Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The iShares 20+ year Treasury Bond ETF (TLT) now down 51% from All-Time-High

Source: Bloomberg, HolgerZ

Fighting the Fed has transformed bond ETFs into cash incinerators..

$TLT has come out of nowhere to hit #3 on the Top 20 Cash Burning ETFs list (lifetime flows minus aum today) with over $10b lost. Top of list used to be -2x/-3x, VIX, commodity ETFs. Now its vanilla bond ETFs... Great table from psarofagis thru Eric Balchunas, Bloomberg

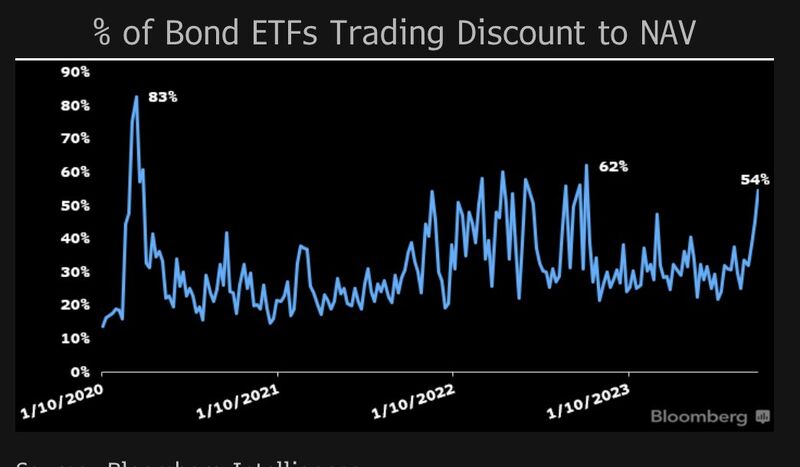

Over half of bond ETFs are now trading at a discount

Spikes in this number have been a pretty reliable bottom signal in the past. That said we not quite near the last two spikes but close.. Source: psarofagis thru Eric Balchunas, Bloomberg

The longest duration bond ETF ($ZROZ) is down over 60% from its peak in 2020 and now has a negative return over the last 10 years. Bond ETF Returns...

Source: Charlie Bilello

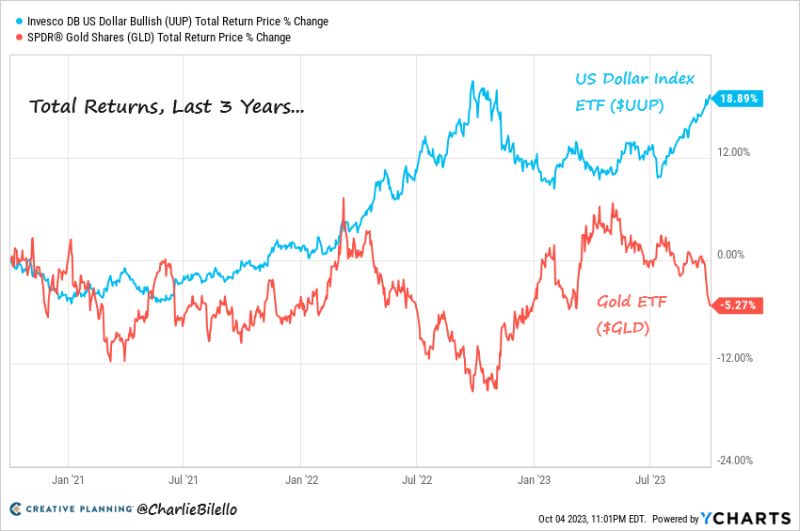

Over the last 3 years, the US Money Supply (M2) has increased by 14%, US inflation (CPI) has increased by 18%, and National Debt has grown by 24%

And over that time the US dollar Index ETF has gained 19% while the Gold ETF has lost 5%. As eveyone predicted... Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks