Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

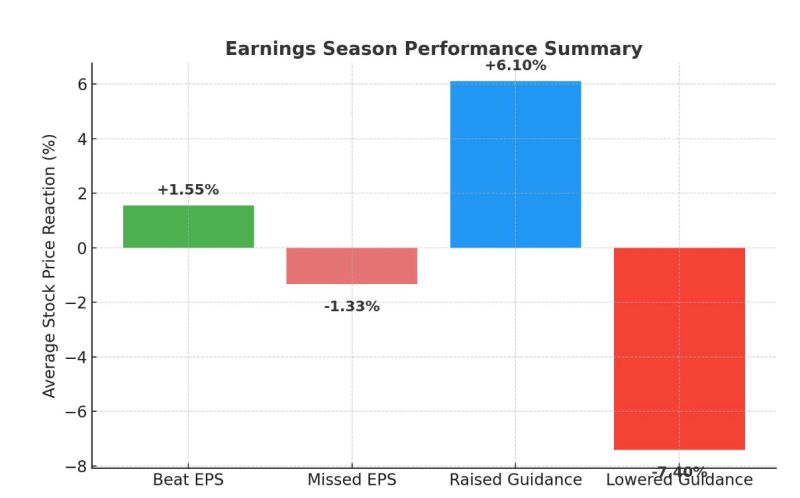

Bespoke on US earnings season thus far:

--Stocks that beat EPS estimates have risen 1.55% while stocks that have missed EPS have fallen 1.33%. --Stocks that have raised guidance (62) have risen 6.1%, while stocks that have lowered (29) have fallen 7.4%. Source: Bespoke

This is pretty crazy...

Robinhood $HOOD's revenue has jumped $300M in 2022 to $1.27B in 2025 📈 Source: Stocktwits

Advanced Micro Devices $AMD fell after beating earnings expectations and guiding above expectations.

Tough market! Source. Barchart

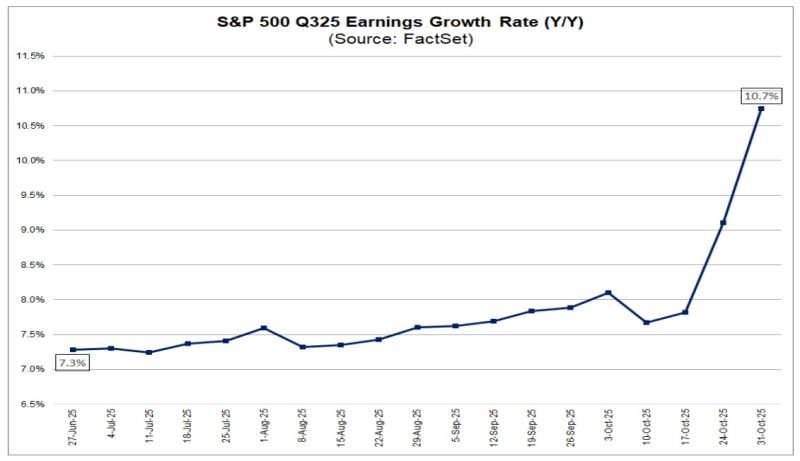

Great chart from @FactSet that shows the vertical move in Q3 earnings.

Source: Ryan Detrick, CMT @RyanDetrick

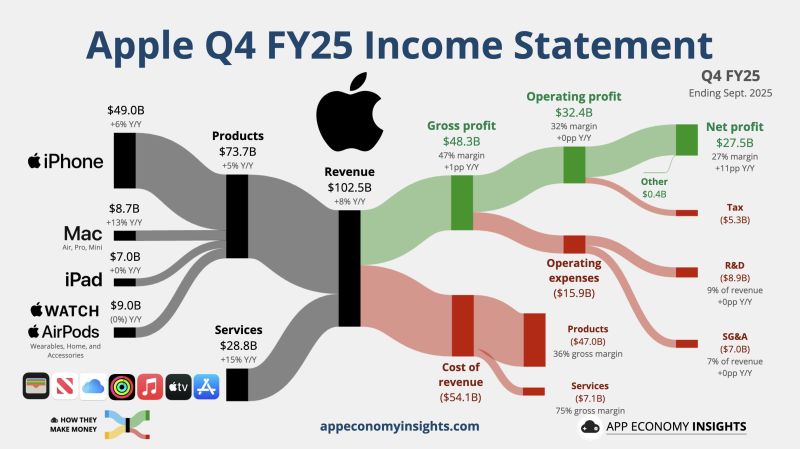

APPLE $AAPL JUST REPORTED EARNINGS EPS of $1.85 beating expectations of $1.75

Revenue of $102.5B beating expectations of $101.8B🟢 Stock is up 5% in after hours 🚀 The company's chief financial officer said Apple expects total company revenue to grow 10 to 12% year over year in the three months to December, with iPhone revenue growing double digits $AAPL Apple Q4 FY25 (Sept. quarter): 💳 Services +15% Y/Y to $28.8B. 📱 Products +5% Y/Y to $73.7B. • Revenue +8% Y/Y to $102.5B ($0.2B beat). • Operating margin 32% (+0.5pp Y/Y). • EPS $1.85 ($0.08 beat). Source: App Economy Insights @EconomyApp

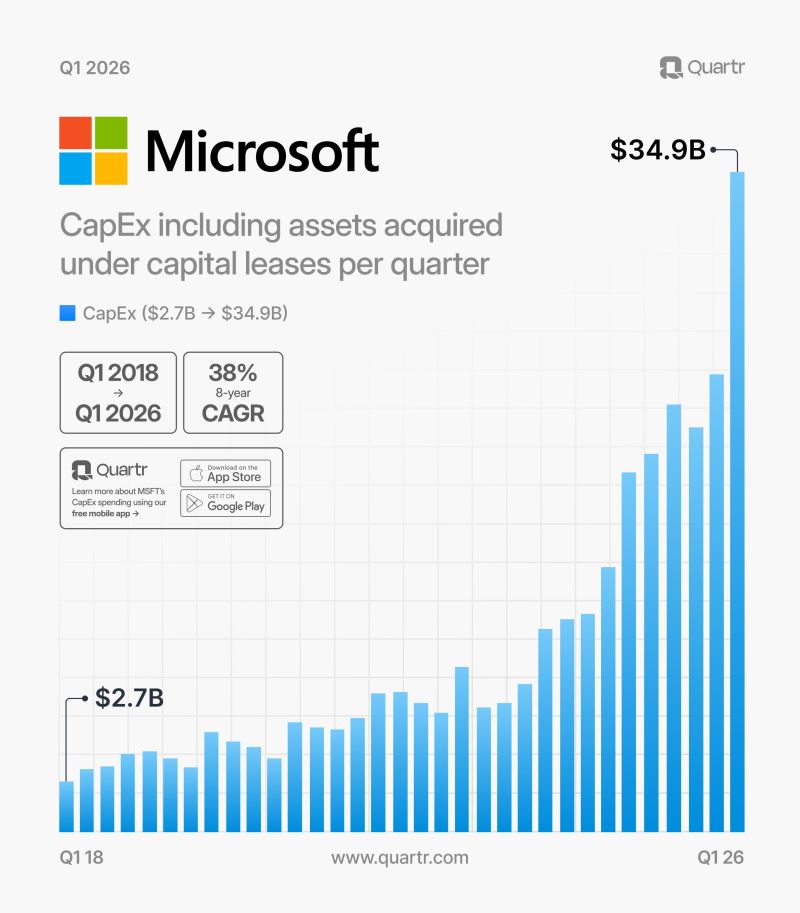

In Q1 2026, Microsoft $MSFT's CapEx totaled $35B, up 44% QoQ

That brings Last Twelve Months (LTM) CapEx to over $100B. Source: Quartr

Very important read-through of yesterday's mega cap tech earnings ➡️

Hyperscaler CapEx remains sky-high: • $GOOGL: FY $91–93B (vs $85B est) • $MSFT: Q1 $34.9B (vs $30B est) • $META: Expects higher CapEx in 2026 Note that Google raises 2025 Capex for the second time this year: “With the growth across our business and demand from Cloud customers, we now expect 2025 capital expenditures to be in a range of $91 billion to $93 billion." BULLISH 🚀 Source: Investing visuals @InvestingVisual Michael Horner @michaelbhorner

IBM’s post-earnings selloff wasn’t about the numbers — it was about the narrative.

On paper, the results were great: ✅ Revenue & earnings beat expectations ✅ Guidance raised ✅ Record free cash flow But in the AI era, “good” isn’t good enough. Investors wanted explosive AI-fueled growth. What they got was solid execution — and that’s not what the market is rewarding right now. This is the re-rating of expectations in real time. IBM is doing a lot right, but markets are chasing narrative velocity over operational discipline. Source: EndGame Macro @onechancefreedm

Investing with intelligence

Our latest research, commentary and market outlooks