Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

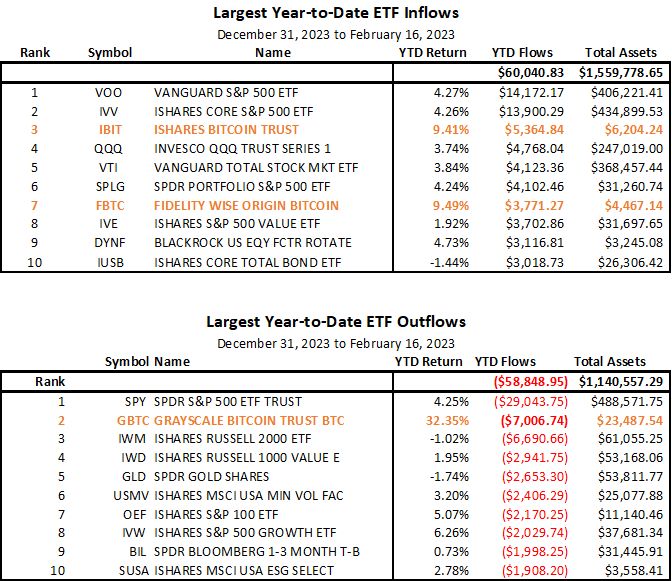

Here are the top 10 ETFs with the most inflows (top) and outflows (bottom) for all 4,500 US ETFs.

Inflows IBIT is #3 and FBTC is #7 Outflows GBTC is #2 And remember, the spot BTC ETFs started trading on January 11! Source: Bianco Research

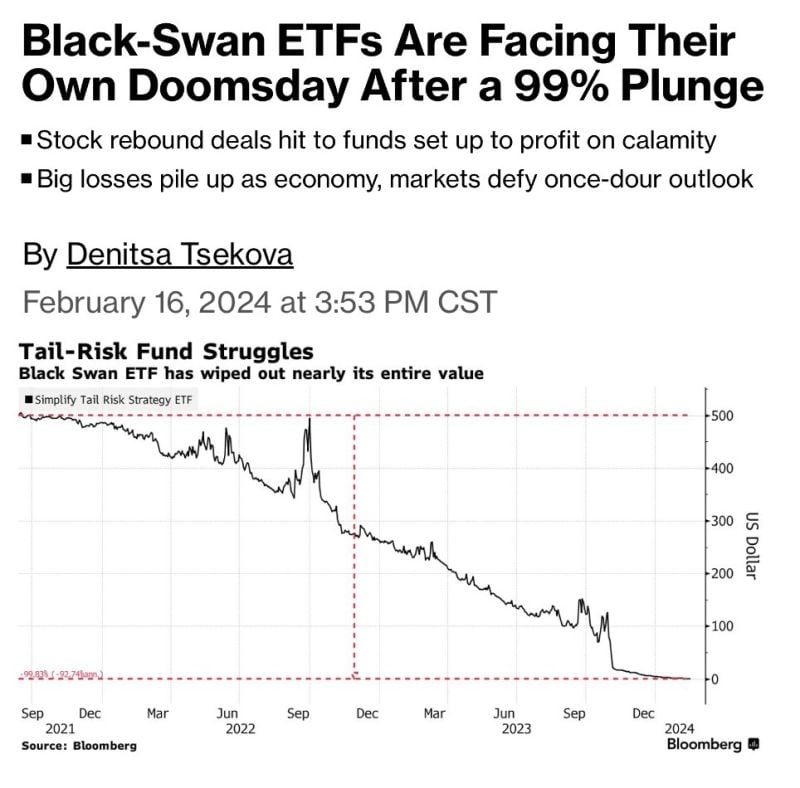

BREAKING 🚨: Black Swan ETFs

Black Swan ETFs have plunged 99% after doomsday dream scenario fails to play out Source: Barchart, Bloomberg

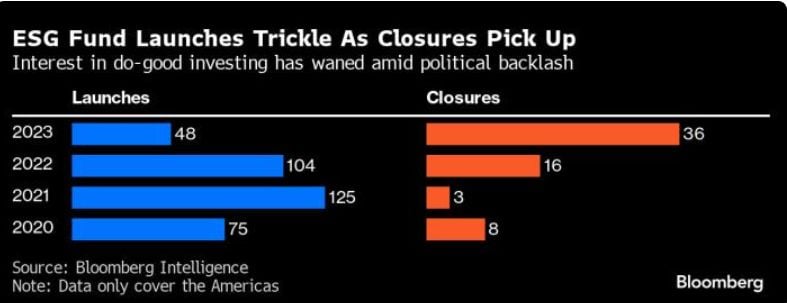

The ESG Backlash on Wall Street Spurs a Jump in ETF Closures

The dwindling demand is evident in the Americas from the slowdown in sales of new exchange-traded funds and the pickup in fund closures and outflows, according to senior ESG strategist at Bloomberg Intelligence. In 2023, the region saw just 48 new ETFs introduced, down from 104 in 2022 and 125 in 2021, data compiled by Bloomberg Intelligence show. A net $4.3 billion was pulled last year from ESG-focused ETFs in the US, marking the first-ever annual outflows. The $13 billion iShares ESG Aware MSCI USA ETF (ticker ESGU), the largest ESG-focused ETF, is seeing continued outflows this year, with $809 million yanked from the fund after a $9 billion exodus last year. Meanwhile, 36 ESG-labeled ETFs were liquidated in the Americas during 2023, more than double the prior year, data from Bloomberg Intelligence show. Almost 60% of the funds that were closed were actively managed. source : yahoo!finance, bloomberg

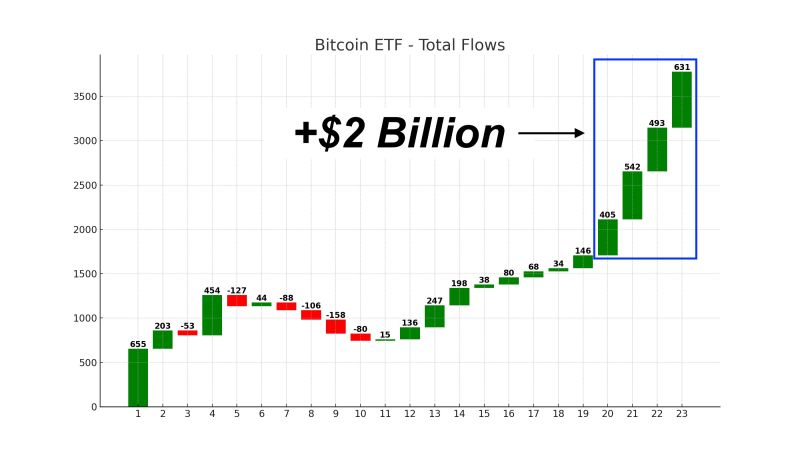

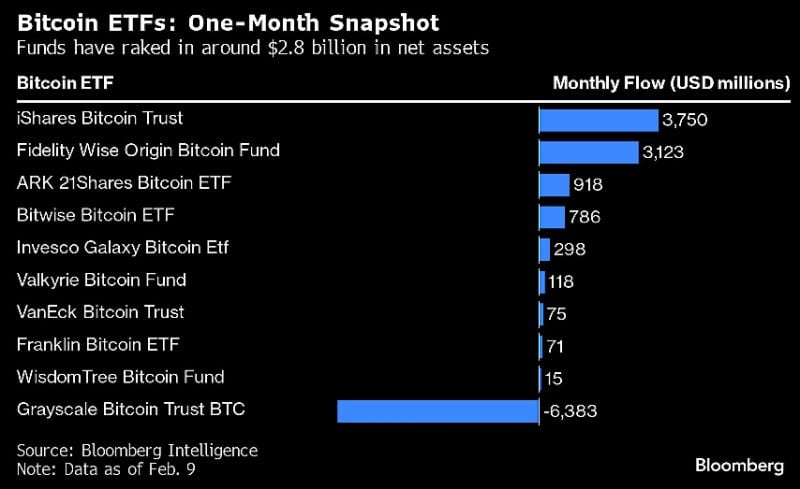

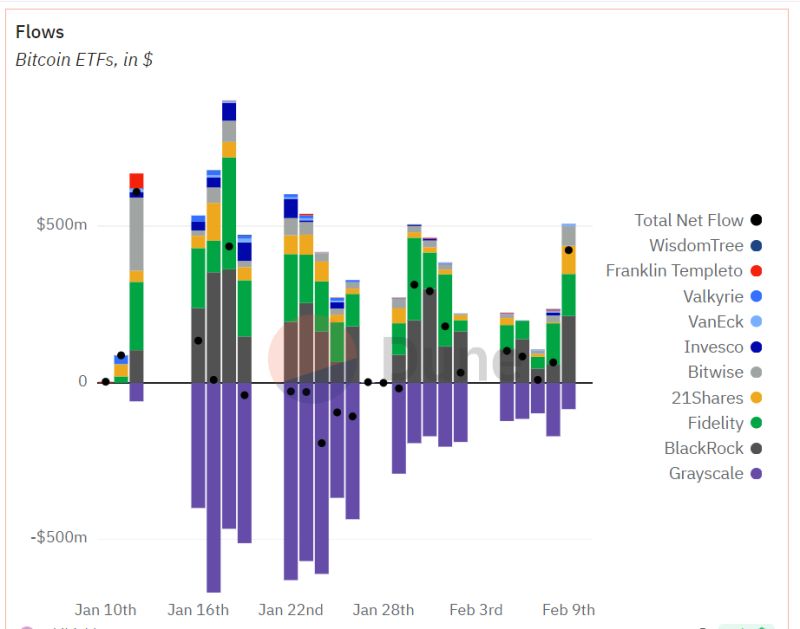

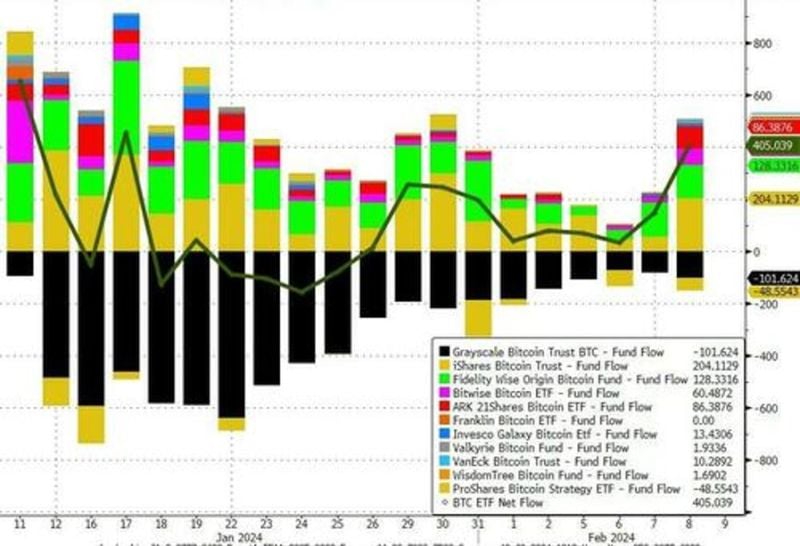

Bitcoin spot ETF launch will be remembered as a major commercial success.

There’s been over 5500 ETF launches in history. NEVER before has an ETF reached $3 Billion AUM in less than 30 days… until now. Both Blackrock and Fidelity’s Bitcoin spot ETFs have just done it. A month after the SEC approval, investors have poured a net $2.8bn into Bitcoin ETFs. Gear up for a Bitcoin FOMO rally to all-time highs, Bernstein's Chhugani says: The market priced in the ETF approval news quickly, but has not priced in the ETF inflows and the upcoming supply crunch. Chhugani believes that the money is still coming from the ‘believers’, who have discovered an easy way to get Bitcoin in their broker accounts via the ETFs. "The disbelievers stay on the sidelines, and based on our investor conversations, we feel that the early interest we are getting is from new curious investors, not yet deployed, but intrigued enough to learn about Bitcoin. The ETF has added a sense of legitimacy, so far missing in the crypto sector. We expect many of these new Bitcoin enthusiasts to allocate capital in the coming days and we think Bitcoin ETFs/Bitcoin miners could benefit, in that scenario". Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks