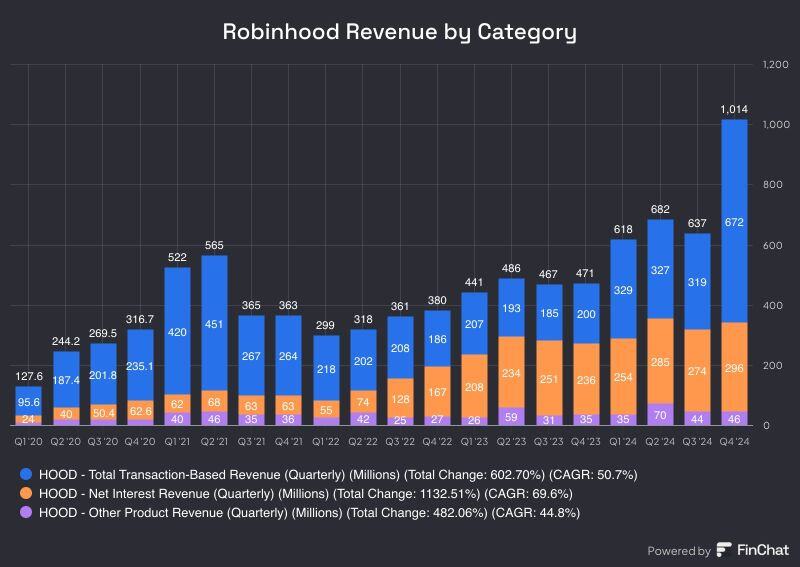

ONE BILLION DOLLAR BABY.....

FOR THE FIRST TIME EVER 🚀 Robinhood $HOOD just had its first quarter with more than $1 Billion of Revenue Source: Evan

BREAKING: Amazon stock, $AMZN, falls over -7% despite reporting stronger than expected Q4 2024 earnings.

Source: The Kobeissi Letter @KobeissiLetter

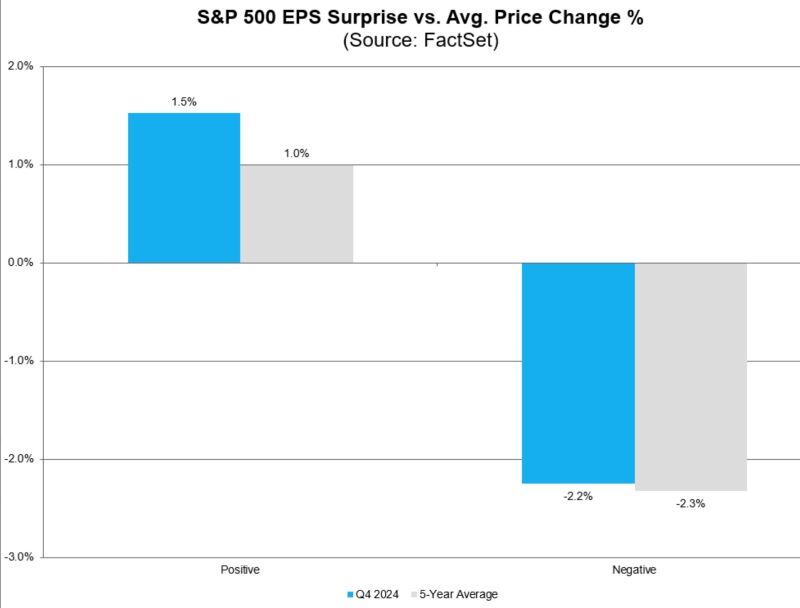

With deepSeek and tariffs, we almost forgot that we are in the middle of the earnings season.

FactSet notes that beats are being rewarded above average and misses are being punished around average.

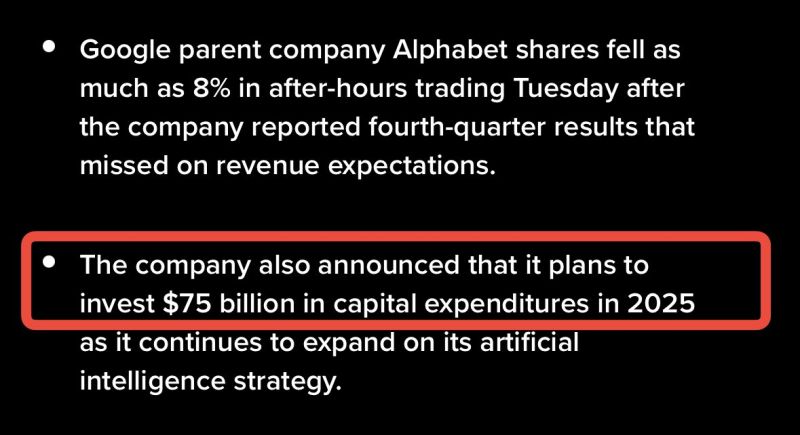

BREAKING: Alphabet stock, $GOOGL, falls over -7% after reporting Q4 2024 earnings.

Source: The Kobeissi Letter

This is the most important datapoint in earnings season so far.

Alphabet to invest $75 billion in CapEx during 2025 - this will ease chip industry fears. Large cap tech is maintaining record investment in AI infrastructure, even after DeepSeek’s disruption. Source: The Kobeissi Letter

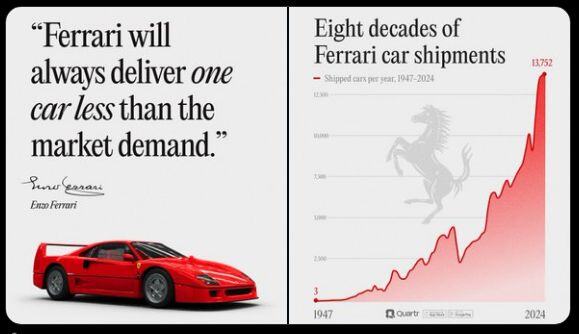

Ferrari $RACE Q4 2024 results

"Quality of revenues over volumes: I believe this best explains our outstanding financial results in 2024" – Benedetto Vigna, CEO. Shipments +2% *EMEA +4% *Americas +8% *Greater China -21% *APAC +5% Revenue +14% EBIT +26% *marg 27% (24.4) EPS +32% Source: Quartr

All eyes on the Nasdaq 100.

Over 25% of stocks in the index report earnings this week... Source: Trend Spider

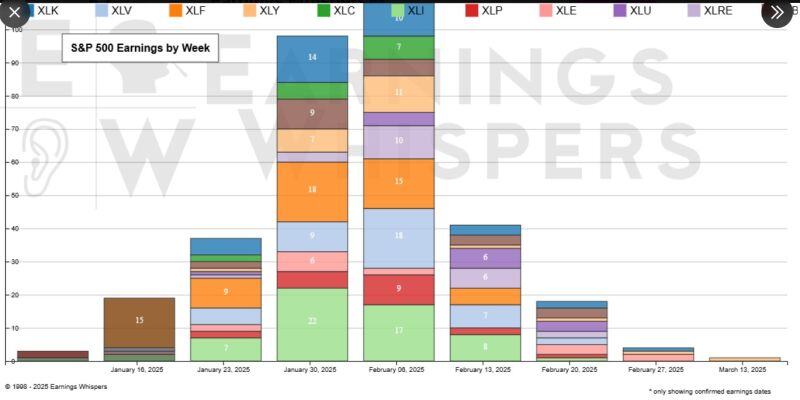

The fourth quarter earnings season is longer than the others because companies need to complete their year-end numbers and get signed off on by the auditors.

Therefore, only half of those S&P 500 $SPY companies expected to report in February have scheduled earnings yet, so look for those right bars to get bigger. That said, we have a pretty good look at the next few weeks. This week will still be mostly about the Financials $XLF, but we’ll begin to get Industrials $XLI reporting too. source : earningswhisper

Investing with intelligence

Our latest research, commentary and market outlooks