Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

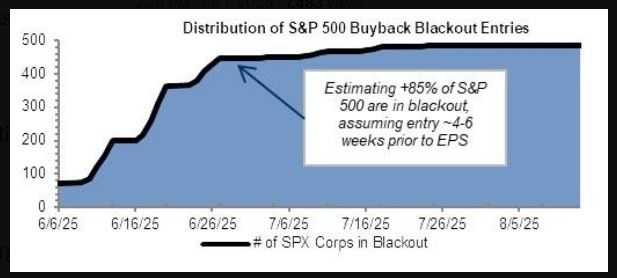

About 85% of SP500 companies are now in buyback blackout, taking away some of the important supportive flows ahead of Q2 earnings season.

Source: Markets & Mayhem, GS

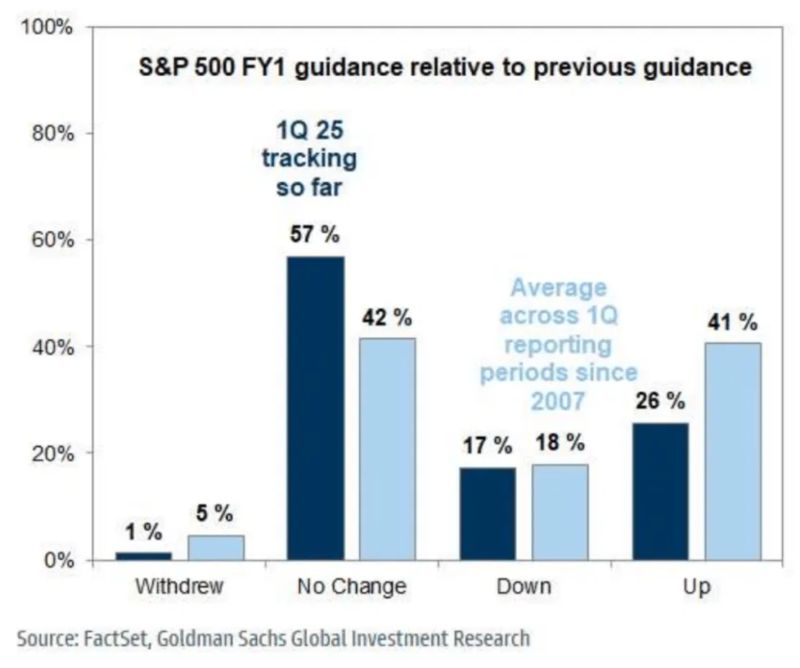

So far very few US earnings downgrades...

Source: GS, Ronnie Stoeferle @RonStoeferle

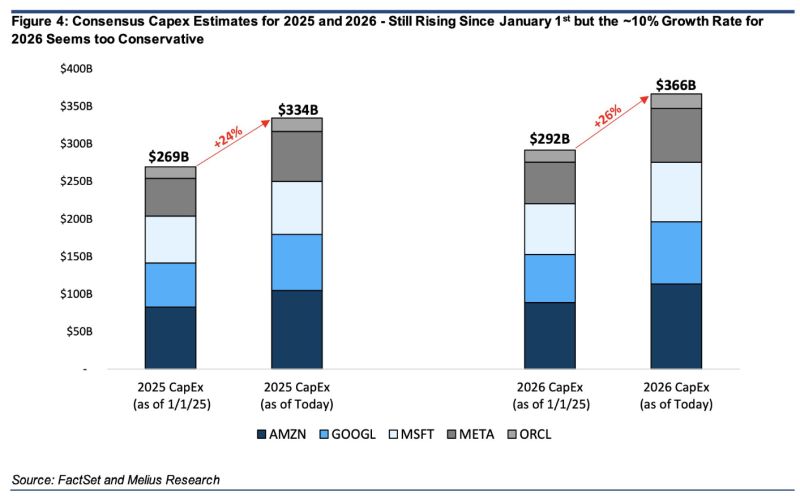

The latest earnings reports offer some reassurance that capital spending (capex) remains strong, says Melius’s Reitzes.

Hyperscalers haven’t cut back on their investments, which is good news for AI-related stocks like Nvidia, Broadcom, and Arista Networks. Source: HolgerZ, Melius Research

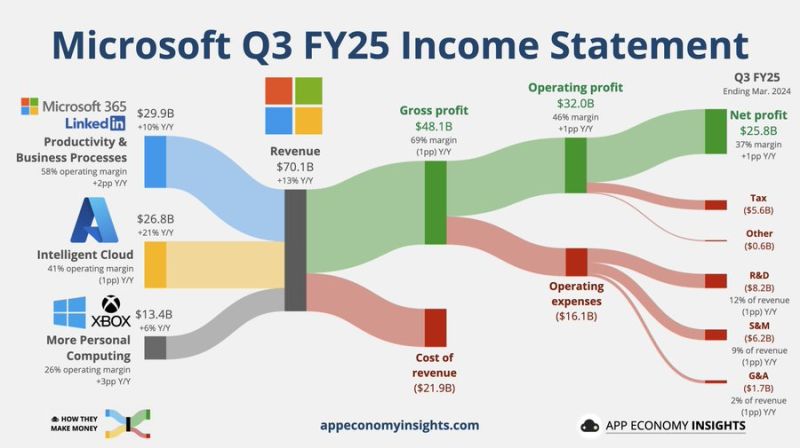

Microsoft ($MSFT) announced its third quarter earnings after the bell on Wednesday, beating expectations on the top and bottom lines on the strength of its cloud performance.

hares of Microsoft rose more than 6% on the news. $MSFT Microsoft Q3 FY25 (ending March): ☁️ Azure +35% Y/Y fx neutral (31% in Q2). 🤖 16% of Azure revenue attributed to AI. • Revenue +13% Y/Y to $70.1B ($1.6B beat). • Operating margin 46% (+1pp Y/Y). • EPS $3.46 ($0.24 beat). Source: App Economy Insights, www.zerohedge.com

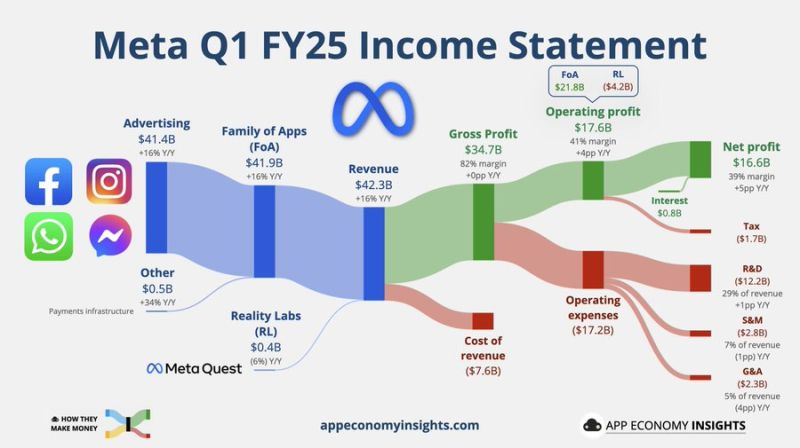

Social media giant Meta (META) reported its first quarter results after the bell on Wednesday, beating on the top and bottom lines.

But the company also raised its full-year capital expenditure estimates to between $64 billion to $72 billion, up from $60 billion to $65 billion. Despite fears of an advertising slowdown amid tariff uncertainty, Meta says it anticipates Q2 revenue of between $42.5 billion and $45.5 billion, ahead of Wall Street's expectations of $44 billion. $META Meta Q1 FY25: 👨👩👧👦 Daily active people +6% Y/Y to 3.43B. 👀 Ad impressions +5% Y/Y. • Revenue +16% Y/Y to $42.3B ($1.0B beat). • Operating margin 41% (+4pp Y/Y). • EPS $6.43 ($1.21 beat). • FY25 Capex: $64-$72B (prev. $60-$65B).

US earnings expectations versus US economic growth surprises dichotomy

▶️ While macro growth expectations continue to fade, EPS expectations are down only modestly (and actually starting to inflect modestly higher in the last couple of days)... Source: Bloomberg, www.zerohedge.com

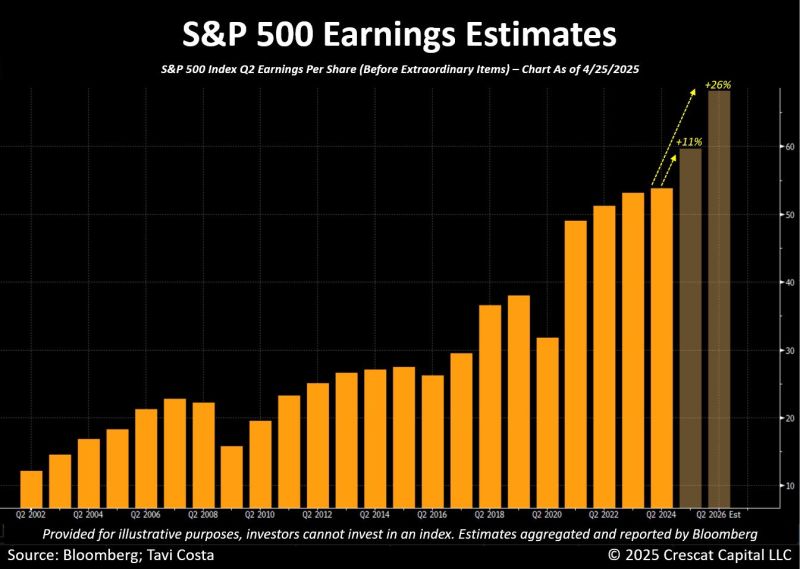

S&P 500 earnings are expected to grow 11% this quarter and another 26% next year.

This probably assumes no recession, because if there is one, a sharp downgrade in earnings estimates is likely. Source. Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks