Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

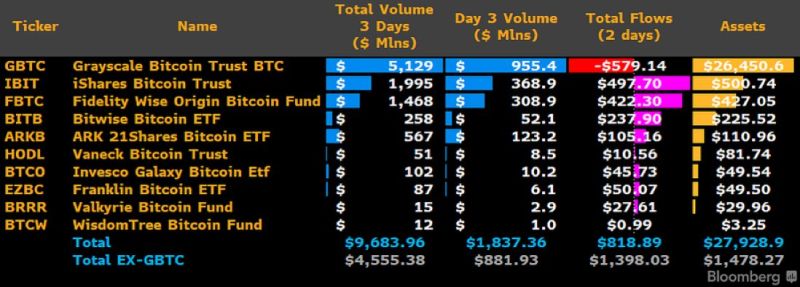

Inflows into the 10 new bitcoin ETFs hit +$1.4 billion over 2 days.

Subtracting GBTC's outflows of -$579m we get a net inflow of +$818.9m into the 10 new vehicles. People rotating out of GBTC into the others & Grayscale selling BTC are behind the price dump despite the inflows. Source: Joe Consorti, Bloomberg

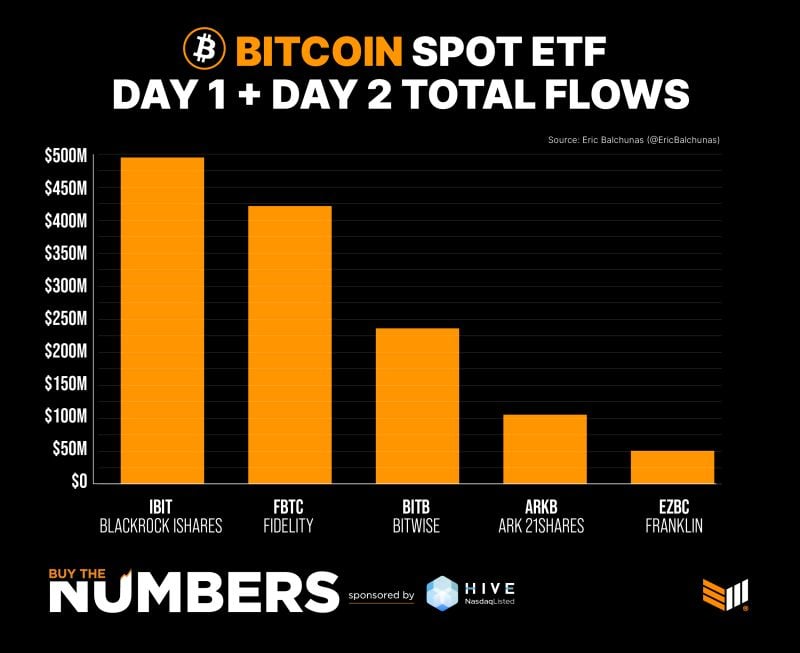

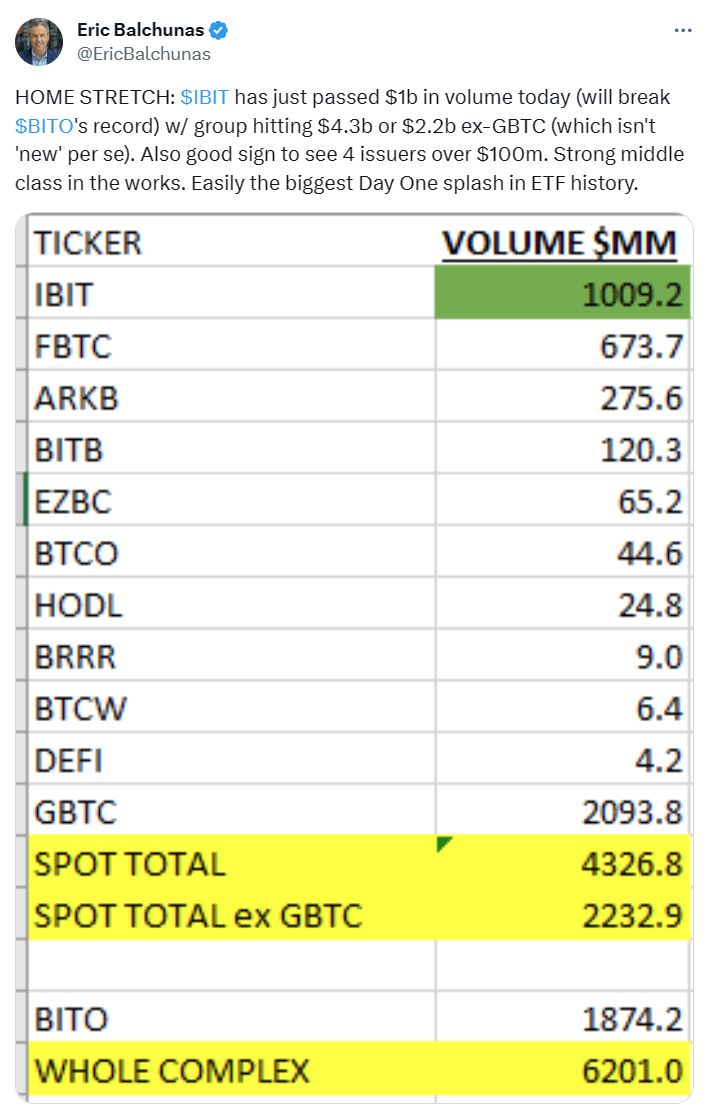

What are the key takeaways from DAY 1 of bitcoin spot etf?

- The first US ETFs that directly hold Bitcoin are off to a strong start, with billions of dollars changing hands in a historical first day of trading for the long-sought investment vehicles. - The Blackrock iShares Bitcoin Trust ($IBIT) has passed $1B in volume today - The whole group hit $4.3B in volume or $2.2B ex-GBTC - 4 issuers are ABOVE $100B volume - The Bitcoin futures ETF $BITO smashed it's all time volume record in this historic day with $2b traded.. perhaps some is redemptions but it is probable that $BITO's liquidity will serve purpose in market maker for a while - $BITO and $GBTC are both in the Top 10 among overall ETFs in trading volume today.. $IBIT and $FBTC also making in Top 25, just to give some context on how this volume fits in w bigger picture. Just overall superb showing. Remember the futures ETFs barely did $2m - As a side note, $7.7 trillion asset manager Vanguard says they will NOT offer spot Bitcoin ETF.

The approval of 11 bitcoin spot etf by the SEC is going to accelerate adoption of cryptocurrencies by Wall Street(and Main Street).

Adoption rhymes with education and this is precisely what the big guys are currently doing -> training their staff to better understand, explain and promote crypto products & solutions to their clients.

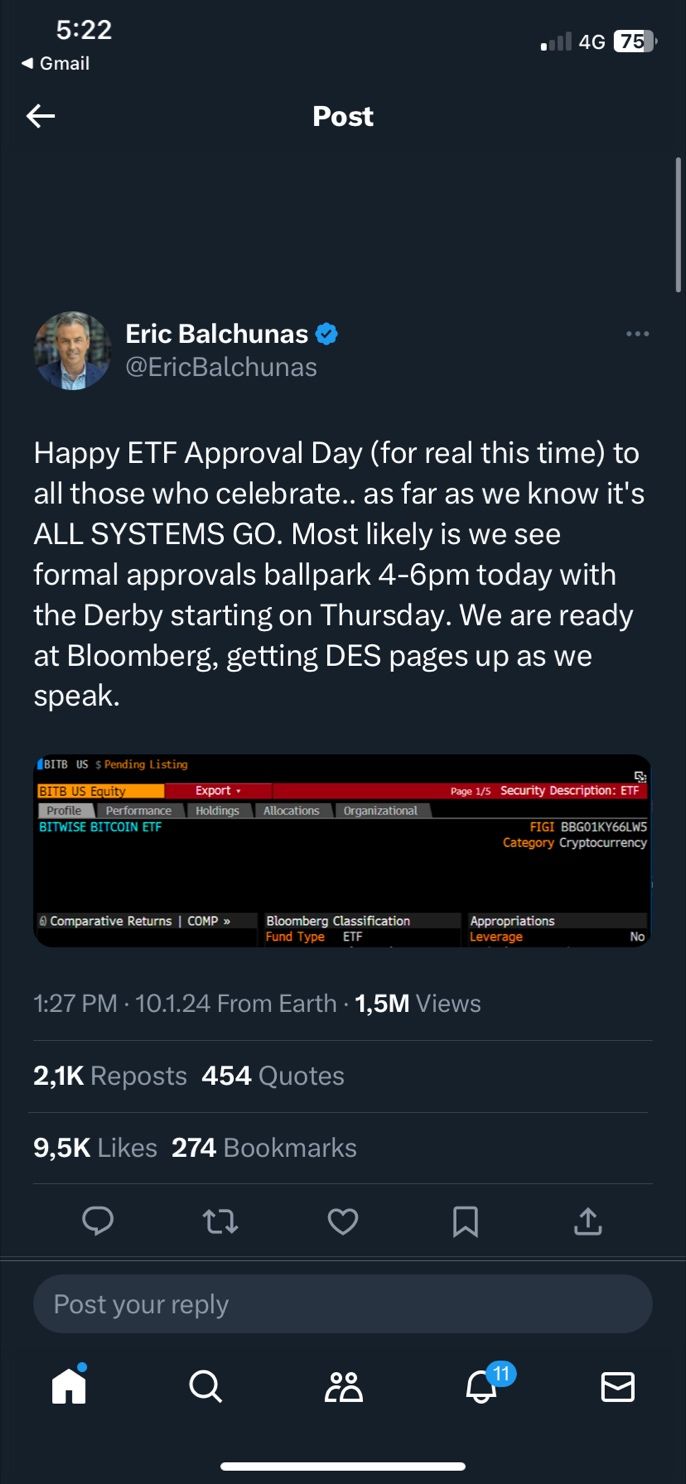

BlackRock may break the first-day flow record with a possible $2 billion asset injection on the first day of trading for its US spot Bitcoin ETF

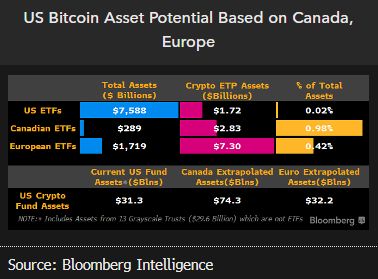

according to BI's senior ETF analyst Eric Balchunas Seed funding could combine with grassroots interest to give it momentum in a race that includes up to 11 ETFs that we think could gather as much as $4 billion on the first day, and $50 billion of assets within two years.

Investing with intelligence

Our latest research, commentary and market outlooks