Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US earnings growth outperforming.

Source: @fundstrat thru Mike Zaccardi, CFA, CMT, MBA

The most important week of us earnings season is here.

Over 37% of $QQQ reports earnings this week. Enjoy the show 🍿 $MSFT | $AAPL | $AMZN | $META Source. BofA, Trend Spider

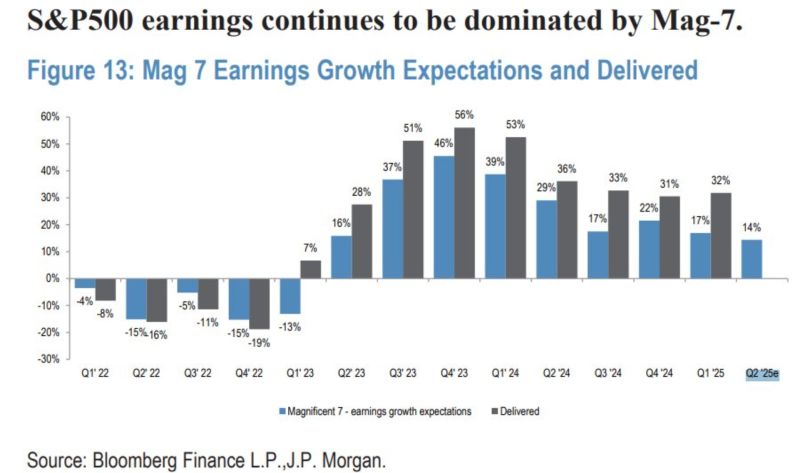

The Mag 7 has consistently blown the doors off EPS estimates

Mag 7 EPS growth is expected to hit 14% this quarter Source: Mike Zaccardi, CFA, CMT, MBA, JP Morgan, Bloomberg

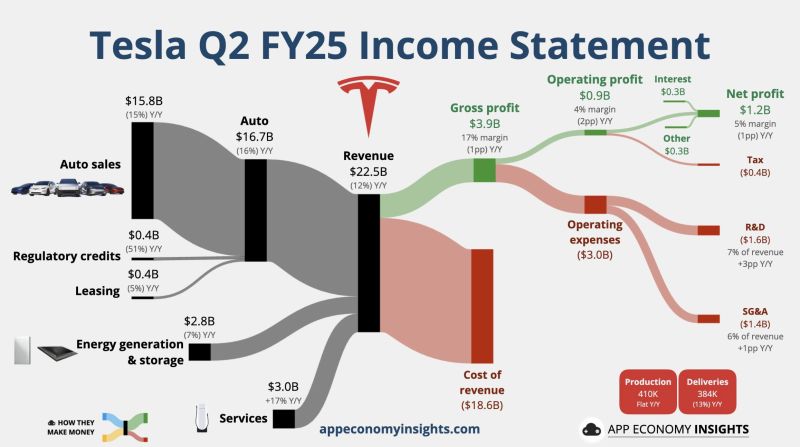

Tesla just posted a double miss for Q2:

~EPS: $0.40 vs $0.42 est ~REV: $22.50B vs $22.79B est Still, the stock $TSLA was up +1% in after-hours trading Here are the details: • Revenue -12% Y/Y to $22.5B ($0.4B beat). • Gross margin 17% (-1pp Y/Y). • Operating margin 4% (-2pp Y/Y). • Capex +5% Y/Y to $2.4B. • Free cash flow -89% Y/Y to $0.1B. • Non-GAAP EPS $0.40 (in-line). Source: App Economy Insights

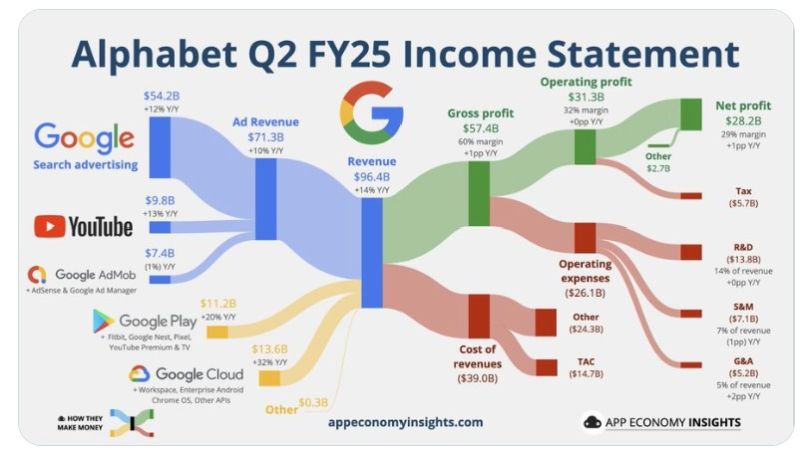

Alphabet reported second-quarter results on Wednesday that beat on revenue and earnings.

The company increased its capital expenditures forecast for 2025 to $85 billion, up $10 billion from February, due to “strong and growing demand for our Cloud products and services.” The company’s overall revenue grew 14% year over year, higher than the 10.9% Wall Street expected. Here are the details ($GOOG Alphabet Q2 FY25): • Revenue +14% Y/Y to $96.B ($2.5B beat). • Operating margin 32% (flat Y/Y). • EPS $2.31 ($0.12 beat). ☁️ Google Cloud: • Revenue +32% Y/Y to $13.6B. • Operating margin 21% (+9pp Y/Y). ▶️ YouTube ads +13% to $9.8B. Source: CNBC, App Economy Insights

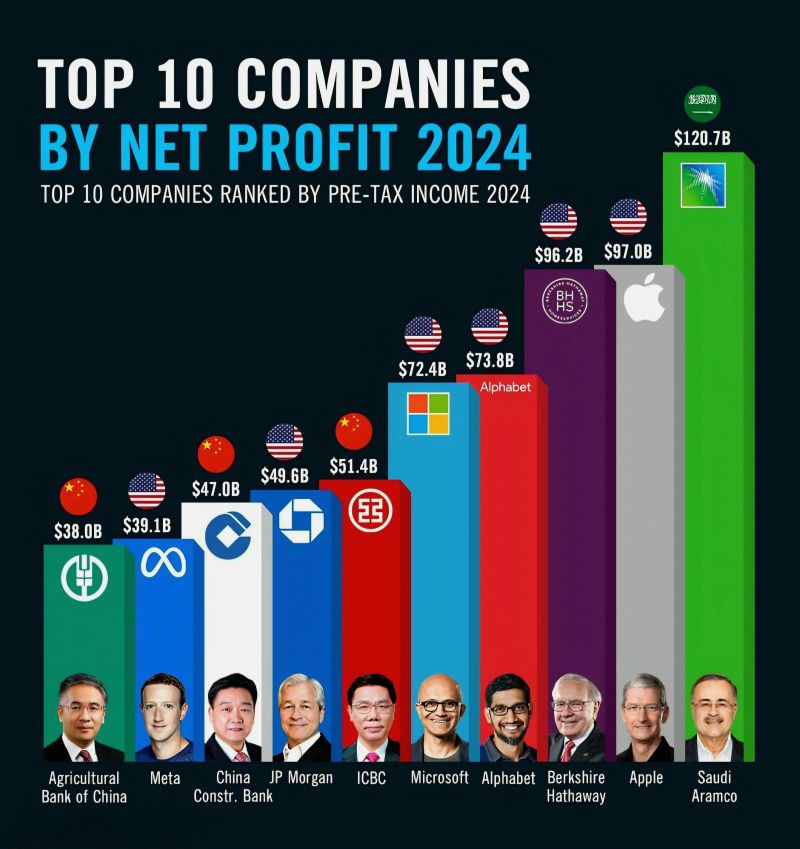

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

S&P 500 earnings have recently seen multiple sharp upward revisions.

This comes after 15 consecutive weeks of downside earnings revisions fueled by tariff fears. Overall, it seems that US corporations are actually coming out on the other side of these fears stronger. This is a tailwind for the stock market. Source: Bravos research

The Q2 2025 earnings season begins this week, with analysts forecasting modest S&P 500 EPS growth of 4.8%, the lowest rate since Q4 2023.

Early reports have already painted a mixed picture, showing strong AI and travel demand ( $MU, $DAL ) but softness in consumer goods and shipping ( $NKE, $FDX). The spotlight is now on the big banks, with $JPM, $C, $WFC, and others reporting Tuesday and Wednesday. In their reports, we'll be watching for commentary on three key themes: credit quality, a potential recovery in investment banking, and the expected plateau in net interest income. Source: Wall Street Horizon

Investing with intelligence

Our latest research, commentary and market outlooks