Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

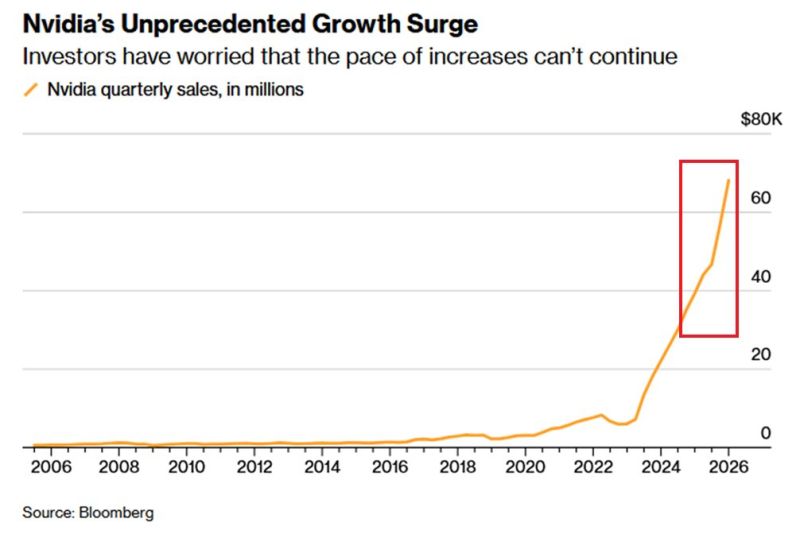

NVIDIA posted its best quarter ever

$68.1B revenue (+73% YoY) and Q1 guidance of ~$78B—but the stock fell, erasing post-earnings gains. CFO Colette Kress flagged potential long-term AI disruption from Chinese chipmakers. China exposure remains limited, with zero H200 chip sales and tariffs on U.S.-licensed shipments. The market reaction shows that when expectations are extremely high, even record results may disappoint. Source: Global Markets Investor, Bloomberg

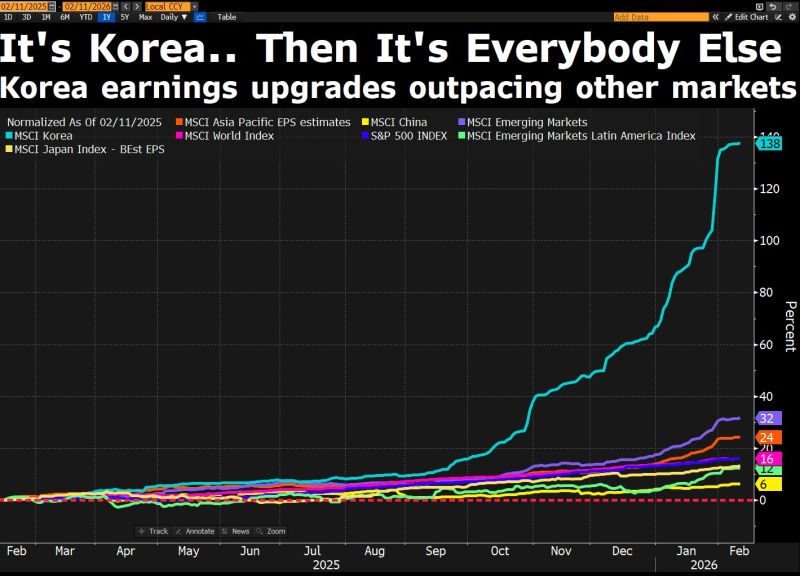

As far as the standout global earnings story is concerned, it's Korea... and then it's everybody else.

Source: David Ingles @DavidInglesTV

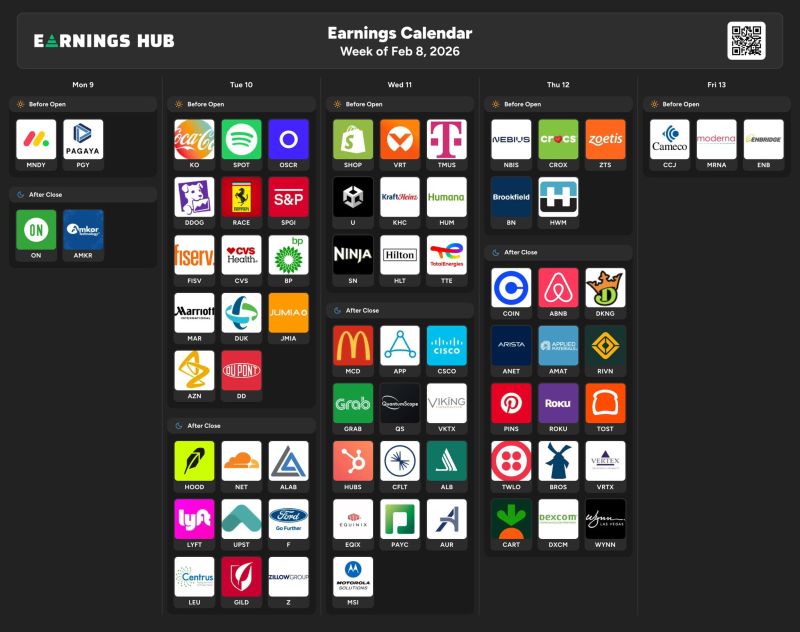

THE MASTER EARNINGS SEASON CALENDAR

Here are the most popular stocks that report earnings this week February 9th - February 13th. Source: Earnings Hub

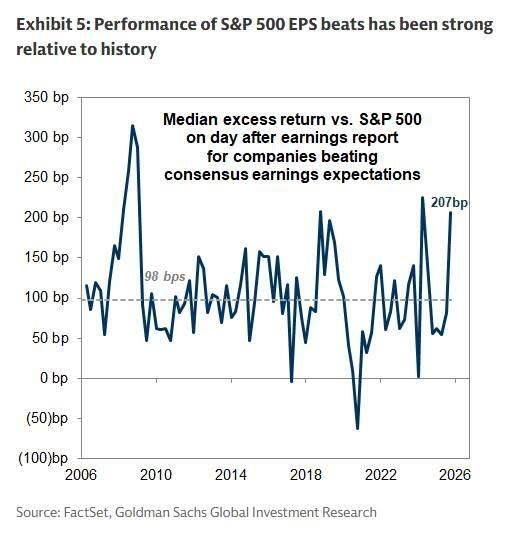

Goldman notes that after a few quarters of uninspiring market that follows positive earnings release, beats are finally being rewarded.

Companies beating consensus EPS estimates have outperformed on the day after reporting by +207 bp on average, more than double the historical average of +98 bp.

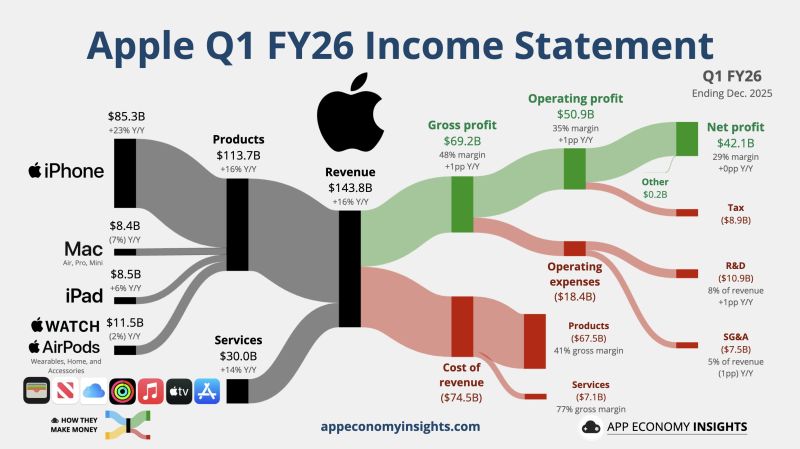

📢 Apple reported fiscal first-quarter earnings on Thursday that surpassed expectations, with revenue soaring 16% on an annual basis.

📌 The company reported $42.1 billion in net income, or $2.84 per share, versus $36.33 billion, or $2.40 per share, in the year-ago period. 🚀 Apple saw particularly strong results in China, including Taiwan and Hong Kong. Sales in the region surged 38% during the quarter to $25.53 billion. Apple quarterly results by App Economy Insights $AAPL Apple Q1 FY26 (Dec. quarter): 📱 Products +16% Y/Y to $113.7B. 💳 Services +14% Y/Y to $30.0B. • Revenue +16% Y/Y to $143.8B ($5.2B beat). • Operating margin 35% (+1pp Y/Y). • EPS $2.84 ($0.17 beat).

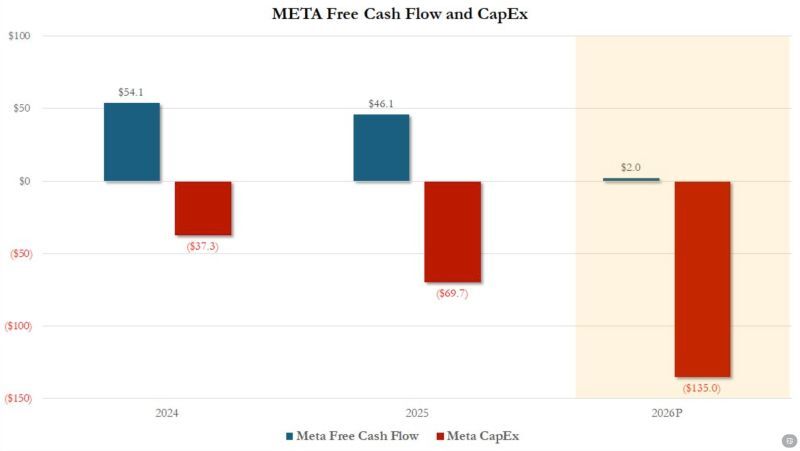

At the high end of its capex forecast ($135BN), META free cash flow in 2026 will be $0

Source: zerohedge

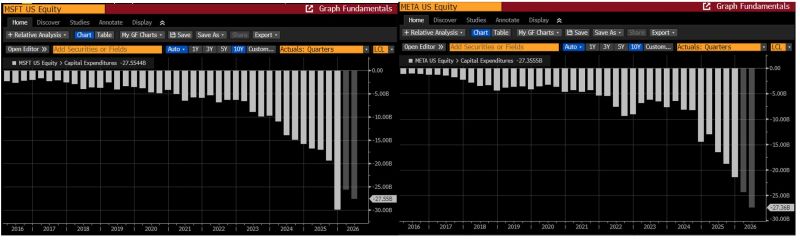

Microsoft and Meta quarterly CAPEX -realised and projected

These aren’t the old MSFT and META... Source: Bloomberg, RBC

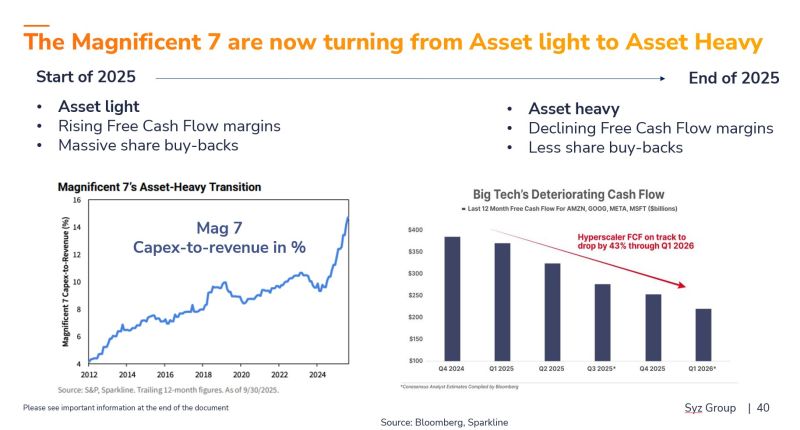

MSFT and META quarterly results (and capex projections) confirm our thesis: these are not your "old" Mag 7.

Indeed, the AI revolution has hit a major turning point as the largest U.S. tech companies embark on unprecedented AI infrastructure spending. The Magnificent 7 are now turning from Asset light to Asset Heavy. Although markets have so far rewarded this surge in investment, history shows that capex booms often lead to overbuilding, intensified competition, and disappointing stock performance. From Magnificent 7 to Magnificent risks ???

Investing with intelligence

Our latest research, commentary and market outlooks