Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

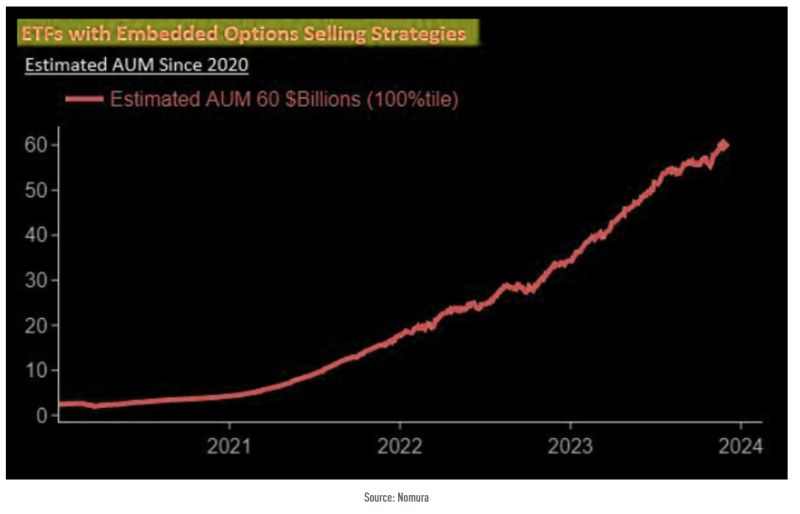

More and more capital going into the business of selling ETFs with embedded options selling features

Source: TME, Nomura

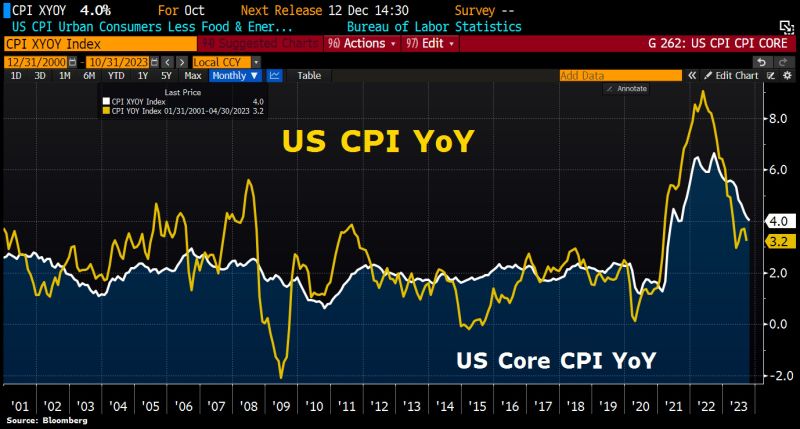

US inflation data for Oct undershoot consensus

Headline dropped to +3.2% from 3.7% in Sep vs 3.3% expected, Core CPI dropped to 4.0% from 4.1% vs 4.1% expected. Dollar and Yields plunge. - Following two months of higher than expected US CPI numbers (mainly driven by higher energy prices and healthcare costs), the October CPI print was expected slow materially (from 3.7% to 3.3% yoy on headline CPI) while the core was expected to remain unchanged at 4.1%. But today’s CPI print is a miss across the board with both headline and core numbers coming in below expectations on both a sequential and annual basis. - Headline CPI came in at 3.2%, below the 3.3% expected, while MoM CPI also missed expectations, being vs. consensus at +0.1% and sharply below last month's 0.4%. Source: Bloomberg, HolgeZ, www.zerohedge.com

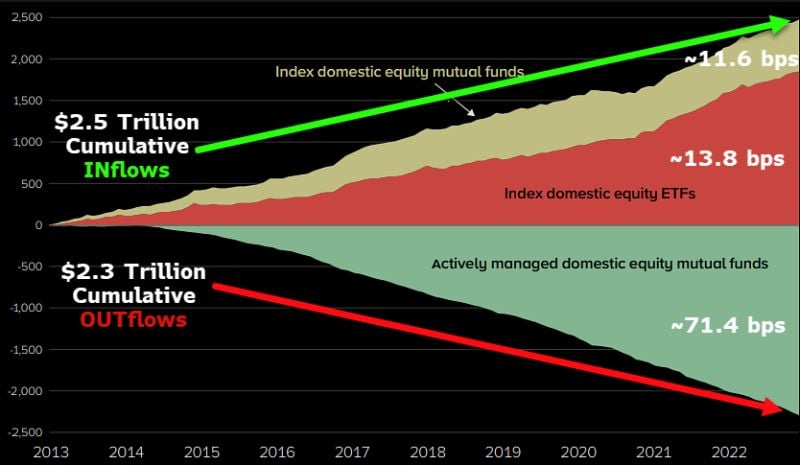

Great ICI-inspired chart showing three of the biggest trends in one shot:

active to passive, mutual fund to ETF and high cost to low cost. Active equity MFs have seen outflows every year for a decade equaling $2.3T (altho their aum still ok bc of bull mkt subsidy) via @JSeyff via Eric Balchunas / Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks