Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

We will know about the Grayscale SEC outcome TODAY at around 11am EST (Grayscale Bitcoin Trust has filed to convert its Trust into spot bitcoin etf)

Only a small fraction of cases have taken longer to get decision. So odds are pretty good. See below: Source: Bloomberg, Eric Balchunas

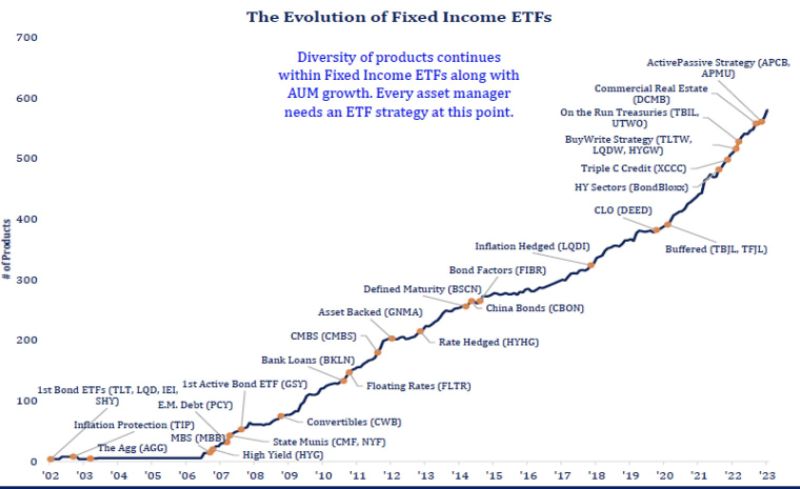

The evolution of fixed income ETFs in one picture...

This chart really shows off how far things have come in 20 years and how far the ETF industry goes with an asset class. Source: Todd Sohn thru Eric Balchunas

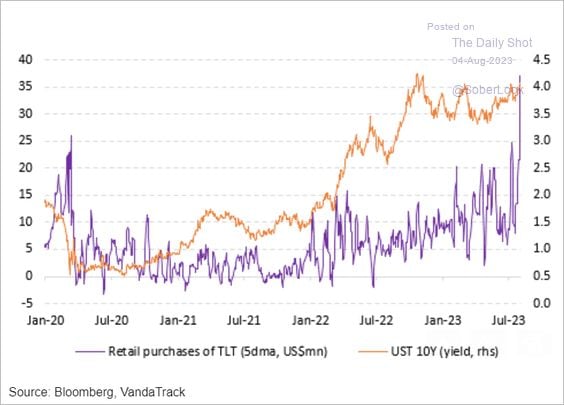

The fact that Retail investors are rapidly buying the iShares 20+Year Treasury Bond ETF (TLT) - despite the bond bloodbath - could mean that the sentiment is far from being oversold

From a contrarian perspective, this is NOT a positive for long-dated bonds. Source: The Daily Shot, Bloomberg, VandaTrack

There is now a huge divergence between semiconductors share price index and semis monthly sakes

Source: Mac10

‘SPDR S&P Semiconductor ETF’ has the highest 10-year returns at 24%.

They are closely followed by BlackRock’s 'iShares Semiconductor ETF’ at 23.3%. There is a clear pattern here where semiconductor and technology ETFs have achieved the highest returns over the last 10 years. Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks