Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

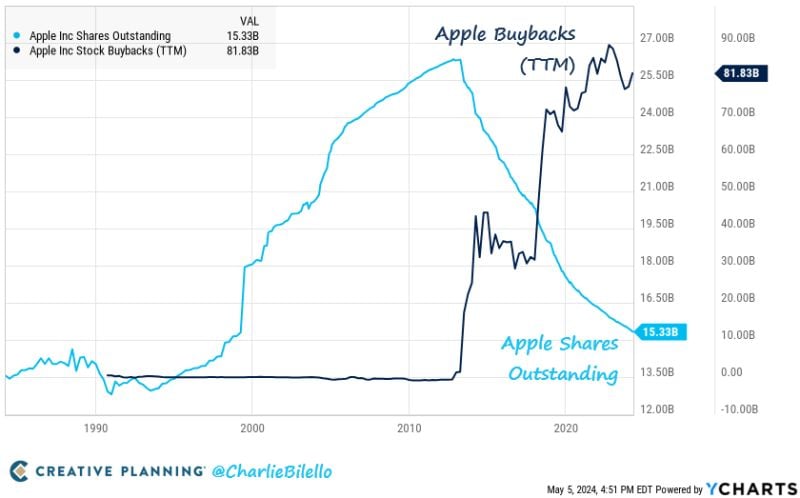

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

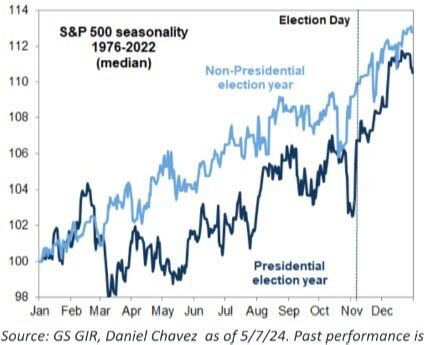

Sell in May and go away? Not in election years…

History shows that the mid-May to mid-June seasonal period is very strong during election years. Source: David Marlin, Goldman Sachs

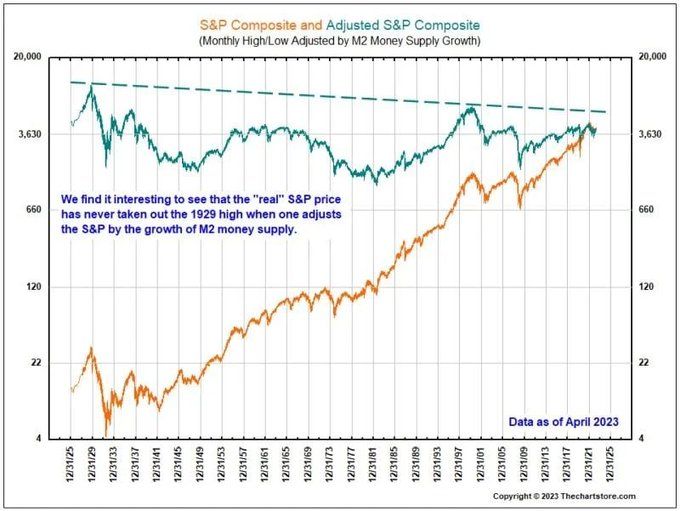

The real price of the S&P500 has never exceeded the 1929 highs...

...If adjusted for M2 money supply growth 💸 Source. Nicolas Cheron

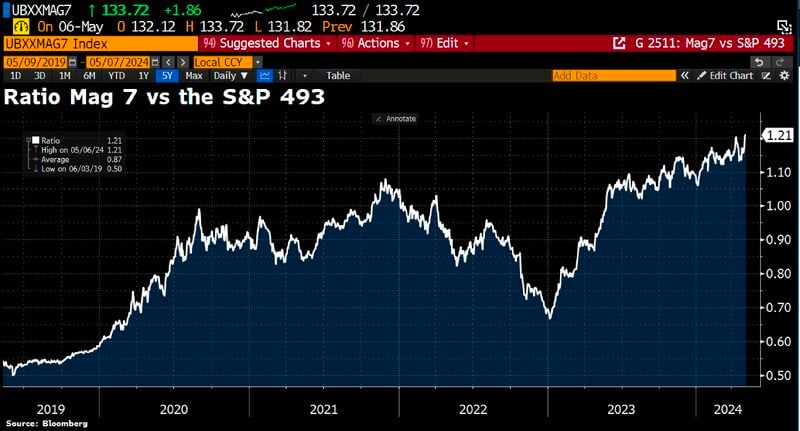

Don't fight the Mag 7?

The ratio of the Mag 7 vs the S&P 493 (S&P 500 ex Mag 7) has just hit another ATH. Source: Bloomberg, HolgerZ

Wall Street is turning less negative on China stocks

Source: Daily Compounding

The S&P 500 $SPX - it has now reclaimed its 50D moving average

Source: Barchart

Great observation by Dr. Michael Stamos, CFA - Head of Global Research & Development of Global Multi Asset Department at Allianz Global Investors

-> "On days when bonds were up, stocks tended to go up as well. When bonds fell, stocks managed to stay at least flat. Overall it was a pretty nice environment for equity investors. Lets hope this doesn't turn into a high-correlation-when-markets-are-down type of environment".

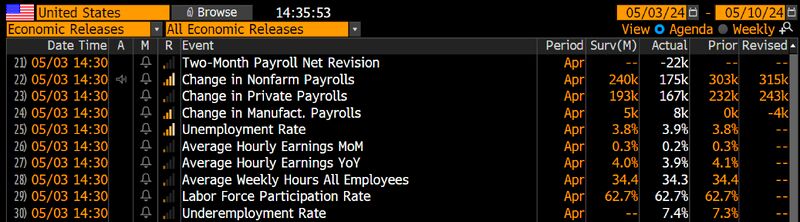

Stocks, bonds and cryptos rally following soft US jobs data.

Hiring slows to 175,000 jobs in April way below the forecasted 240k. This is the lowest figure since Oct 2023’s +165k. Household survey came in below forecasts as well with unemployment rate rising to 3.9% from March's 3.8%. Wage growth slows to 0.2% MoM vs 0.3% expected. Note that 0.2% is consistent with 2% inflation. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks