Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

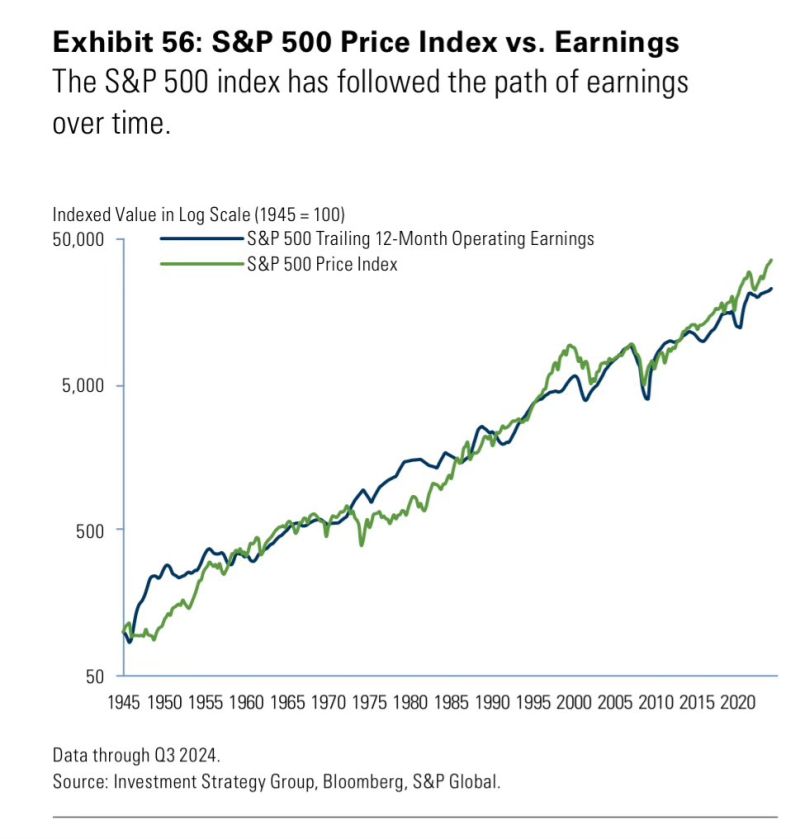

Earnings do matter

Source: Investment Strategy Group, Bloomberg, S&P Global

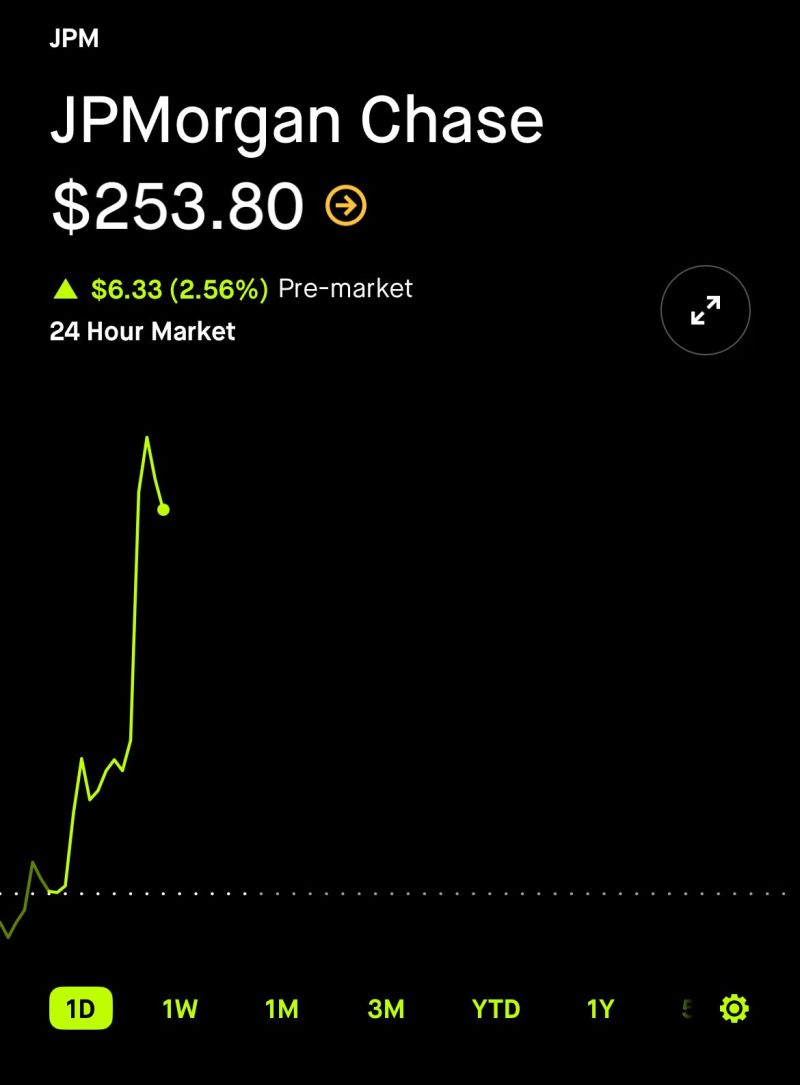

JPMorgan $JPM reported earnings

EPS of $4.84 beating expectations of $4.11 Revenue of $43.7B beating expectations of $41.7B Jamie Dimon added … “two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II” Source: App Economy Insights

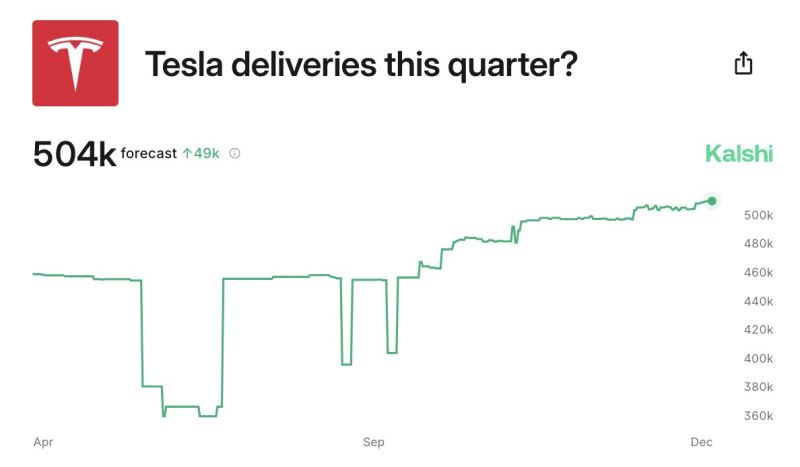

All eyes are on Tesla, $TSLA, this week: Tesla is expected to report Q4 2024 deliveries of 504,000 this week, according to Kalshi.

This would mark an ~8.9% increase from the 462,890 vehicles delivered in Q3 2024. If Tesla does in fact report over 500,000 deliveries, it would mark a new quarterly record for the company. Tesla is now the 8th largest company in the world by market cap and worth ~$1.4 trillion. Can Tesla extend its historic run this week? Source: The Kobeissi Letter

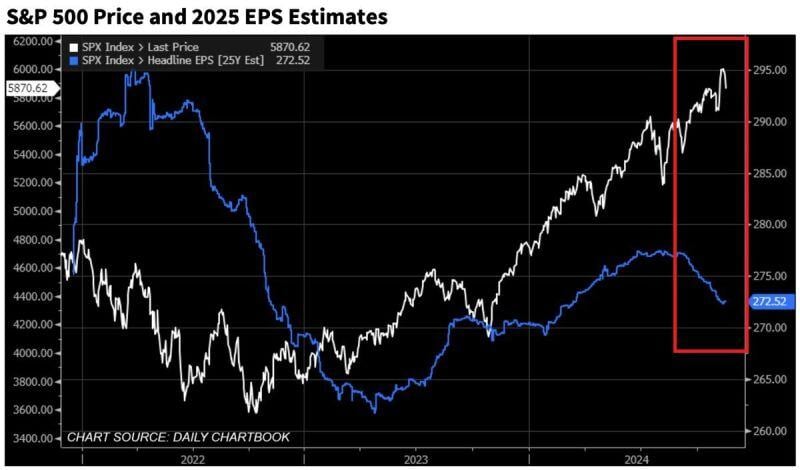

S&P500 earnings estimates for 2025 have rolled over and declined over the last few weeks.

At the same time, the S&P 500 continued to rise making valuations even more stretched (expensive). Will earnings estimates catch up or stocks fall? Source: Global Markets Investor

Quarterly revenue growth almost as parabolic as the stock price. 💸 $NVDA

Source: TrendSpider

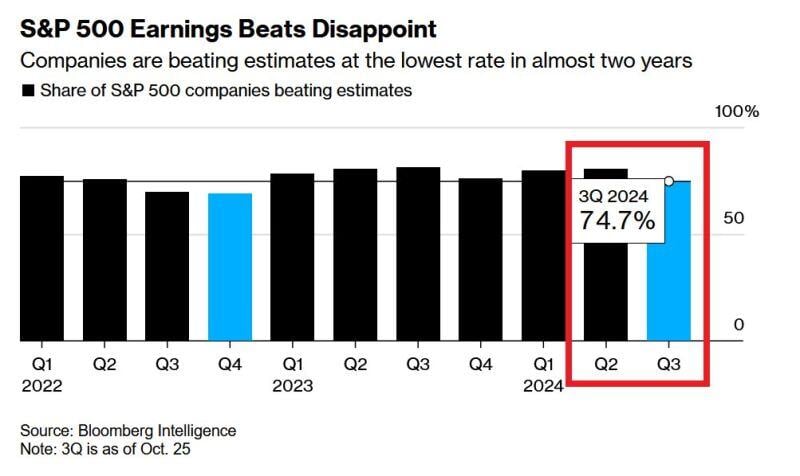

⌛ S&P 500 EARNINGS HAVE BEEN DISAPPOINTING⌛

75% of companies beat Wall Street analysts' Q3 earnings expectations, the lowest share since Q4 2022. This is despite huge earnings estimates downgrades that took place in Sep This week will be extremely crucial as 42% firms report. Source. Global Markets Investor, Bloomberg

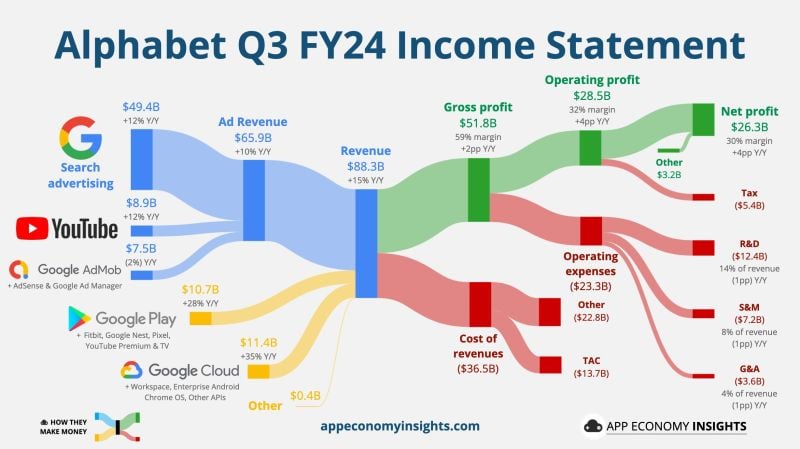

Google parent Alphabet reported Q3 earnings, which beat on top and bottom lines.

The company’s shares rose 4% on the results. Alphabet’s revenue grew 15% year over year, which is stronger than the same quarter last year. The company reported blow-out cloud revenue at $11.35 billion — up nearly 35% from the $8.41 billion a year ago. The company attributed its strong cloud results to their AI offerings, which includes subscriptions for enterprise customers. $GOOG Alphabet Q3 FY24: • Revenue +15% Y/Y to $88.3B ($2.0B beat). • Operating margin 32% (+4pp Y/Y). • EPS $2.12 ($0.27 beat). Google Cloud: • Revenue +35% Y/Y to $11.4B. • Operating margin 17% (+14pp Y/Y). YouTube ads +12% to $8.9B. Source: App Economy Insights

🥉 Swiss bank UBS smashes third-quarter expectations with $1.4 billion in profit (vs. $667.5 million expected)

👉 Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included: - Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year. - Return on tangible equity hit 7.3%, compared with 5.9% over the second quarter. - CET 1 capital ratio, a measure of bank solvency, was 14.3%, down from 14.9% in the second quarter. The lender said it expects to complete its planned $1 billion share buyback program in the fourth quarter and intends to continue repurchases in 2025. 💪 UBS Sees Uninterrupted Client Momentum: Switzerland's largest bank reports strong transactional activity in its core business and expects to achieve its objective of $100 billion in net new assets by the end of the year. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks