Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

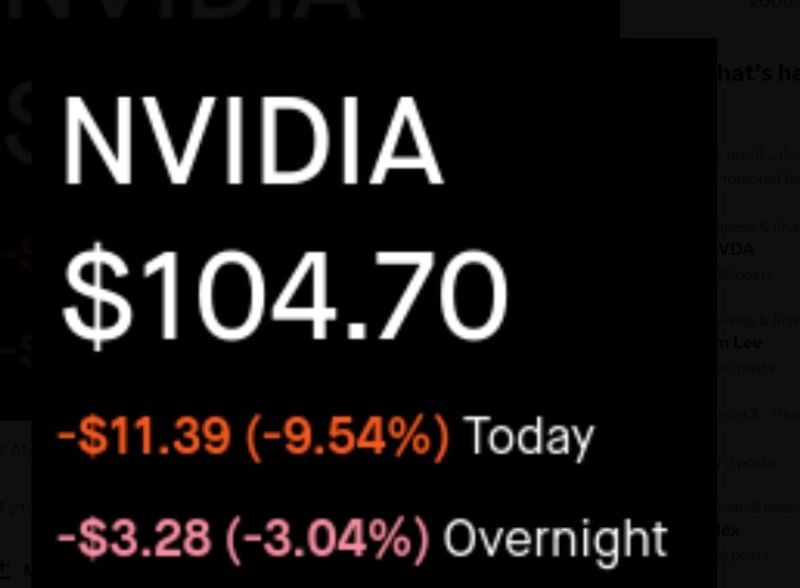

Adding Insult To Margin Calls, Nvidia Receives DOJ Subpoena Making Record Price Drop Even Worse.

$NVDA is down another 3% in the overnight session After the close, the DOJ sent subpoenas to Nvidia and other companies in an escalation of its investigation into possible antitrust law violations by Nvidia. DOJ is concerned with whether Nvidia penalizes buyers that don’t exclusively use Nvidia chips and makes it difficult to switch suppliers. Source: Markets & Mayhem

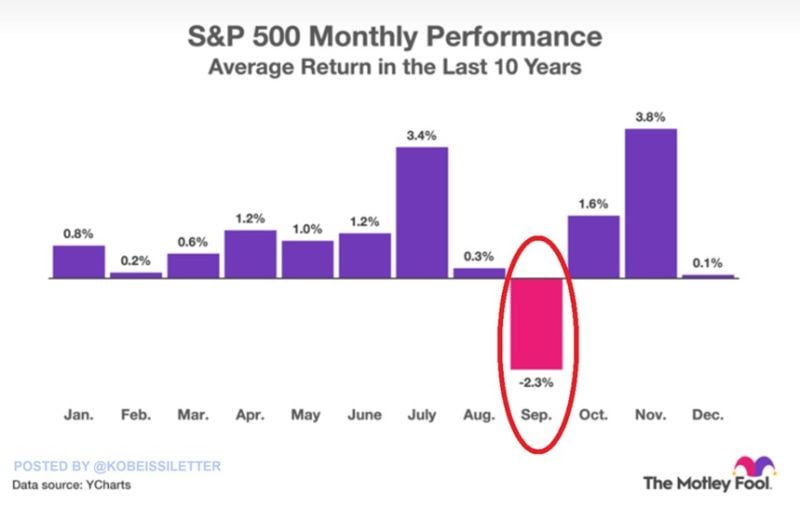

September is historically the worst month of the year for stocks:

The S&P 500 has fallen -2.3% on average in September over the last 10 years, marking the only month with negative returns. Since World War II, the average September return has been negative, at -0.8%. Moreover, the Volatility Index, $VIX, has seen an average spike of ~10% in September over the last 33 years. Subsequently, in October and November, the S&P 500 has seen a +1.6% and +3.8% rally on average. Markets are entering their most volatile period of the year. Source: The Motley Fool, The Kobeissi Letter

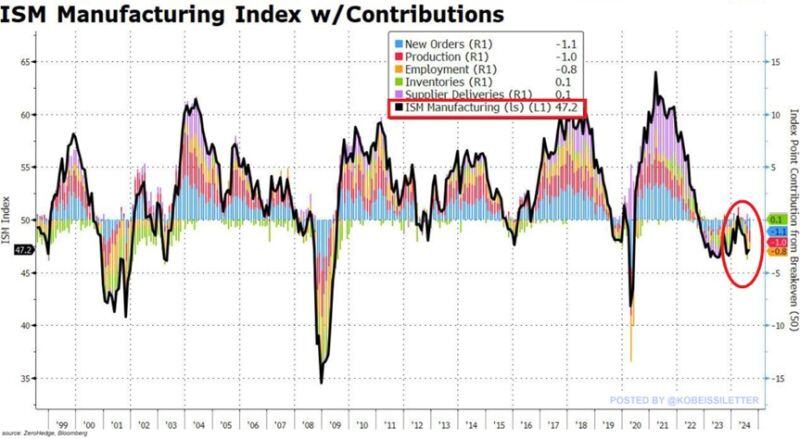

US manufacturing has officially contracted for the 5th consecutive month, to 47.2 points.

