Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔥 NVIDIA (NASDAQ: $NVDA) earnings are in! Another DOUBLE beat from the world’s most valuable company! 🚀

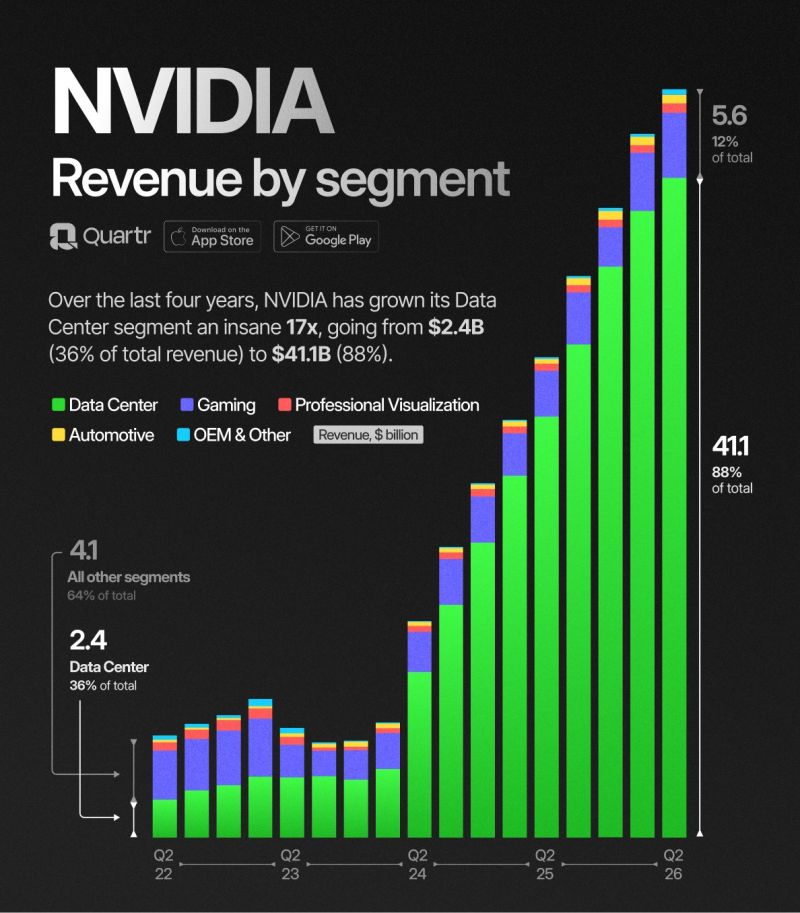

EPS: $1.05 vs. $1.01 est. (+4.17%) YoY EPS growth: +54.41% ($0.68 last year) Revenue: $46.743B vs. $46.018B est. (+1.58%) YoY Revenue growth: +55.60% ($30.04B last year) Q2 FY26 Highlights: 🤖 Data Center: $41.1B 🧠 Blackwell AI surge: +17% seq 💰 New $60B buyback approved Q3 guide: $54B revenue 😤Note that the outlook does NOT include any shipments of H20 chips to China. Nvidia is excluding China data center revenue from future projections to give Wall Street a clearer baseline in an otherwise volatile environment. Bottom-line: Nvidia beat on revenue and earnings but didn't raise guidance. The result? It's down after market, but no crash (-2% to -3%). Source: Quant Data @QuantData, Day Trading News

$NVDA Q2 2026

"Production of Blackwell Ultra is ramping at full speed, and demand is extraordinary." - Jensen Huang Revenue growth by segment: *Data Center +56% *Gaming +49% *Professional Vis. +32% *Automotive +69% Source: Quartr

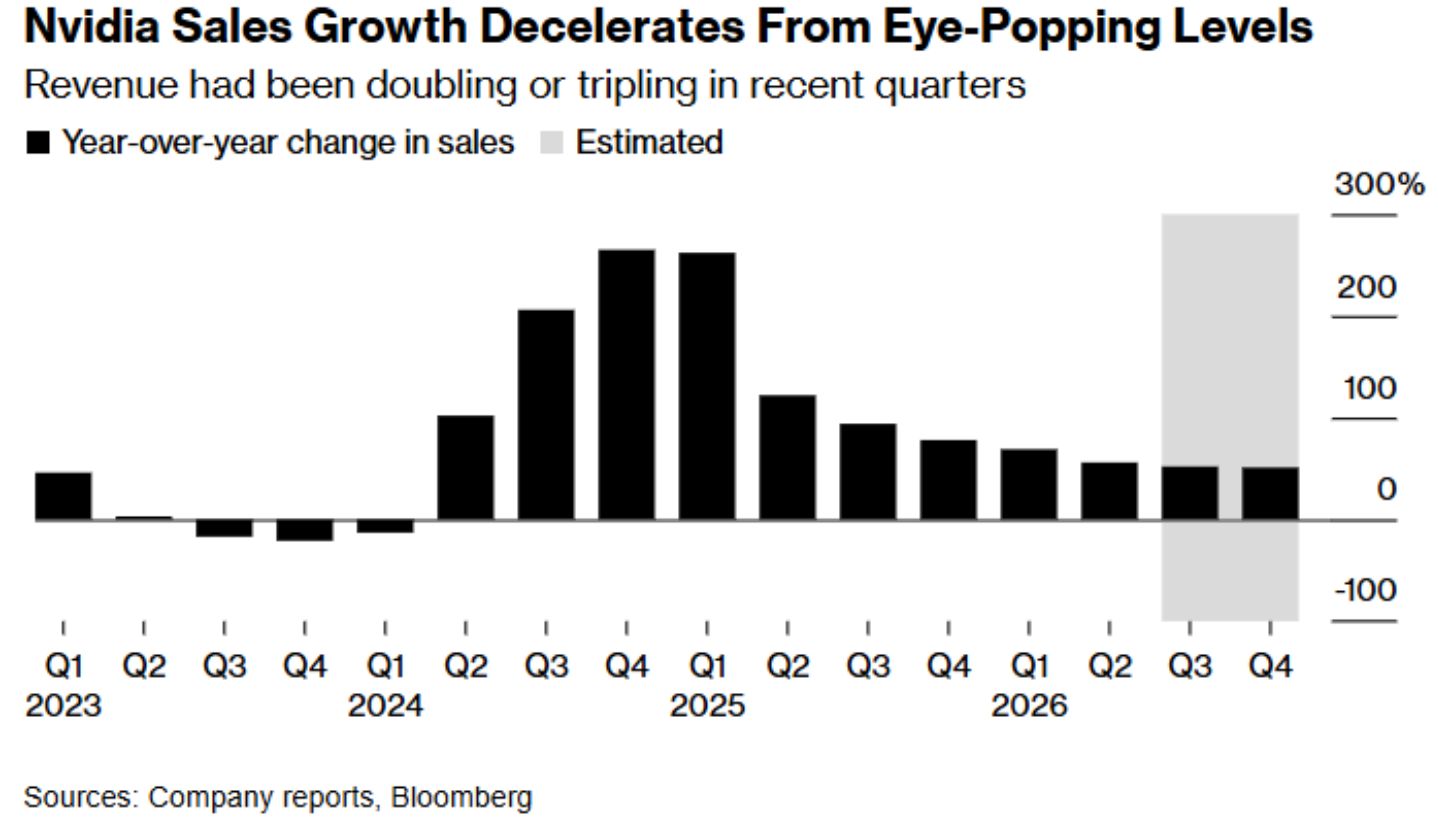

Bloomberg title: "Nvidia sales growth decelerates from eye-poping levels".

True, but I still find remarkable Nvidia is able to see +56% YoY growth when the quarterly revenues amount to $46.7B. That's crazy.

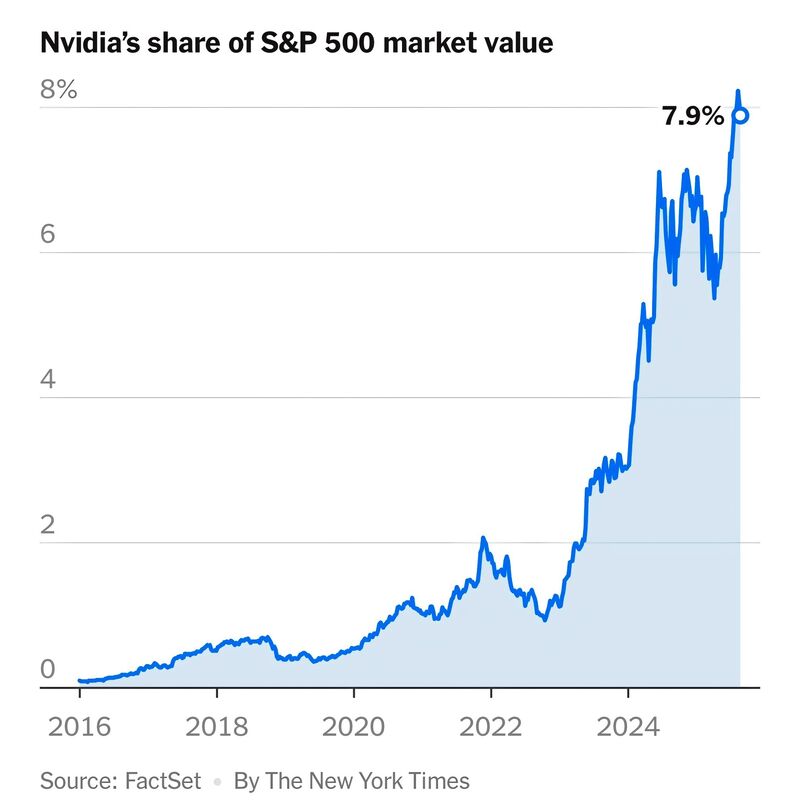

All eyes on Nvidia quarterly earnings tonight

Nvidia now makes up ~8% of the S&P 500. It has a Trailing PE of 58x vs. 28x for the SPX (Gaap). It is forecast to grow 34% in the next year vs. 13.5% for the SPX. It is facing a growing number of competitors and a decreasing number of Global clients (China is discouraging the purchase of its H20 chips). It will probably report good numbers, but those good numbers must grow for a long time to justify its rating. Source: Brew Markets @brewmarkets, Vaughan Henkel, CFA, CAIA

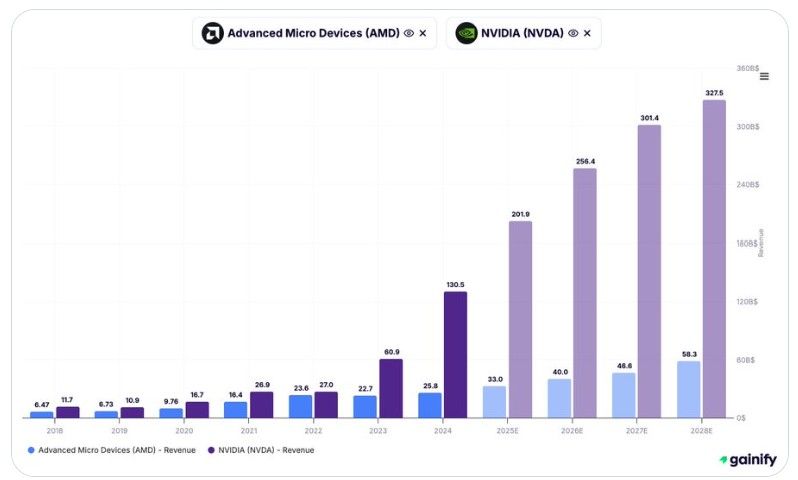

Putting things into perspective...

Future estimates show $AMD vs. $NVDA revenue growth is worlds apart: $AMD expected to add: +$7B in 2025 +$7B in 2026 +$7B in 2027 $NVDA expected to add: +$71B in 2025 +$55B in 2026 +$45B in 2027 $NVDA is adding an AMD-sized company every single year! Source: @gainify_io

Super Micro shares plunge 15% on weak results, disappointing guidance...

Nothing super about it.... $SMCI 🩸 Here’s how the company did in comparison with LSEG consensus: - Earnings per share: 41 cents adjusted vs. 44 cents expected - Revenue: $5.76 billion vs. $5.89 billion expected Source: Trend Spider

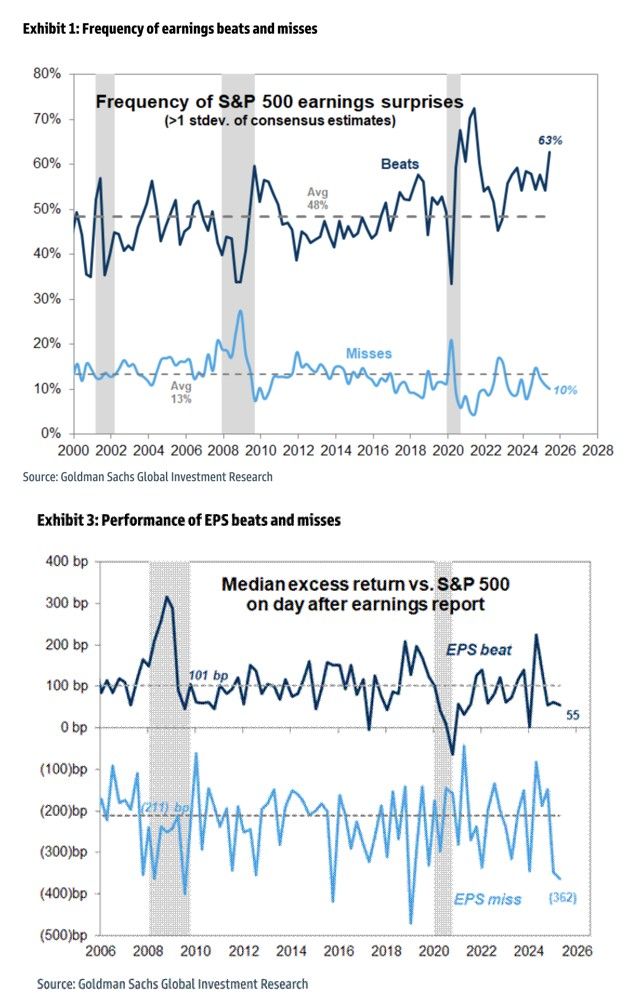

US earnings season update: so far so good...

Companies are beating, EPS growth is more than double so far vs expectations.. but beats are barely getting paid, while misses are getting pounded a little worse. Source: Goldman Sachs, RBC

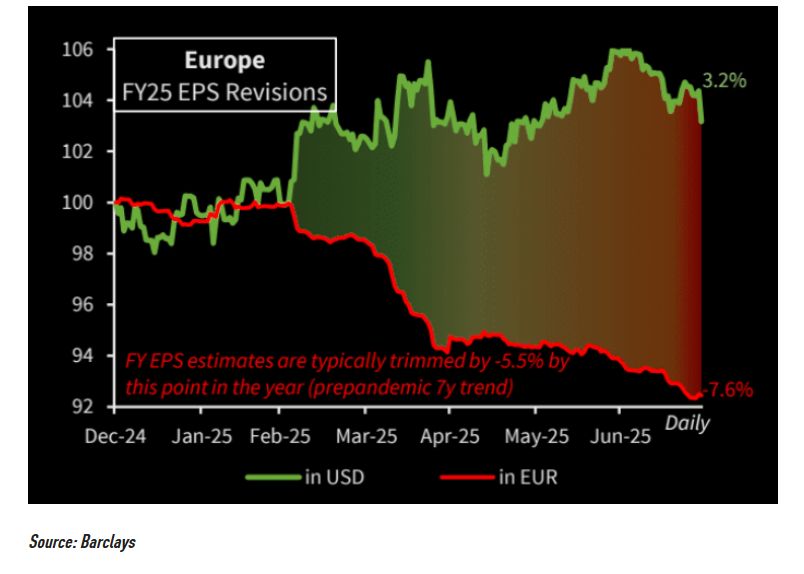

FY25 EPS revisions in Europe are trending somewhat worse than that of a typical year.

Source: Barclays, The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks