Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

One of the most important chart in the asset allocation decision process:

Stocks vs. long duration US Treasuries. The trend is your friend Source: J-C Parets

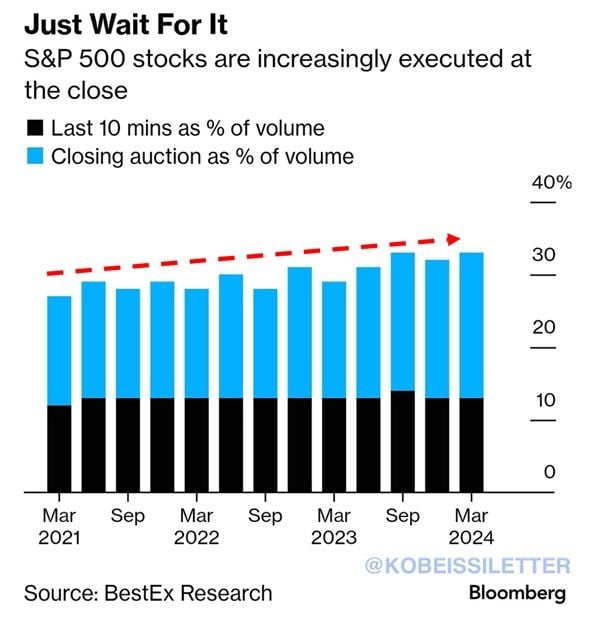

~33% of all S&P 500 stock trades are now executed in the last 10 minutes of the trading session.

This is up from ~27% in 2021 and has been steadily increasing over the last few months. The entire trading session lasts for 390 minutes, but ONE THIRD of all trades are done in the last 10. Interestingly, assets of passive equity funds such as ETFs have risen to nearly $12 trillion in the US, according to Bloomberg. These funds usually execute their trades near the end of a trading session. This explains the significant spike in volatility at the end of the day. Source: The Kobeissi Letter, Bloomberg

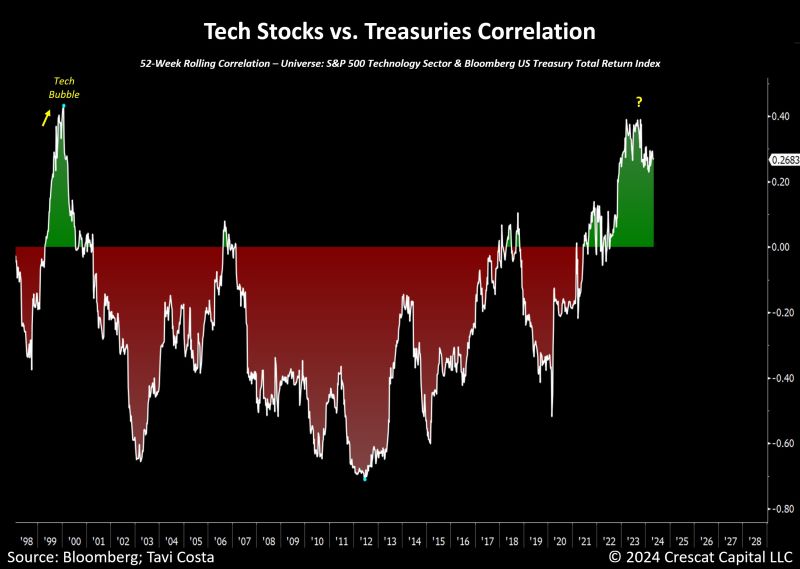

The correlation between tech stocks and treasuries is now as positive as it was during the peak of the tech bubble in early 2000.

This issue strikes at the heart of conventional 60/40 portfolios, as the risk of overweighting these two asset classes has significantly increased. Source: Tavi Costa, Bloomberg, Crescat Capital

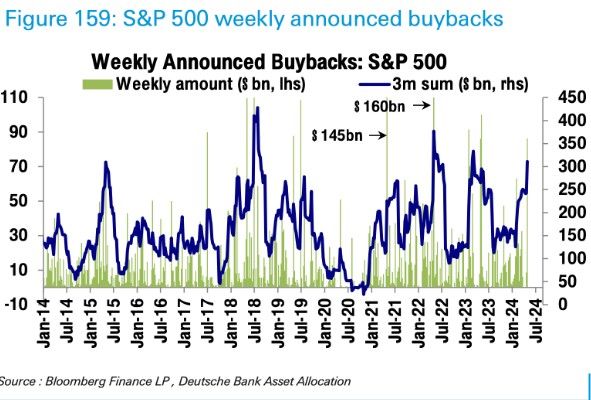

Halfway thru earnings season and buyback announcements are ticking up..

DB notes $85B announced last week. Source: DB

Goldman Sachs and HSBC are saying that funds and global investors are rotating out of US and Japanese stocks

To reposition on the Hong Kong stock market which appears to offer significantly better opportunity. Hong Kong listed companies mainly do business across Asia with limited interference from the Chinese government. Source: Bloomberg

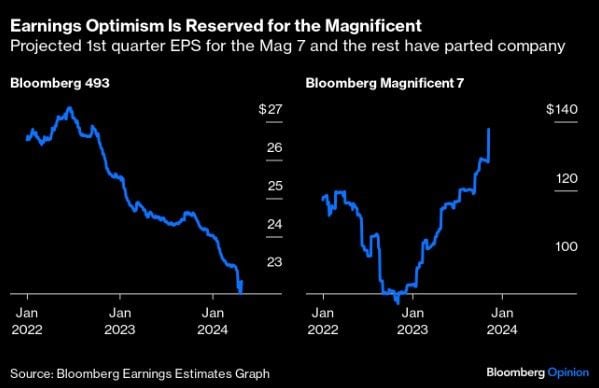

Projected Q1 earnings for the S&P 500 ex-Mag 7 (left-hand chart) vs. Projected Q1 earnings for the Mag 7...

Source: Bloomberg

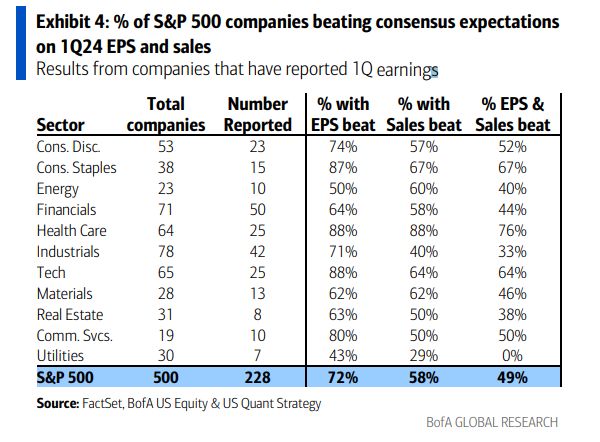

72% EPS beat rate so far

6.6% EPS growth SPX ex-Fins & Energy Source: Mike Zaccardi, BofA

Investing with intelligence

Our latest research, commentary and market outlooks