Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

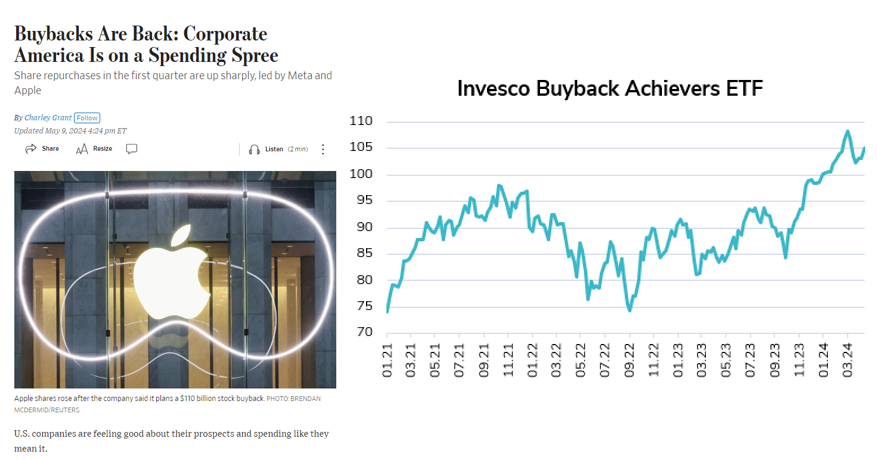

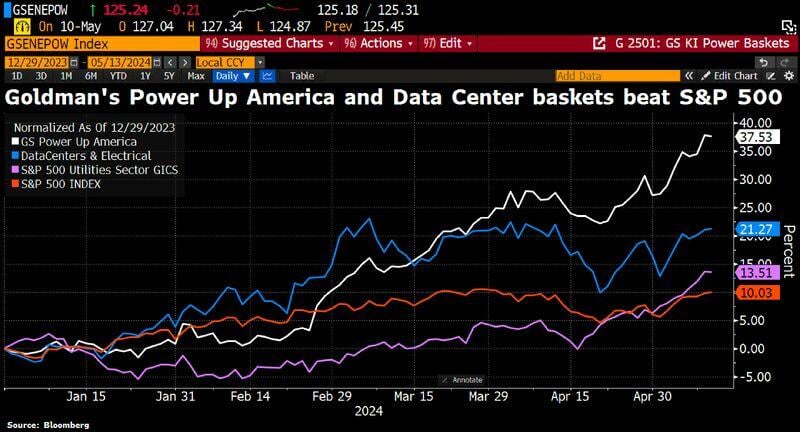

S&P 500 companies continue to outpace earnings expectations, but not quite as much on the sales side.

But now we are seeing these expectations rise, so the quarters ahead may become a bit more challenging as we may see earnings growth slowing at the same time. Source: Bloomberg, Markets & Mayhem

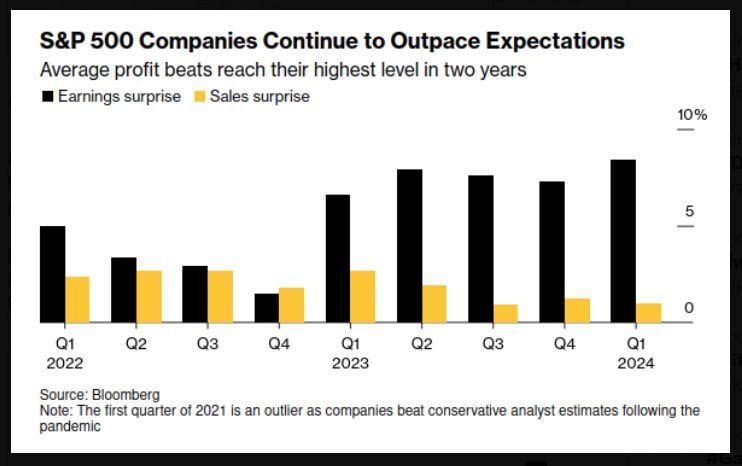

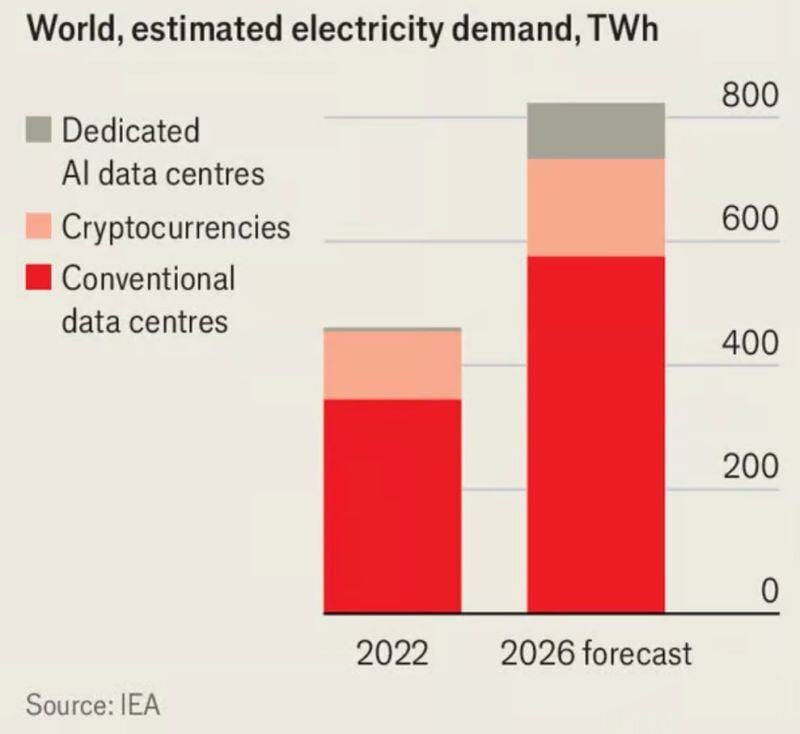

"Power Up America" theme is Goldman's top performing basket year-to-date w/+37.5% driven by global data centers' eye-popping demand for power.

17 of the 22 companies from the basket that have reported earnings have beat estimates by an average of +29%. Source: HolgerZ, Bloomberg

Retail investors have bought over $5 billion of leveraged equity ETFs in the last 12 months, the most since 2022.

This marks a $3 billion increase on a 1-month rolling sum basis in just a few months. Since the October 2023 low, retail investors have been piling into leveraged ETFs. However, a similar pattern was seen in 2021 and early 2022 after which retail experienced significant losses. The average retail investor portfolio drawdown from the 2022 peak was 35% and took 1.5 years to recover. Retail risk appetite is near record highs. Source: FT, The Kobeissi Letter

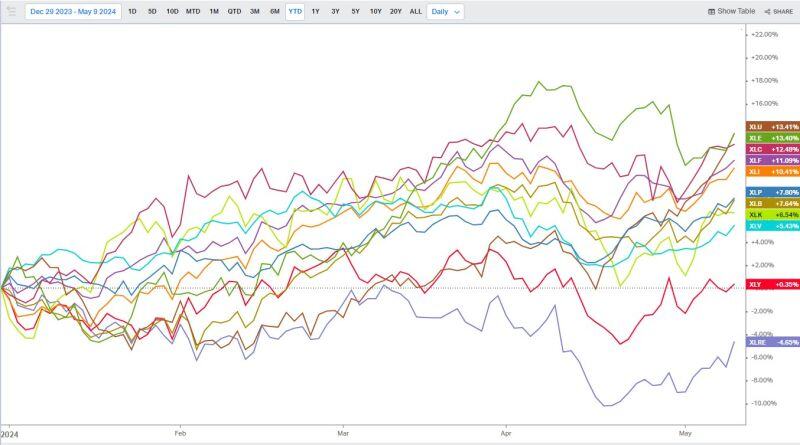

Who needs Mag 7 if one can buy utilities stocks?

Source: Michel A.Arouet

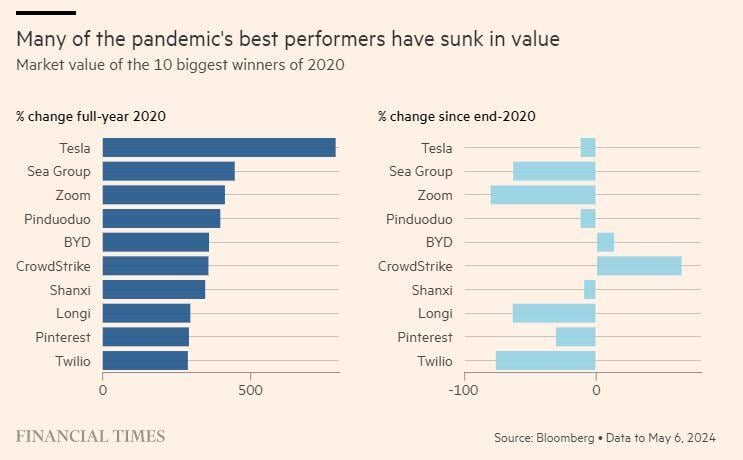

8 of the 10 biggest winning stocks in 2020 have lost value since the end of that year including Tesla $TSLA

Source: Barchart, FT

Believe it or not, utilities $XLU is now the best performing SP500 ETFsince the start of the year (+13.4%).

Technology $XLV is in the second half of the ranking (+5.4%). So what's going on? Utilities has been on a run as we are reaching the 2nd derivative of the AI trade. Investment bankers are pushing new AI baskets and many of them include some Utilities stocks. Source: Mike Zaccardi

Investing with intelligence

Our latest research, commentary and market outlooks