Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

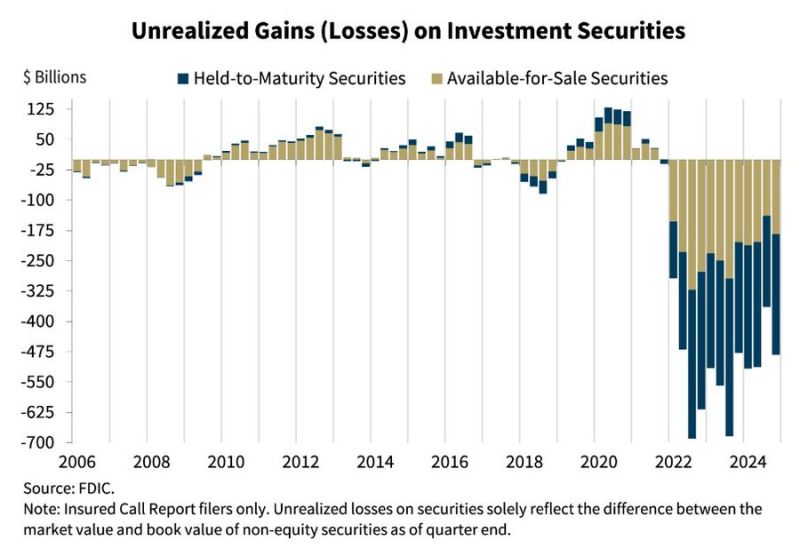

BREAKING: U.S. Banks are currently facing $482 Billion in unrealized losses, an increase of 33% from the prior quarter.

Source: Barchart, BofA

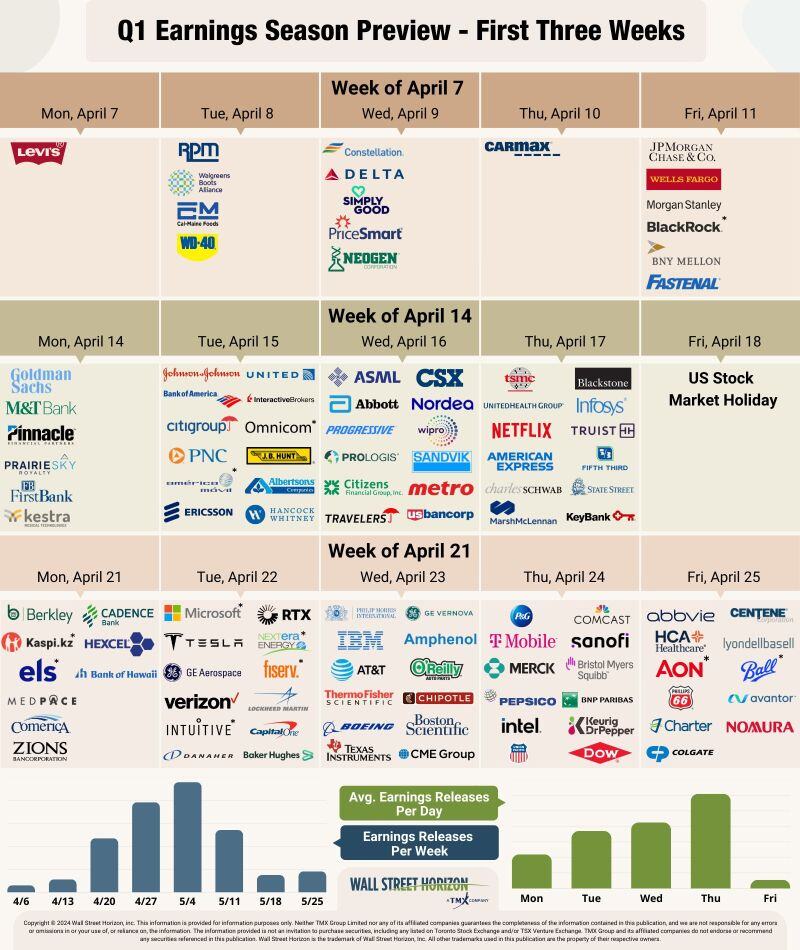

🔴 A HUGE WEEK AHEAD FOR EARNINGS

👉 Monday: $WM $DPZ 👉Tuesday: $KO $V $SBUX $SNAP $SOFI $SPOT $PFE $UPS $MO $GM $HON 👉Wednesday: $MSFT $META $HOOD $QCOM $CAT $ETSY 👉 Thursday: $AAPL $AMZN $LLY $MA $ABNB $MSTR $RBLX $MRNA $RDDT $XYZ 👉 Friday: $XOM $CVX (Source for the Earnings Calendar - @EarningsHubHQ) thru Evan on X

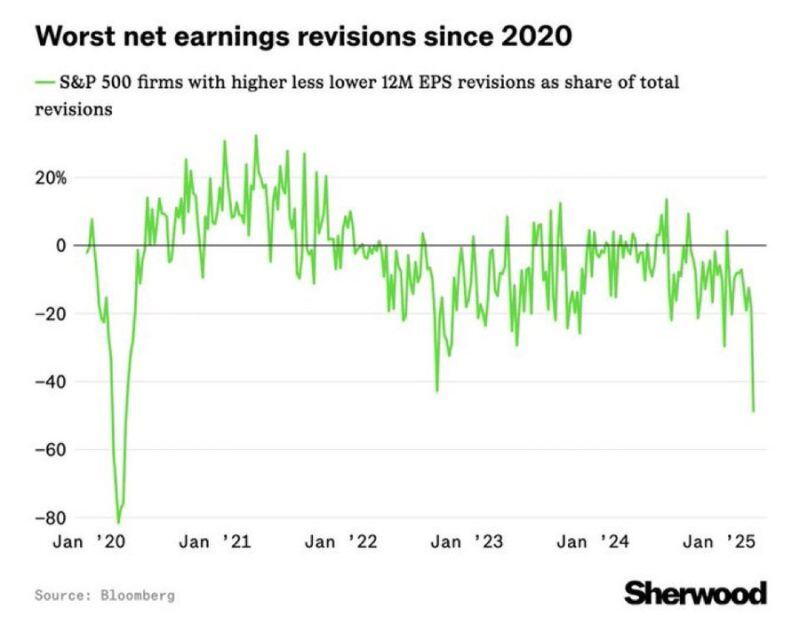

Worst net US earnings revisions since 2020!

Source: Win Smart, CFA @WinfieldSmart

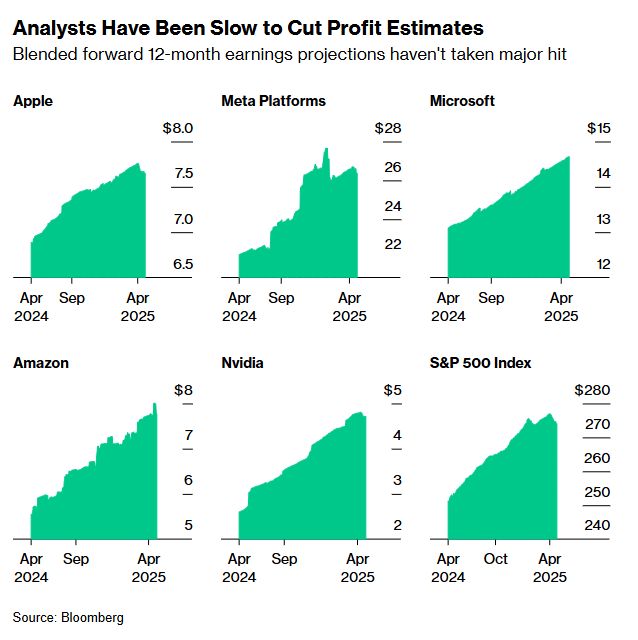

‼️Wall Street strategists are CAPITULATING on earnings estimates:

➡️ S&P 500 earnings have been revised DOWN for 17 consecutive weeks, the longest streak since the 2022 BEAR MARKET. ➡️The share of firms with higher less lower EPS revisions hit 48%, the highest since the 2020 CRISIS. Source: Global Markets Investor, Liz Ann Sonders, Bloomberg

Updated version of our Q1 2025 earnings season preview, data as of April 7, 2025.

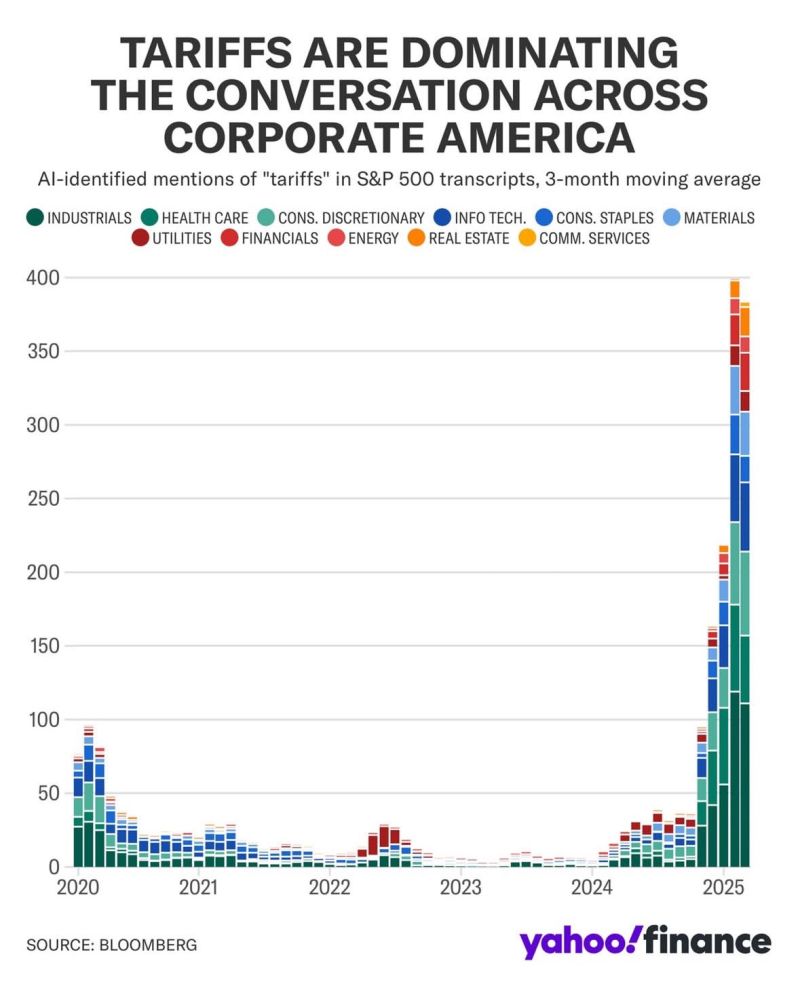

The season kicks off this Friday with all eyes on the big banks. Over 50% of S&P 500 firms mentioned tariffs in their Q4 conference calls according to FactSet, could we see that number go higher? Source: Wall Street Horizon @WallStHorizon

Roughly 80% of the stocks in the SP500 said the word tariffs on their last earnings call

Source: Evan on X

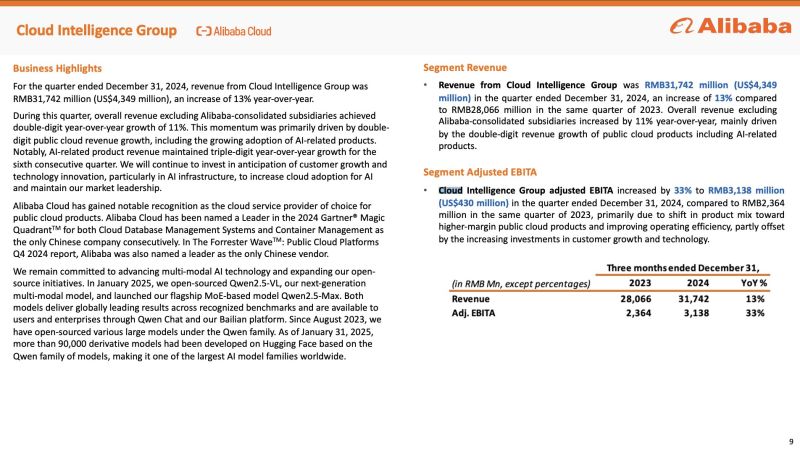

$BABA beats on the big three revenue, adjusted net income and adjusted EPS!

"Cloud revenue growth accelerated to double digits at 13% year-over-year, with AI-related product revenue achieving triple-digit growth for the sixth consecutive quarter" Source: The Transcript

Investing with intelligence

Our latest research, commentary and market outlooks