The ISM manufacturing PMI index missed expectations of 47.5 points for last month. New orders fell to 44.6 points from 47.4 in July, experiencing contraction for the 3rd straight month. Manufacturing activity has now shrunk in 21 of the last 22 months, extending the second-longest downturn in history. The worst part? The prices paid index jumped to 54.0 points from 52.9 in July, expanding for the 8th month in a row. Rising prices with falling output is rarely a good combo for stocks >>> to be monitored Source: www.zerohedge. The Kobeissi Letter

BREAKING: Magnificent 7 stocks have now erased $550 BILLION of market cap today.

Nvidia, $NVDA, is on track for its largest daily drop since April 2024. As discussed during our H2 outlook, volatility is coming back with a vengeance ahead ahead of US elections. Source: The Kobeissi Letter, Bloomberg

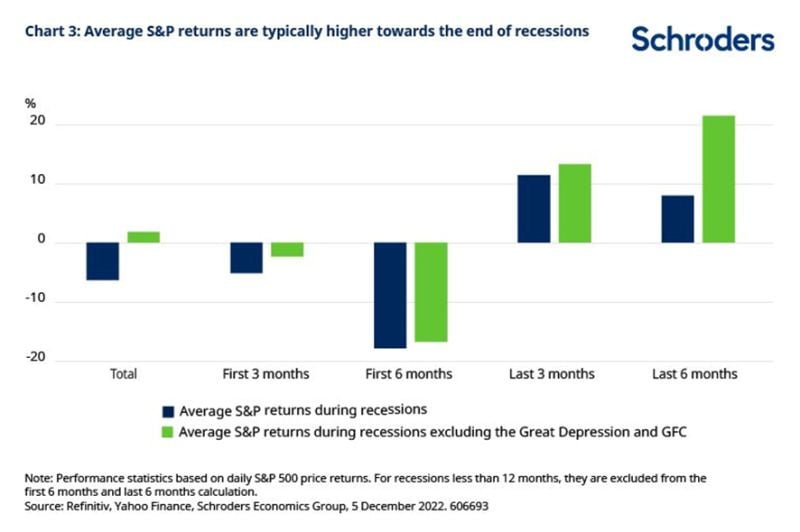

Recessions are Bad for Stocks...

-but only during the first part -stocks do well in the later stages Basically you need to lighten exposure into recession, then load up in the depths. Source: Schroders thru Callum Thomas

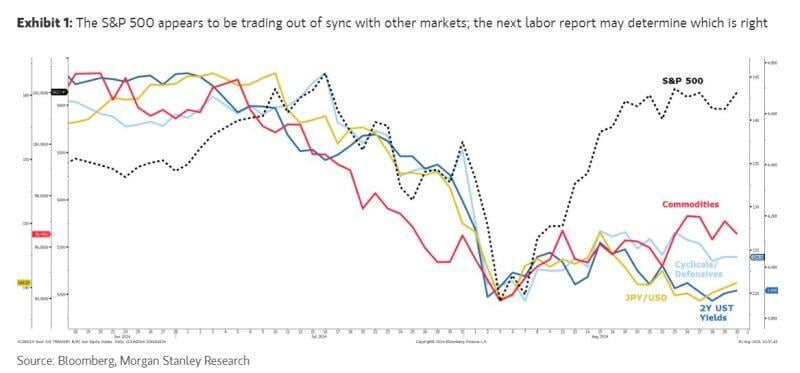

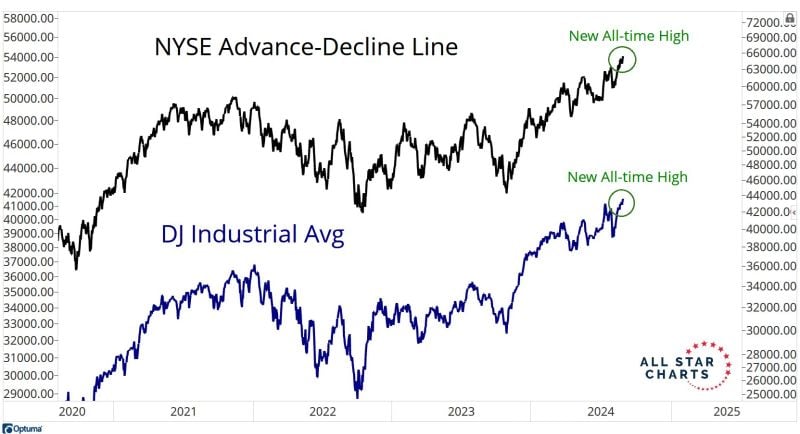

The world's most important stock exchange and the world's most important stock index.

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks