Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

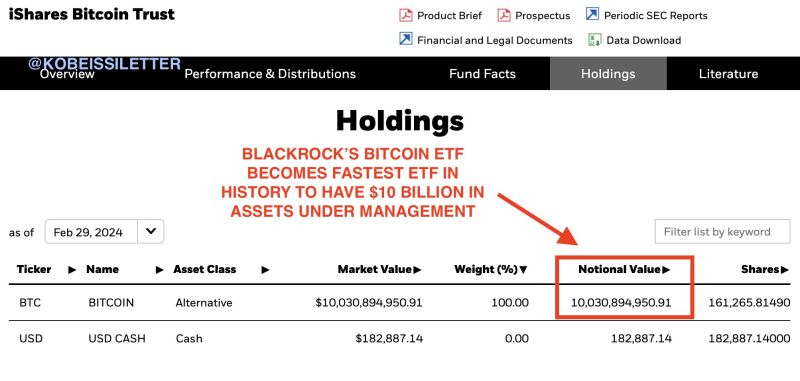

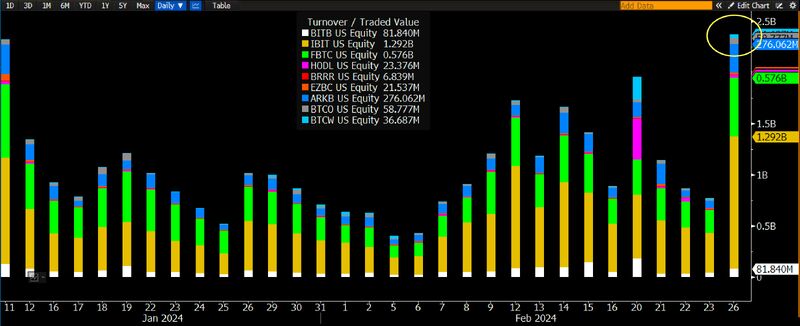

BREAKING: BlackRock's Bitcoin ETF, $IBIT, hits a record $10 billion in assets under management

This is the fastest an ETF has hit $10 billion in assets under management, at 37 trading days. Just ~4% of all ETFs have reached the $10 billion mark. More history made by Bitcoin. Source: The Kobeissi Letter

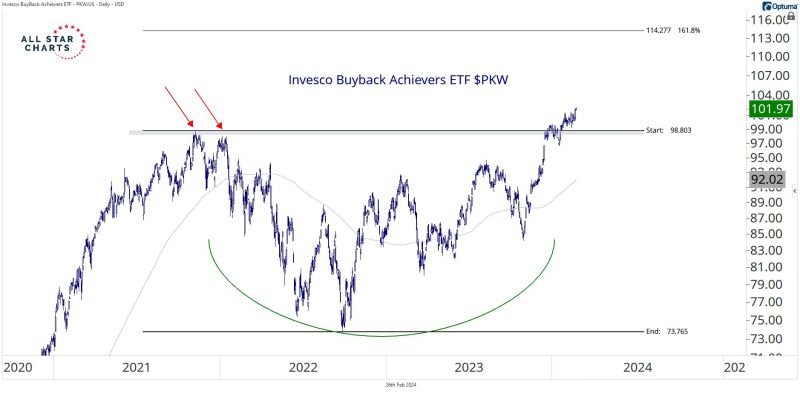

Buybacks win again! New all-time highs for the Buyback Achievers ETF

$PKW as it resolves higher from a multi-year base. Source: Alfondo de Pablos, J-C Parets

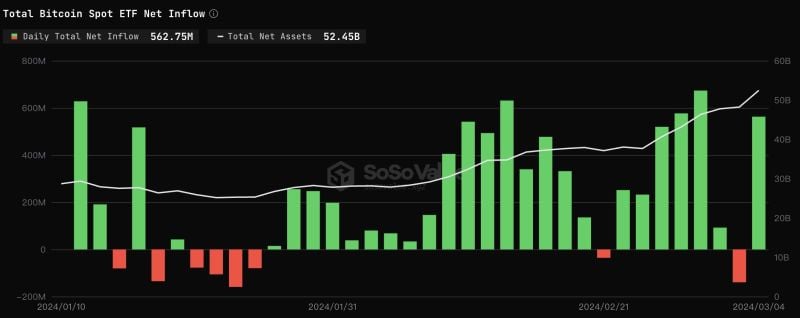

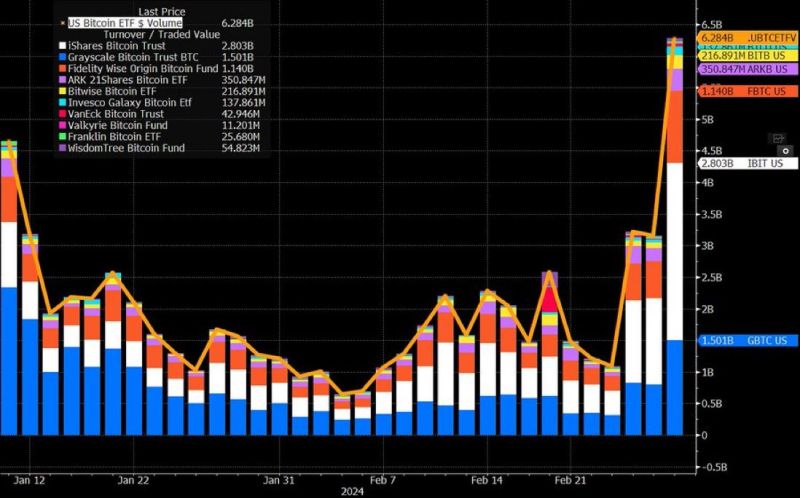

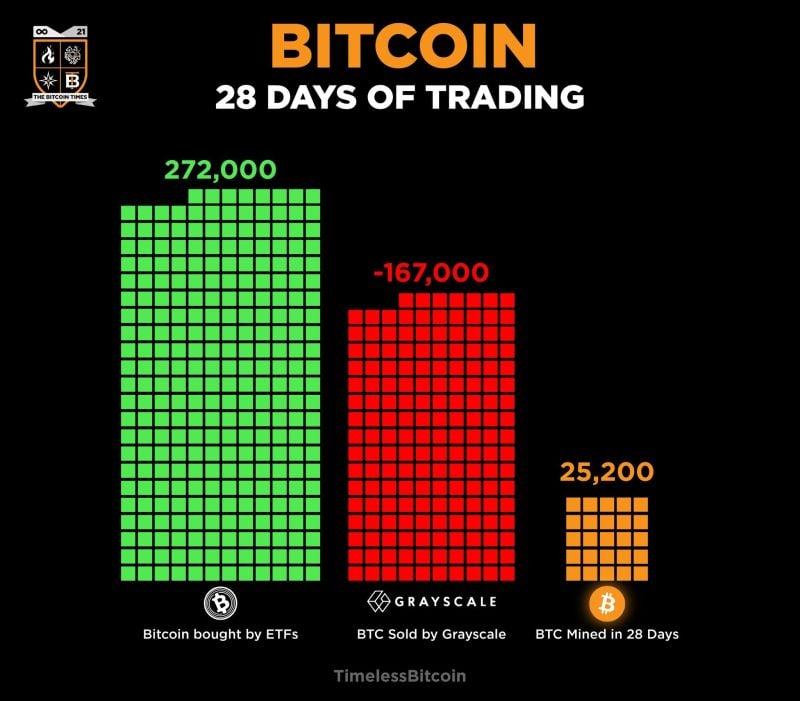

The bitcoin supply squeeze explained in a few sentences and one chart

272,000 Bitcoin bought in the last 28 days by ETFs. Meanwhile only 25,200 $BTC were mined! Yes, GBTC outflows are still a concern, but at some point that will have to end. Assuming this number stays consistent (or possibly even increases) with roughly ~2 million BTC on exchanges (based on today's liquidity), that would mean that in about 8 months time there would literally be ZERO BTC available for sale!!! And not mention the halving in 3 months will cut this amount to just 12,600 BTC mined in the same amount of time. (Source: CryptoZombie)

Investing with intelligence

Our latest research, commentary and market outlooks