Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

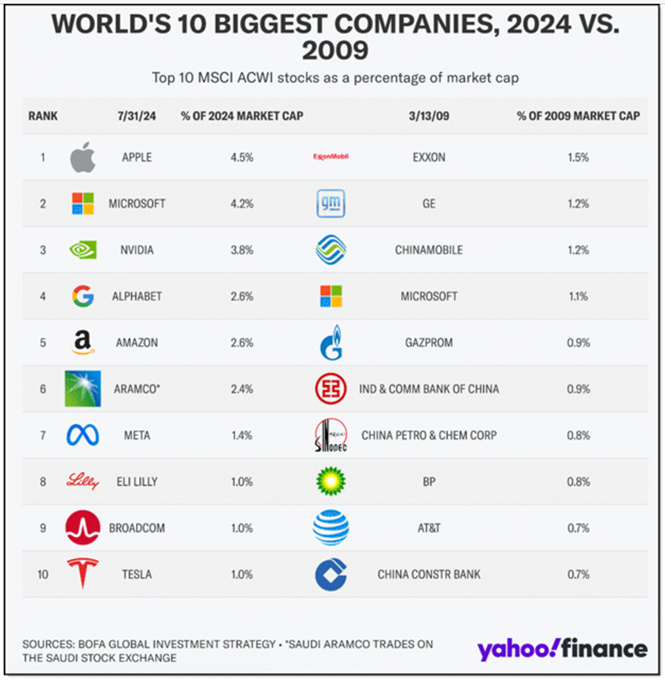

World's 10 biggest companies in 2024 vs. 2009

Source: Yahoo Finance

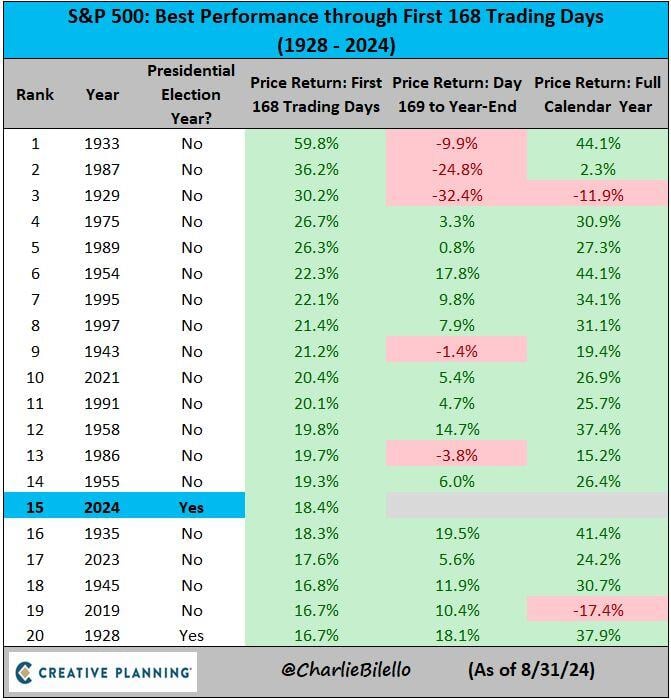

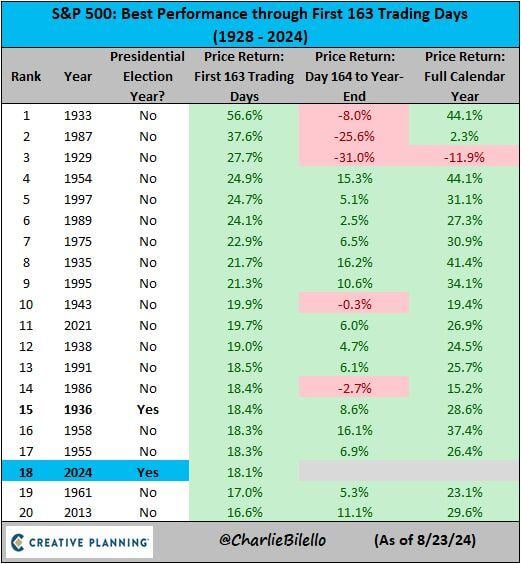

The sp500 is up 18.1% in the first 163 trading days of 2024, the 18th best start to a year going back to 1928 and 2nd best start to a presidential election year ever. $SPX

Source: Charlie Bilello

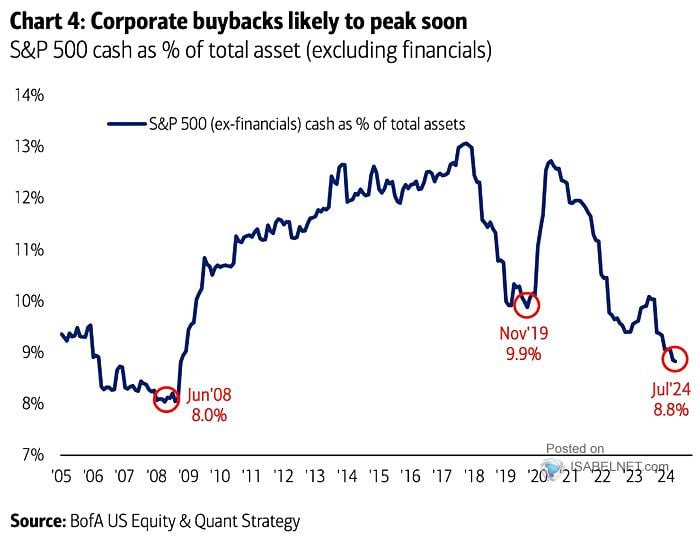

Will the share buyback effect soon fade?

Since 2000, Share Buybacks have comprised ~100% of net equity purchases. Such has been a huge support for higher asset prices. That is all fine until you run out of cash to execute buybacks. Source: h/t @ISABELNET_SA, BofA, Lance Roberts

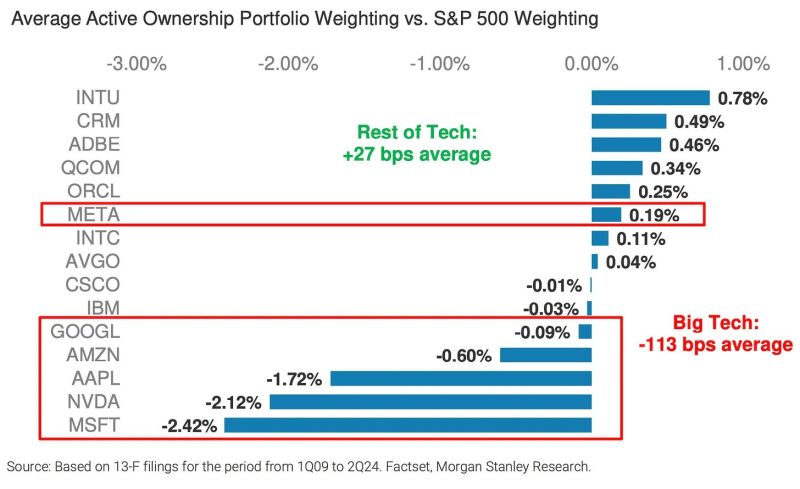

What are the most under-owned and over-owned large-caps stocks in portfolios?

"Of the large cap stocks we evaluate, MSFT, NVDA, AAPL, AMZN, and GOOGL are currently the most under owned in actively managed portfolios vs. the S&P 500, while INTU, CRM, ADBE and QCOM are the most over-owned." - MS Woodring. Source: Daily Chartbook, MS

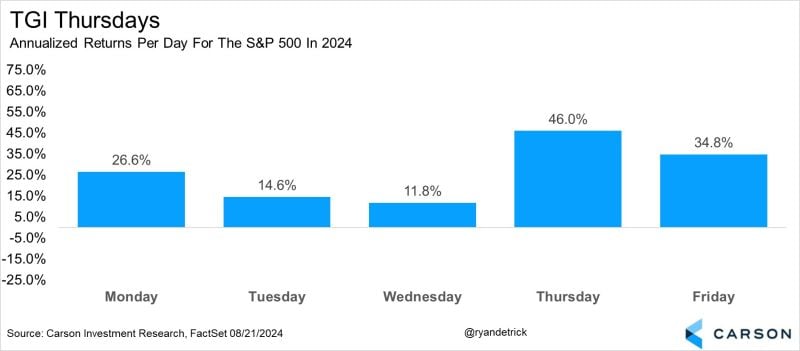

TGI Thursdays

The S&P 500 is up an annualized +46.0% on Thursday so far in 2024. This would be the best return for Thursday since '21 (+51.5%) and best for any day since Friday last year (+53.0%). Bottom line, in bull markets you tend to see strength ahead of the weekend. ✔☑✅ Source: Ryan Detrick, CMT @RyanDetrick on X, Carson research

China names healthcare, education, tech as likely venues for more foreign investment

Source: South China Morning Post

Investing with intelligence

Our latest research, commentary and market outlooks