Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

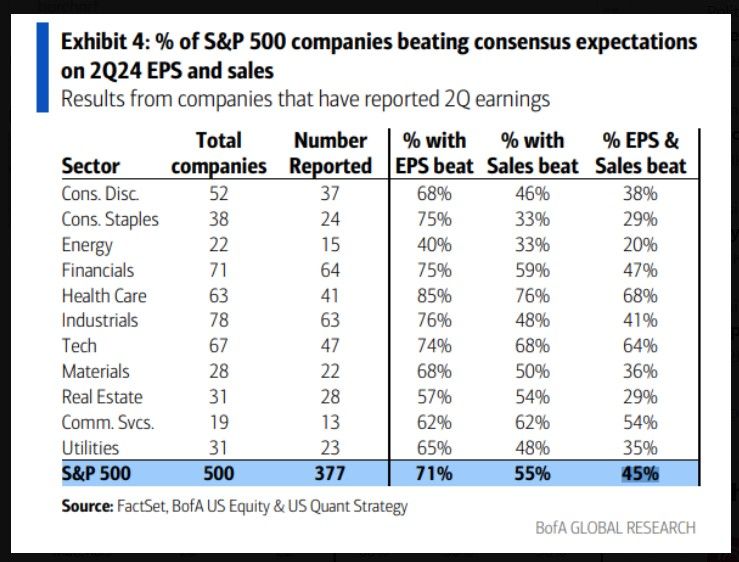

US earnings: The beat rate is the smallest since 4th quarter of 2022 377 S&P 500 companies (80% of index EPS) have reported, beating consensus by 2%, the smallest since 4Q22.

71%/55%/45% beat on EPS/sales/both Source: BofA, Mike Z.

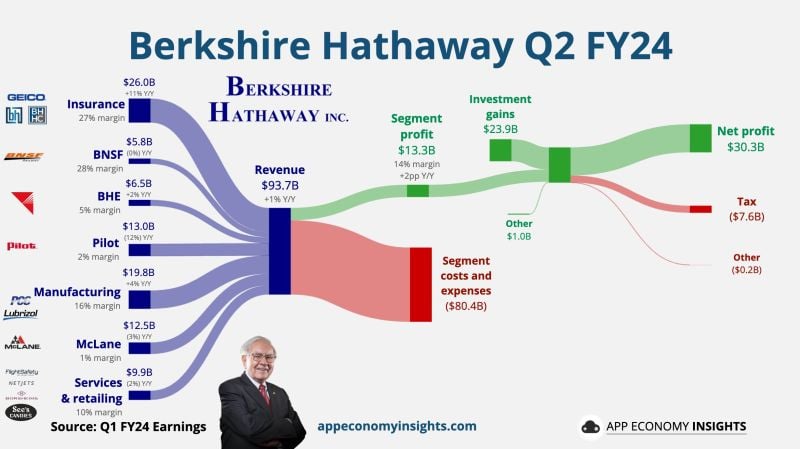

Berkshire Hathaway’s cash pile swelled to a record $276.9 billion last quarter as Warren Buffett sold big chunks in stock holdings including Apple

The Omaha-based conglomerate’s cash hoard jumped significantly higher from the previous record of $189 billion, set in the first quarter of 2024. The increase came after the Oracle of Omaha sold nearly half of his stake in Tim Cook-led tech giant in the second quarter. Berkshire has been a seller of stocks for seven quarters straight, but that selling accelerated in the last period with Buffett shedding more than $75 billion in equities in the second quarter. That brings the total of stocks sold in the first half of 2024 to more than $90 billion. The selling by Buffett has continued in the third quarter in some areas with Berkshire trimming its second biggest stake, Bank of America, for 12 consecutive days, filing this week showed. For the second quarter, Berkshire’s operating earnings, which encompass profits from the conglomerate’s fully-owned businesses, enjoyed a jump thanks to the strength in auto insurer Geico. Operating earnings totaled $11.6 billion in the second quarter, up about 15% from $10 billion a year prior. $BRK Berkshire Hathaway Q2 FY24. • Stock repurchase $0.3B. • $AAPL stake cut by nearly half. • Segment margin 14% (+2pp Y/Y). • Cash and short-term securities $277B. Source: App Economy Insights, CNBC

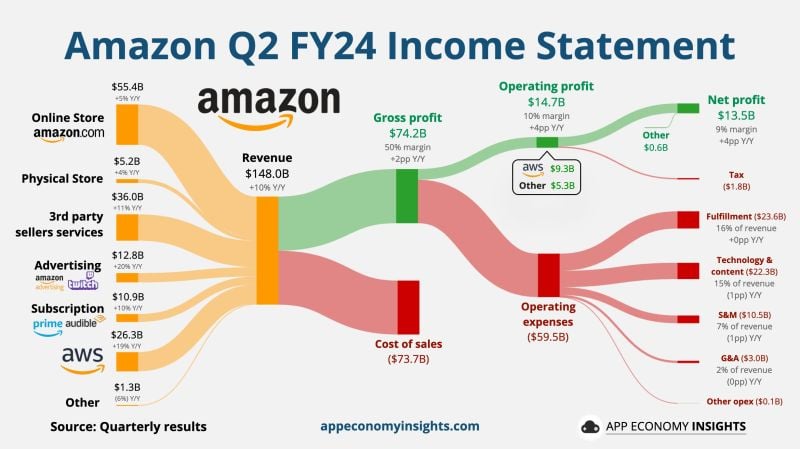

Amazon reported weaker-than-expected revenue for the second quarter on Thursday and issued a disappointing forecast for the current period.

The shares slid as much as 6% in extended trading. Here's how $AMZN Amazon did in Q2 FY24: • Revenue +10% Y/Y to $148B ($0.8B miss). • Operating margin 10% (+4pp Y/Y). • FCF $53B TTM. ☁️ AWS: • Revenue +19% Y/Y to $26.3B. • Operating margin 36% (+11pp Y/Y). Q3 FY24 Guidance: • Revenue ~$154-$158.5B ($158.3B expected).

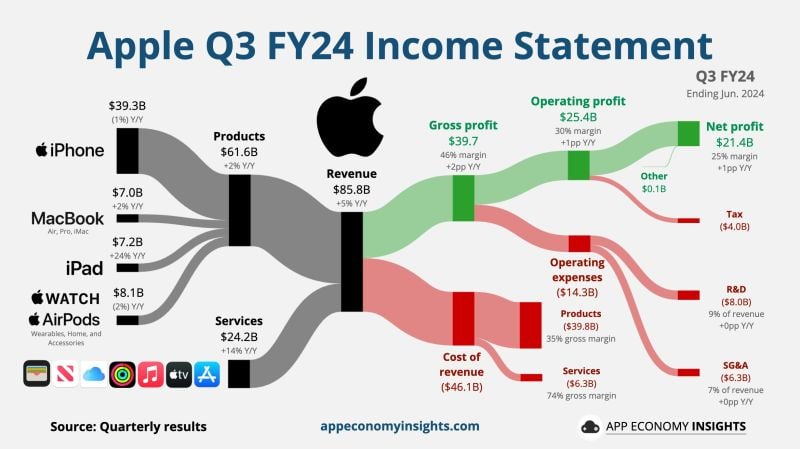

Apple reported fiscal third-quarter earnings on Thursday that beat Wall Street expectations, with overall revenue rising 5%. iPhone, iPad and Services revenue all beat analyst expectations.

Apple's most important business remains the iPhone, which accounted for about 46% of the company's total sales during the quarter. Apple expects similar overall revenue growth in the current quarter, company finance chief Luca Maestri said on a call with analysts. Apple also expects Services to grow at about the same rate as the previous three quarters, which was about 14%. The company sees operating expenditures between $14.2 billion and $14.4 billion in the current quarter, Maestri added, with gross margin of between 45.5% and 46.5%. Apple shares were flat in extended trading. Here's how $AAPL Apple did in Q3 FY24 (June quarter): 💳 Services +14% Y/Y to $24.2B. 📱 Products +2% Y/Y to $61.6B. • Revenue +5% Y/Y to $85.8B ($1.4B beat). • Operating margin 30% (+1pp Y/Y). • EPS $1.40 ($0.06 beat). Source: App Economy Insights, CNBC

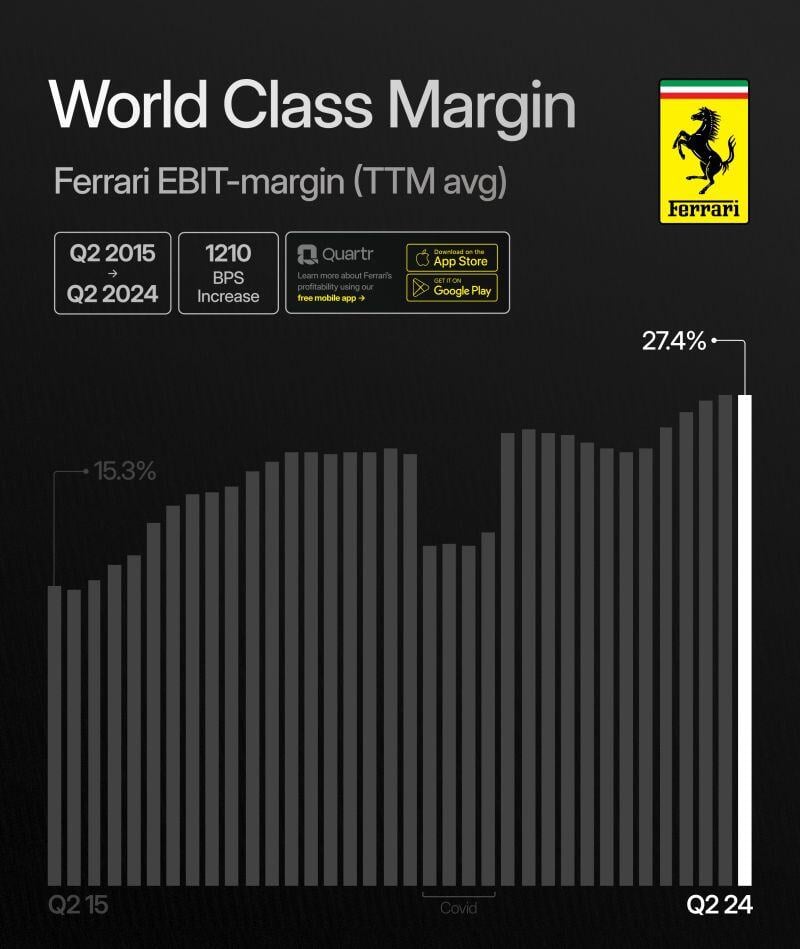

Ferrari (RACE) boosted its full-year guidance when delivering second-quarter results that topped revenue expectations on Thursday.

The Italian automaker now projects 2024 net revenue of more than 6.55 billion euros ($7.07 billion), up from more than EUR6.4 billion, and adjusted earnings per share (EPS) of at least EUR7.90, up from at least EUR7.50. “We are delighted to announce excellent financial results in the second quarter of 2024, which demonstrate again a strong execution and continued growth." – Benedetto Vigna, CEO Ferrari $RACE Q2 2024 in a nutshell: Shipments +3% *EMEA +1% *Americas +13% *Greater China -18% *APAC +4% Revenue +16.2% EBIT +17% *marg 29.9 (29.7) EPS +25% Source: Quartr

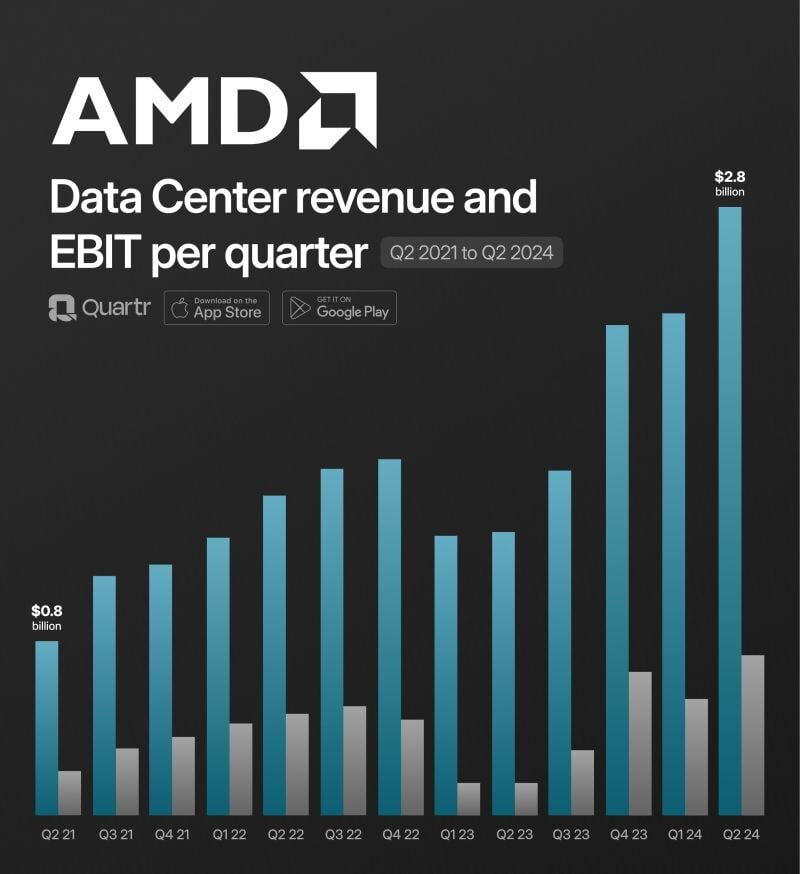

$AMD Q2 2024: "Our AI business continued accelerating and we are well positioned to deliver strong revenue growth in the second half of the year" - Lisa Su, CEO

Details by Quartr: Revenue +9% *Data Center +115% *Client +49% *Gaming -59% *Embedded -41% Gross Profit +17% *marg. 49% (46%) EBIT +1445% *marg. 5% (0) EPS +700%

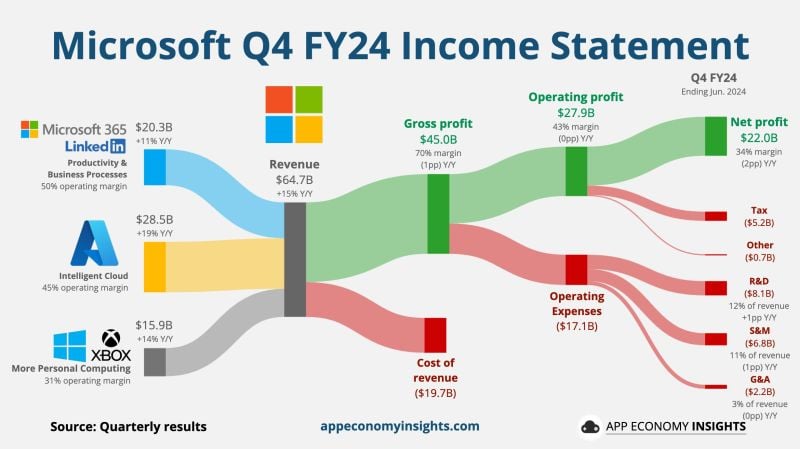

Microsoft shares fell 7% in extended trading on Tuesday as investors looked past better-than-expected earnings and revenue and focused instead on disappointing cloud results.

Here’s how the company did, compared with the LSEG consensus: -> Earnings per share: $2.95 vs. $2.93 expected -> Revenue: $64.73 billion vs. $64.39 billion expected Microsoft’s revenue increased 15% year over year in the fiscal fourth quarter, which ended on June 30, according to a statement. Net income, at $22.04 billion, was up from $20.08 billion, or $2.69 per share, in the year-ago quarter. The company’s top segment, Intelligent Cloud, generated $28.52 billion in revenue. It includes the Azure public cloud, Windows Server, Nuance and GitHub. The total was up about 19% and below the $28.68 billion consensus among analysts surveyed by StreetAccount. GitHub’s revenue is now at an annual run rate exceeding $2 billion, Microsoft CEO Satya Nadella said on a conference call with analysts. Revenue from Azure and other cloud services grew 29% during the quarter. Analysts polled by CNBC and StreetAccount had expected 31% growth. Microsoft’s Azure number hadn’t fallen short of consensus since 2022. Microsoft doesn’t disclose revenue from the category in dollars. In a nutshell: $MSFT Microsoft Q4 FY24 (ending in June): ☁️ Azure +30% Y/Y fx neutral (vs. 31% in Q3). • Revenue +15% Y/Y to $64.7B ($0.3B beat). • Gross margin 70% (-1pp Y/Y) • Operating margin 43% (flat Y/Y). • EPS $2.95 ($0.02 beat). Source: CNBC, App Economy Insights

A critical week ahead for the Nasdaq 100 QQQ which is sitting at critical trendline support at the time of FOMC meeting + $AAPL $MSFT $AMZN $META earnings...

Source; Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks